Mahindra continued to dominate this mid-size SUV segment with its Scorpio/N and XUV700 commanding a near 70% market share in January 2024

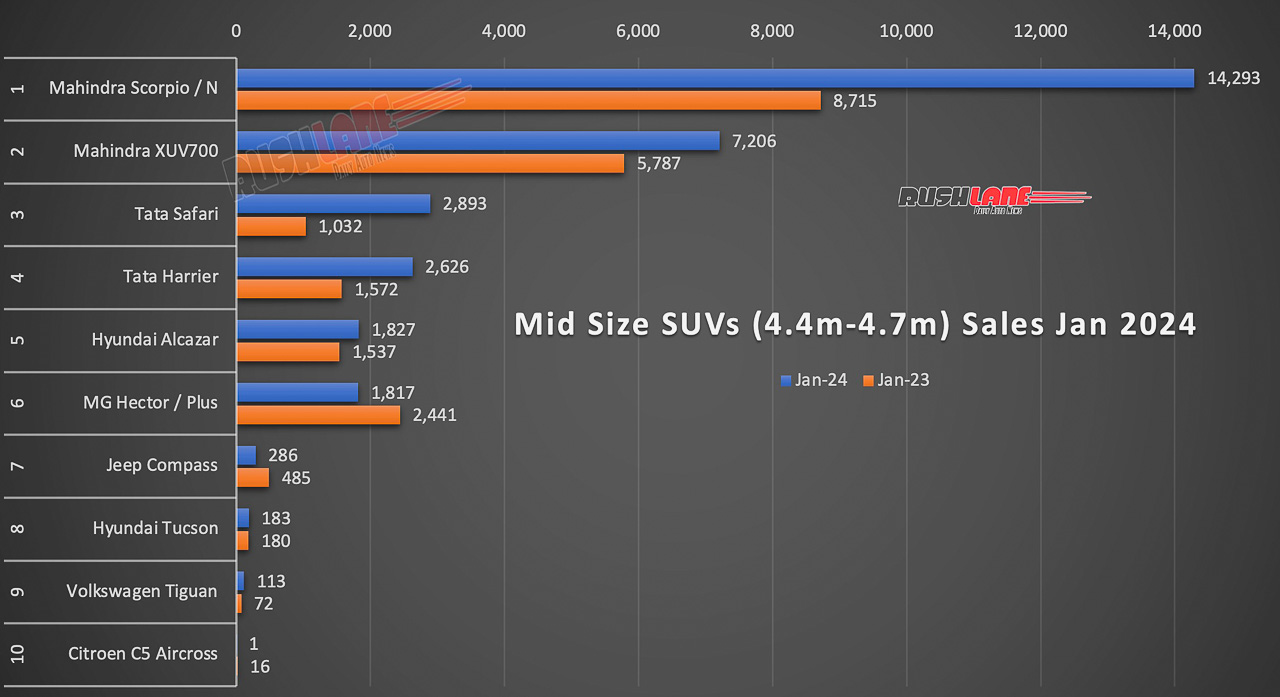

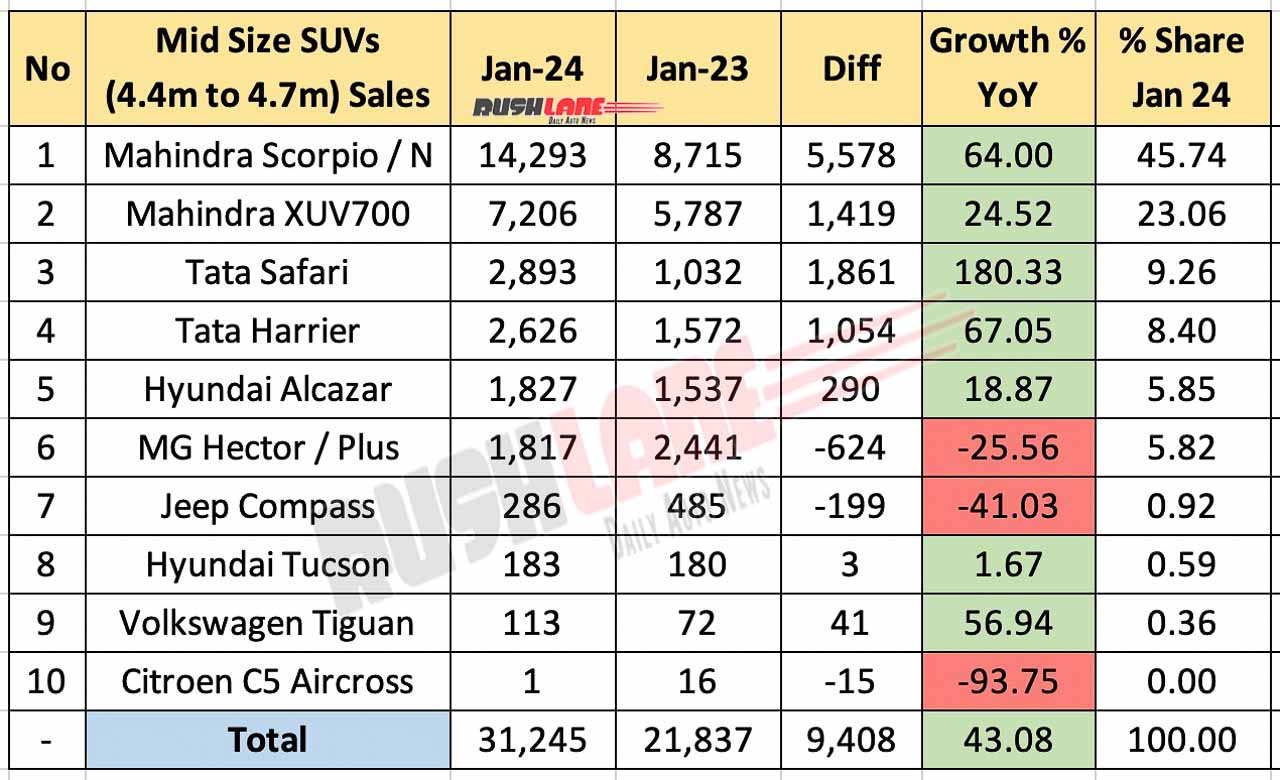

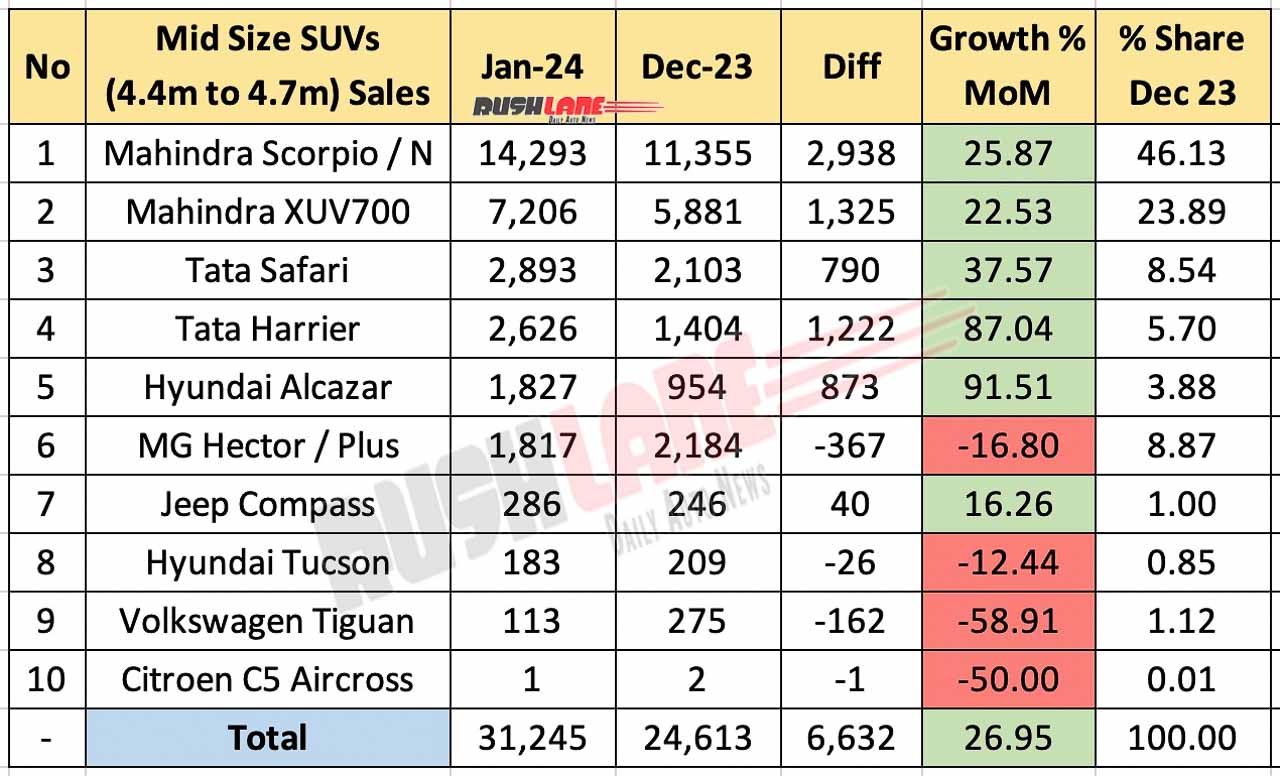

Following our earlier report on sub-4 meter SUVs (3.8m to 4.0m) which had Tata Punch and Nexon in top order and compact SUV sales (4.0m to 4.4m) which saw Maruti Grand Vitara in the lead, we now bring you mid-size SUV sales. Mid-size SUVs (4.4m-4.7m) have seen sales improve both in terms of YoY and MoM by significant numbers. Sales stood at 31,245 units in January 2024, up 43.08 percent over 21,837 units sold in January 2023. This was a volume growth of 9,408 units. MoM sales also increased by 26.95 percent from 24,613 units sold in December 2023.

Mid-Size SUV Sales January 2024

Mahindra led the segment with both its Scorpio/N and XUV700 commanding a 68.80 percent share on this list. Scorpio/N sales improved by 64 percent YoY to 14,293 units in January 2024, up from 8,715 units sold in January 2023. The Scorpio/N currently commands a 45.74 percent share marginally down from 46.13 percent held in December 2023 when sales had stood at 11,355 units relating to a 25.87 MoM growth.

