Honda’s strongest contender in Indian market is still the Activa with close to 2 lakh units sold in November 2023, followed by CB Shine

Honda Motorcycles and Scooters India (HMSI) posted a strong 18.98% YoY growth in domestic market and an even stronger 33.70% YoY growth where exports to global markets are concerned. Honda 2W sales stood at 4,20,648 units in domestic market and 26,314 units in exports. This was a slight decrease in sales when compared to October 2023 charts.

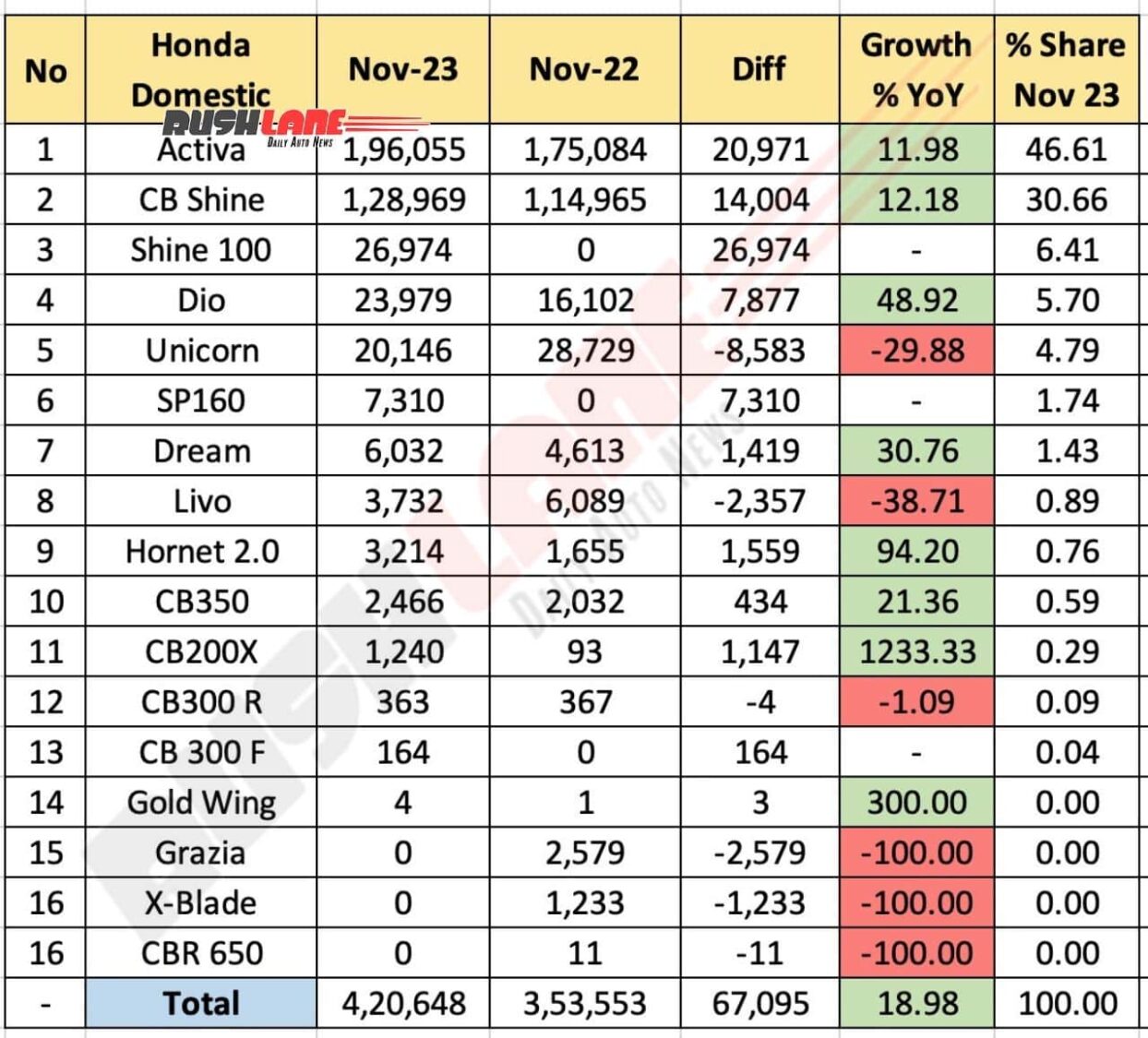

Honda 2W Sales Breakup November 2023 – Domestic market

In domestic market, HMSI sold 4,20,648 units with 18.98% YoY growth. As opposed to 3,53,553 units sold in November 2022, volume growth was 67,095 units YoY. Primary contributor for Honda is Activa scooter with 1,96,055 units that took a 46.61% share of company’s total domestic sales. YoY growth with Activa lineup was 11.98% with 20,971 units gained in volume.

CB Shine contributed 1,28,969 units accounting for 20.66% of Honda’s domestic sales. CB Shine 125 registered 12.18% YoY growth flexing 14,004 units gained in volume. Activa and CB Shine contribute to around 77% of Honda’s total sales in India. The new 100cc Shine 100 sold 26,974 with a 6.41% market share.

Recently updated Dio saw 23,979 takers last month and registered 48.92% YoY growth and 7,877 units volume growth YoY. Honda Unicorn’s appeal has reduced YoY by 29.88% decline, losing 8,583 units in volume. The newly launched SP160 is the replacement for Honda’s X-Blade. SP160 saw 7,310 takers, which is significantly better than X-Blade’s 0 sales.

Honda Dream commuter sold 6,032 units with 30.76% YoY growth and 1,419 units volume growth. Livo and Hornet 2.0 sold 3,732 and 3,214 units respectively. Where Hornet’s numbers almost doubled at 94.2% YoY growth, Livo saw a 38.71% decline YoY. Best-selling Big Wing motorcycle, CB350, sold 2,466 units with 21.36% You growth.

