Splendor maintains its lead as the No 1 two wheeler of India followed by the likes of Activa, Pulsar, etc

As we bid farewell to 2023, the Indian two-wheeler market witnessed a dynamic close with impressive sales figures for December. This article explores the top 10 two-wheelers that dominated the market during this period, shedding light on their sales performance, year-on-year growth, and the overall market share.

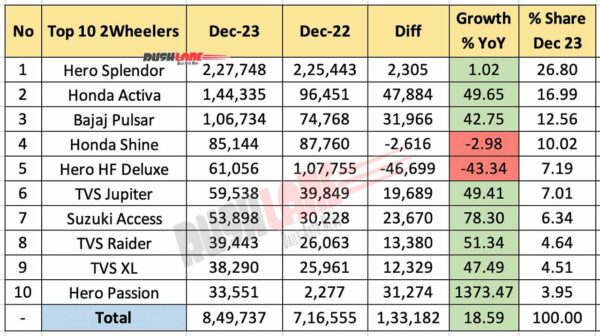

Top 10 Two Wheelers Dec 2023 vs Dec 2022

Leading the pack is the iconic Hero Splendor, with a remarkable 2,27,748 units sold in December 2023. Despite a marginal increase of 1.02% from the previous year, the Splendor maintains its stronghold as the go-to choice for Indian riders, commanding a substantial 26.80% market share. Honda Activa secures the second position with 1,44,335 units sold, demonstrating an impressive 49.65% year-on-year growth.

Bajaj Pulsar claims the third spot with 1,06,734 units sold. Boasting a growth rate of 42.75% compared to the previous year, the Pulsar remains a favorite in the motorcycle segment, capturing a 12.56% market share. Despite a slight dip of 2.98% in sales, the Honda Shine retains its position in the top four with 85,144 units sold. With a 10.02% market share, the Shine continues to be a significant player in the commuter motorcycle segment.

Hero HF Deluxe, with 61,056 units sold, experienced a year-on-year decline of 43.34%. However, it remains a prominent choice in the market, securing a 7.19% share. In the scooter segment, the TVS Jupiter exhibited stellar performance with 59,538 units sold, showcasing a substantial 49.41% growth. With a 7.01% market share, the Jupiter continues to be a preferred choice among scooter enthusiasts.

Suzuki Access, with 53,898 units sold, witnessed an impressive 78.30% growth, reflecting its popularity among consumers. The scooter commands a 6.34% market share, highlighting its strong market presence. The TVS Raider, a motorcycle known for its style and performance, secured 39,443 unit sales, marking a 51.34% growth. With a 4.64% market share, the Raider is establishing itself as a formidable contender in the motorcycle segment.

The TVS XL, a moped with a utilitarian design, recorded 38,290 unit sales, achieving a 47.49% growth. With a 4.51% market share, the TVS XL continues to cater to a unique segment of consumers. Closing the top 10 is the Hero Passion, experiencing an astonishing year-on-year growth of 1373.47%. With 33,551 units sold, the Passion captures a 3.95% market share, showcasing its resurgence in the market.

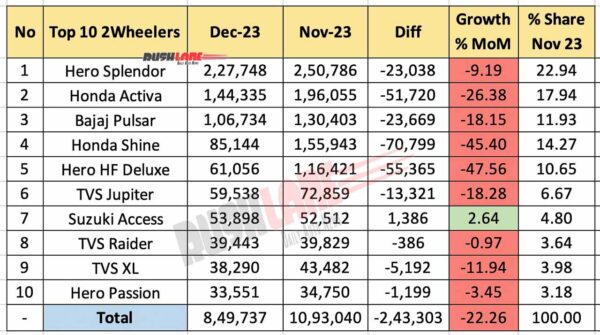

Month on Month Comparison

December 2023 witnessed intriguing developments in the Indian two-wheeler market, showcasing notable shifts in consumer preferences and market dynamics. This article delves into the month-on-month comparison of the top 10 two-wheelers, analyzing sales figures, growth rates, and changes in market shares from November to December 2023.

Hero Splendor experienced a 9.19% decline in sales from November to December 2023, with 2,27,748 units sold. Honda Activa, securing the second spot, faced a notable 26.38% decrease in sales, with 1,44,335 units sold in December. Bajaj Pulsar witnessed an 18.15% decline in sales, selling 1,06,734 units in December.

Honda Shine experienced a significant 45.40% drop in sales, with 85,144 units sold in December. Hero HF Deluxe faced the steepest decline in sales, with a 47.56% drop and 61,056 units sold. TVS Jupiter experienced an 18.28% decline in sales, with 59,538 units sold in December.

Suzuki Access demonstrated resilience, registering a modest 2.64% growth with 53,898 units sold. TVS Raider faced a marginal decline of 0.97% in sales, with 39,443 units sold. TVS XL experienced an 11.94% decline in sales, with 38,290 units sold. The TVS XL maintains a 3.98% market share, catering to a unique segment of consumers. Hero Passion experienced a 3.45% decline in sales, with 33,551 units sold in the previous month.