Qualcomm is working hard with multiple PC makers in a bid to release notebooks based on system-on-chips (SoCs) with its Oryon general-purpose cores, developed by Nuvia, sometime next year. Although the SoC itself seems to work fine, there is a design decision that may severely affect the appeal of the platform: Qualcomm wants its partners to use its own smartphone-oriented power management ICs (PMICs) with its next-gen processors, reports SemiAccurate.

Qualcomm’s SoCs use proprietary power management protocols that necessitate using the company’s own PMIC. On one hand, this allows the company to keep its power management trade secrets private, but it also means the company will (or at least should) earn more money. For now, Qualcomm’s PMICs are all designed for smartphones, which is logical as smartphone chips represent the lion’s share of the company’s revenue. But Qualcomm insists on using these smartphone PMICs in laptops. While these PMICs might be efficient for smartphones, they are not optimized for the power requirements of mobile PCs.

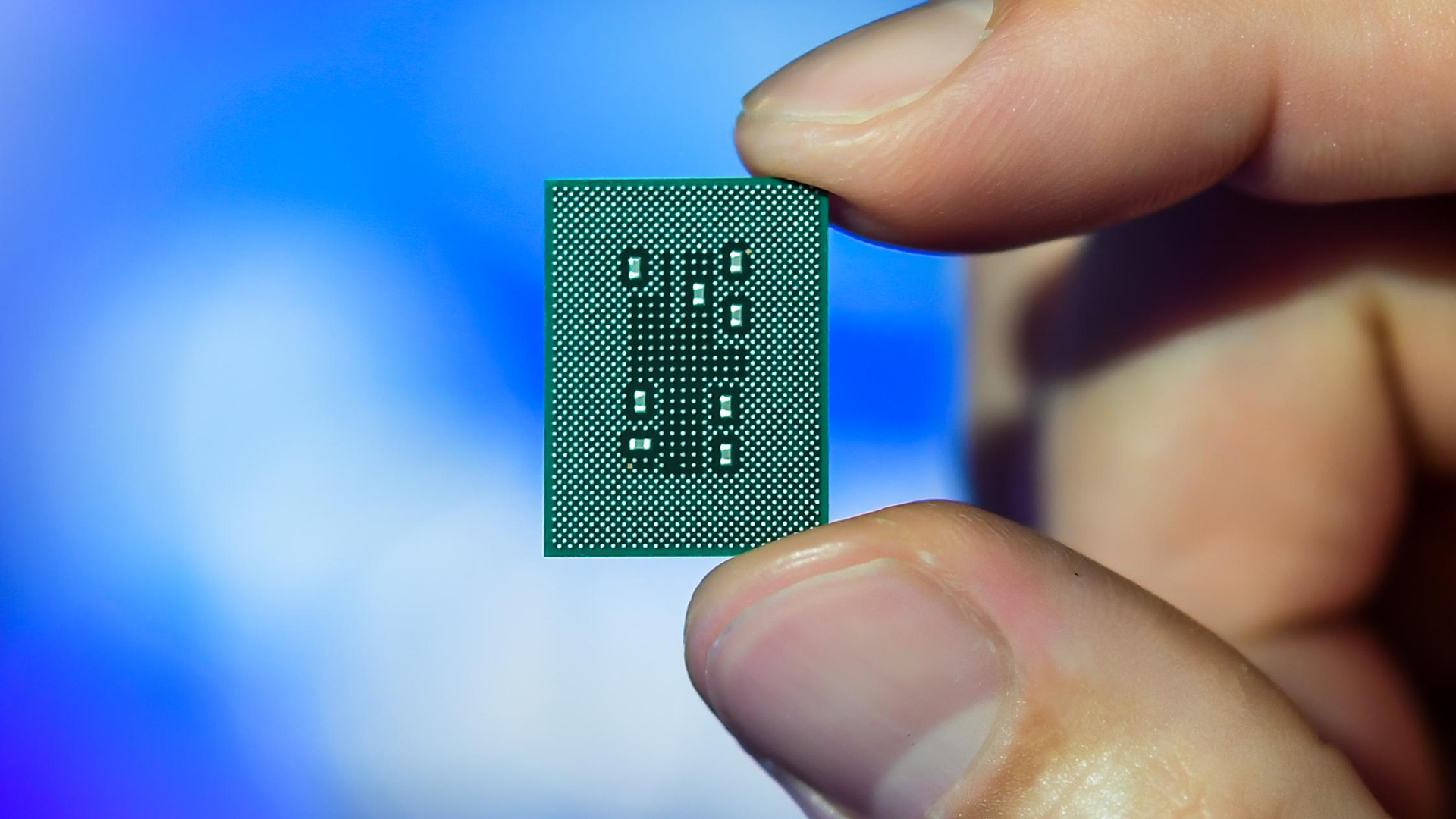

Not only does the use of these PMICs necessitate using a number of them to handle a PC-class SoC, they also require the use of printed circuit board (PCB) with a 0.6mm pitch HDI, common in high-end cell phones, but rarely used for PCs. While they are used for smartphones because they are small and allow for installing plenty of components on a tiny board, scaling them up for laptops results in exorbitant costs. This decision has been a source of frustration for many OEMs that work with Qualcomm on PCs, who view it as an unnecessary expense introduced solely because of Qualcomm’s bundled PMICs. Some reportedly even threatened to abandon their Oryon-powered projects.

While normally PC makers would buy SoCs and PMICs from Qualcomm and then simply not use the latter, they cannot do so here because of proprietary power management protocols. In an attempt to mitigate the rising tensions and financial implications, Qualcomm has reportedly resorted to compensating the OEMs. Interestingly, the compensation offered was reported to be more than the cost of the PMICs, indicating a financial loss for Qualcomm. Meanwhile, it is unclear whether the company followed the same PMIC-related strategy with its existing Snapdragon platforms aimed at Windows-on-Arm machines.

SemiAccurate goes as far as saying that Qualcomm’s insistence on using specific PMICs has escalated costs and created tensions with key partners. While it looks like the SoC works right and is expected to achieve the desired performance metrics, the cost-efficiency of Qualcomm’s Oryon-based platform remains uncertain. This naturally increases the appeal of AMD- and Intel-based laptop platforms in 2024, so it now remains to be seen whether Qualcomm will be able to gain a significant share of the PC market any time soon.