The number of chip companies in China has been declining ever since the U.S. started imposing sanctions against the semiconductor sector in 2019 – 2020. The situation got worse in 2022 – 2023 as demand for chips slowed. More than 22,000 chip-related firms have disappeared since 2019, but 2023 saw record-setting extinction according to DigiTimes (citing TMTPost).

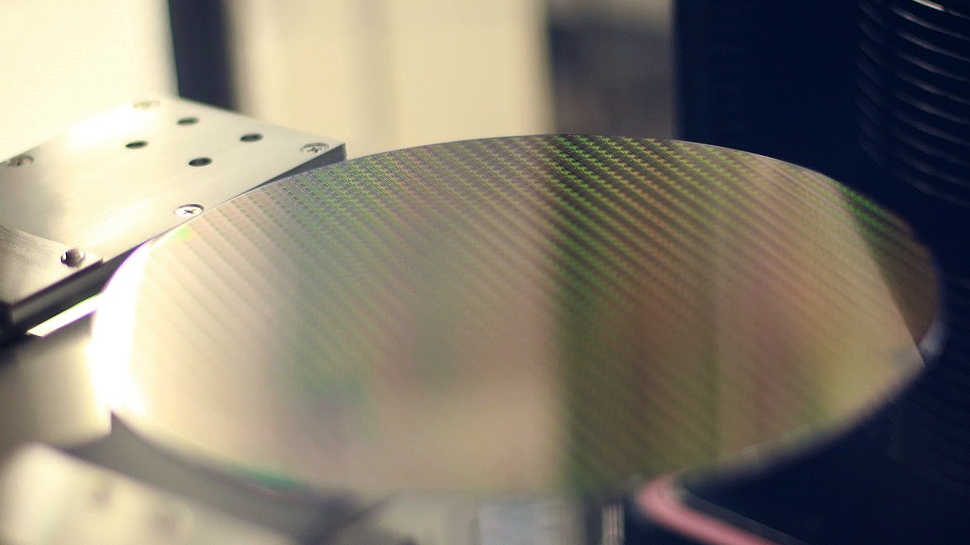

A record 10,900 chip-related companies have lost their registration in 2023 so far — a big jump from the 5,746 companies that folded in 2022, according the report. That means an average of 30 Chinese chip-related companies closed their doors each day in 2023. This is part of the five-year trend, which saw over 10,000 Chinese chip-related companies close in 2021 – 2022. The spike in 2023 highlights the growing struggles in chip design, semiconductor manufacturing, and wafer fab equipment sectors.

Out of 3,243 chip design companies in China in 2023 (many of which emerged, at least partly, thanks to incentives from federal and local governments), more than half were making less than 10 million CNY (about $1.4 million USD) a year, according to Wei Shaojun, IC design lead at the China Semiconductor Industry Association and professor at Tsinghua University. Shaojun is not particularly fond of how the Chinese industry is developing.

These firms are not just struggling with sales. Most are losing money from unsold stock, due to market oversupply and a general downturn in the semiconductor industry from wider economic circumstances. A big part of the problem comes from a misstep planning: In 2021 and 2022, many companies produced tons of chips, expecting high sales from the Covid-induced work-from-home trend. But as the pandemic waned, demand took a downturn and the market slumped in the end of 2022 / beginning of 2023, leaving companies with a lot of inventory they couldn’t sell. And, of course, these products are losing value as time passes.

Another problem, for smaller companies especially, is lack of investments. The U.S. has restricted investments in the Chinese semiconductor industry (as well as AI and quantum computing technologies), and European investors are not inclined to invest in Chinese chip companies with U.S. sanctions in place.

Larger companies like YMTC have spent billions finding alternative suppliers and procuring third-party tools to stay in business, while Huawei built a secret fab network; smaller companies don’t have the resources to keep up. And while the Chinese government is investing in the chip industry — the China Integrated Circuit Industry Investment Fund dropped $1 billion in HLMC a week ago — it can’t pour money into every chip startup out there.

It’s been a tough year for China’s chip industry — especially for the smaller players. The record number of companies shutting down reflects the hard times they’re facing: low demand, overstock, and difficulty in obtaining funding. This has forced many out of the game and has shifted China’s semiconductor industry into mostly big companies instead of smaller startups.