Honda’s pseudo ADV, CB200X, saw a sudden spike in sales registering 1,233% YoY growth with 1,240 units sold as opposed to 93 units sold in November 2022. CB300R showed a slight 1.09% YoY decline with 363 units sold last month. Despite the recent price revision, CB300 F has not been seeing many takers with just 164 last month. Honda’s big boy Goldwing sold 4 units last month, which is a 300% YoY growth as opposed to 1 unit sold last year.

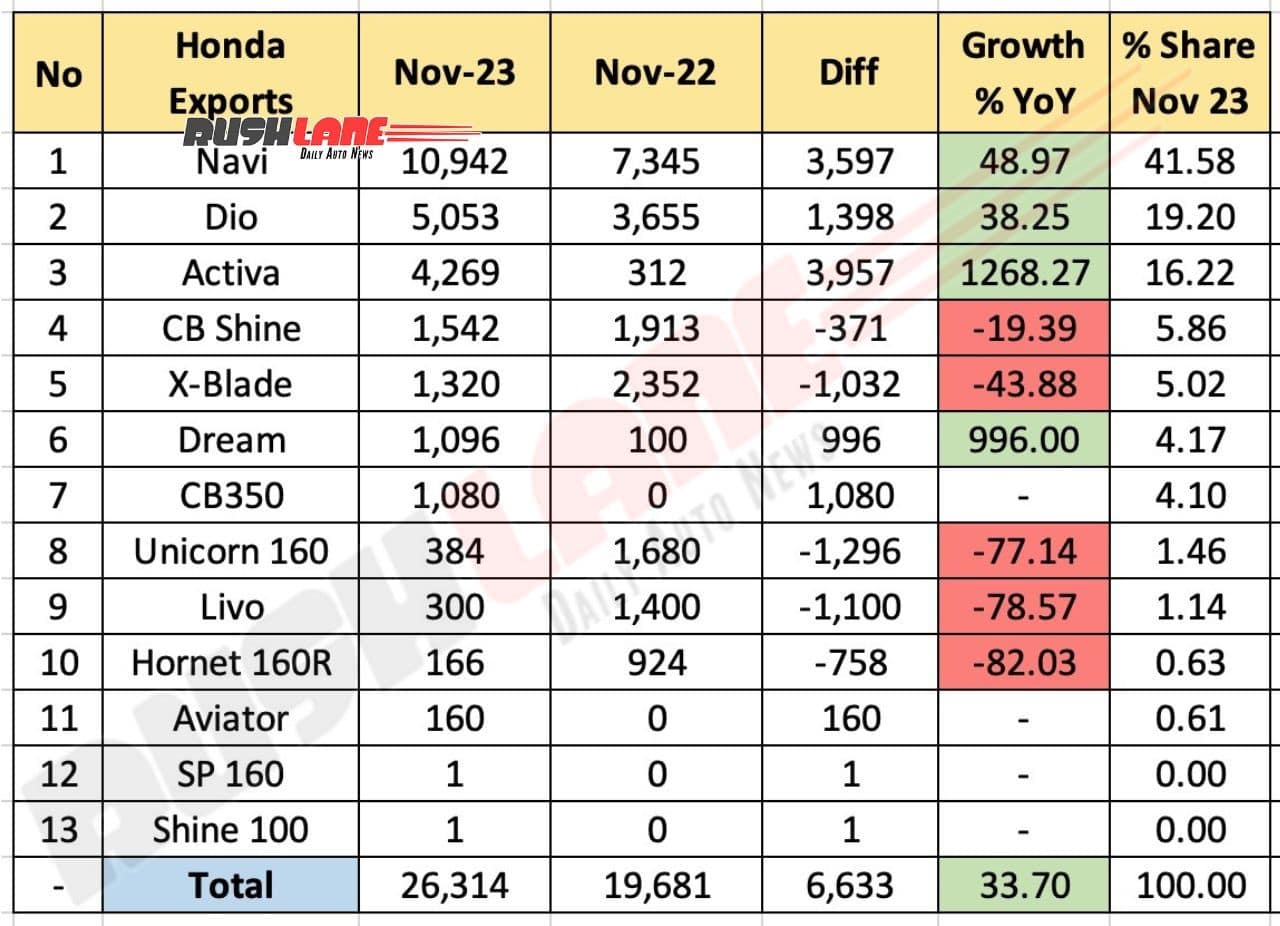

Honda 2W exports

Where exports are concerned, Honda registered a solid 33.70% YoY growth by shipping 26,314 units last month as opposed to 19,681 units last year. This resulted in 6,633 units YoY volume growth. Surprisingly, it is the Navi that is the highest-shipped Honda 2W vehicle from India. Navi saw 10,942 buyers abroad accounting for 41.58% of Honda’s total shipments.

When compared to 7,345 units shipped last year, Navi registered 48.97% YoY growth and gained 3,597 units YoY in volume. Dio took 2nd place in company’s exports with 5,053 units, 38.25% YoY growth and 19.20% market share. Volume growth is 1,398 units YoY. Highest-seller in India, Activa has seen a significant rise in export charts too with 1,268.27% YoY growth and 16.22% market share.

Honda shipped 4,269 Activa as opposed to 312 units shipped in November 2022. CB Shine and X-Blade shipped 1,542 and 1,320 units with 19.29% and 43.88% YoY decline respectively. Dream and CB350 shipments stood at 1,096 and 1,080 units respectively, with Dream registering 996% YoY growth.

Unicorn 160, Livo and Hornet 160R saw a significant decline in sales with 384, 300 and 166 units shipped respectively. Aviator scooter might be long forgotten in India, but Honda shipped 160 units last month.