Mahindra XUV700 posted YoY and MoM growth with 7,206 units sold in the past month. This was a growth of 24.52 percent over 5,787 units sold in January 2023 while MoM sales improved by 22.53 percent from 5,881 units sold in December 2023. Recently Mahindra announced its plan to reduce waiting periods for the Scorpio/N, XUV700 and Thar. Increase in production has brought down order backlog significantly.

Tata Safari and Harrier Post Outstanding YoY and MoM Growth

Tata Motor’s two offerings the Safari and Harrier together command a 17 percent share on this list. Both these mid-size SUVs have seen increased sales both on YoY and MoM basis. Safari sales were up 180.33 percent YoY to 2,893 units, from 1,032 units sold in January 2023. MoM sales were up 37.57 percent over 2,103 units sold in December 2023.

Tata Harrier sales also escalated 67.05 percent YoY and 87.04 percent MoM to 2,626 units in January 2024. There had been 1,572 units and 1,404 units sold in January 2023 and December 2023 respectively. Lower down the sales list was the Hyundai Alcazar with 1,827 units sold last month. This was an 18.87 percent YoY growth over 1,537 units sold in January 2023. MoM sales were up 91.51 percent from 954 units sold in December 2023. MG Hector sales dipped 25.56 percent YoY and 16.80 percent MoM to 1,817 units in January 2024.

Premium Mid Size SUV Sales Jan 2024

Jeep Compass faced a challenging month, witnessing a 41.03% decline in sales, with only 286 units sold in January 2024. Similarly, Volkswagen Tiguan experienced a modest growth of 56.94%, selling 113 units. Both brands may need to strategize to address the evolving market dynamics.

Hyundai Tucson also contributed to the brand’s success with 183 units sold, showing a slight growth of 1.67%. Citroen C5 Aircross started its journey with only 1 unit sold in January 2024. While the sales figures are minimal, it’s important to note that the model is still trying to establish its presence in the market.

The overall performance of mid-size SUVs in India for January 2024 indicates a robust demand, with key players like Mahindra, Tata, and Hyundai leading the way. The market is evolving, with consumer preferences shifting towards feature-rich and performance-oriented vehicles. As the year progresses, the mid-size SUV segment is expected to remain dynamic, with manufacturers likely to introduce new models and features to meet the growing demands of Indian consumers.