Hero MotoCorp and Honda have solidified their positions as industry leaders, collectively contributing to over 52% of the total market share

The Indian two-wheeler industry has demonstrated robust growth in February 2024, combining strong domestic and export sales. Hero MotoCorp and Honda have emerged as frontrunners, contributing significantly to the industry’s overall stellar performance.

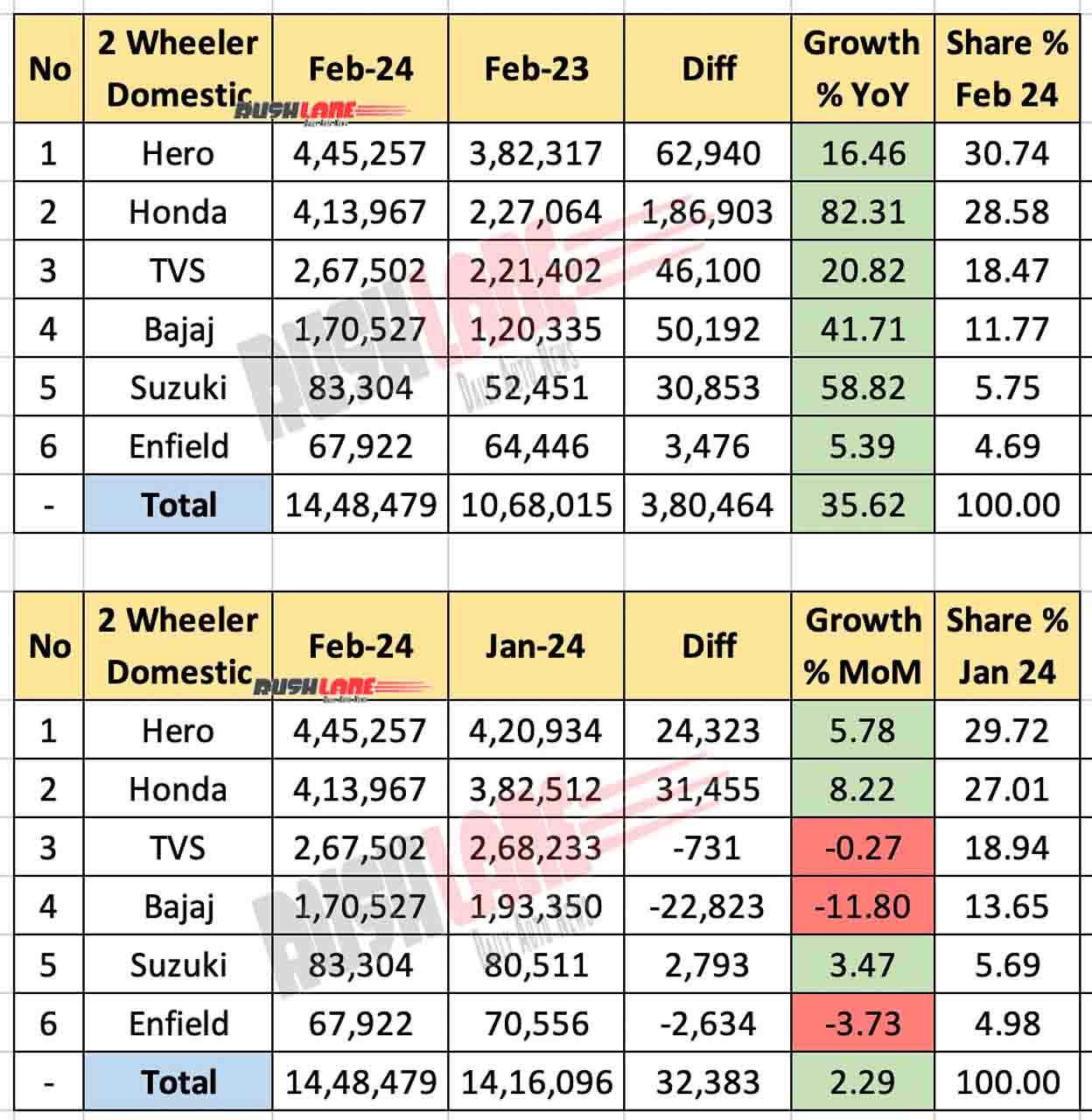

Two Wheeler Sales Feb 2024 – Domestic

Hero MotoCorpthe country’s largest two-wheeler manufacturer, reported a remarkable 16.46% year-on-year (YoY) growth, selling 4,45,257 units in January 2024 compared to 3,82,317 units in the same period last year. Honda, securing the second spot, experienced an even more impressive YoY growth of 82.31%, with 4,13,967 units sold in January 2024 compared to 2,27,064 units in January 2023.

TVS Motor Company maintained its strong position with a YoY growth of 20.82%, selling 2,67,502 units in January 2024. Bajaj Auto, Suzuki, and Royal Enfield also contributed significantly to the sector’s growth, with YoY growth percentages of 41.71%, 58.82%, and 5.39%, respectively. The cumulative domestic two-wheeler sales for January 2024 reached a staggering 14,48,479 units, marking a remarkable 35.62% YoY growth.

On a month-on-month (MoM) basis, Hero MotoCorp continued to dominate with a 5.78% growth, selling 4,45,257 units in January 2024 compared to 4,20,934 units in December 2023. Honda followed suit with an 8.22% MoM growth, selling 4,13,967 units in January 2024. TVS witnessed a marginal decline of 0.27% MoM, while Bajaj Auto experienced a more substantial drop of 11.80%. Suzuki and Royal Enfield also faced challenges, reporting 3.47% and 3.73% MoM declines, respectively.

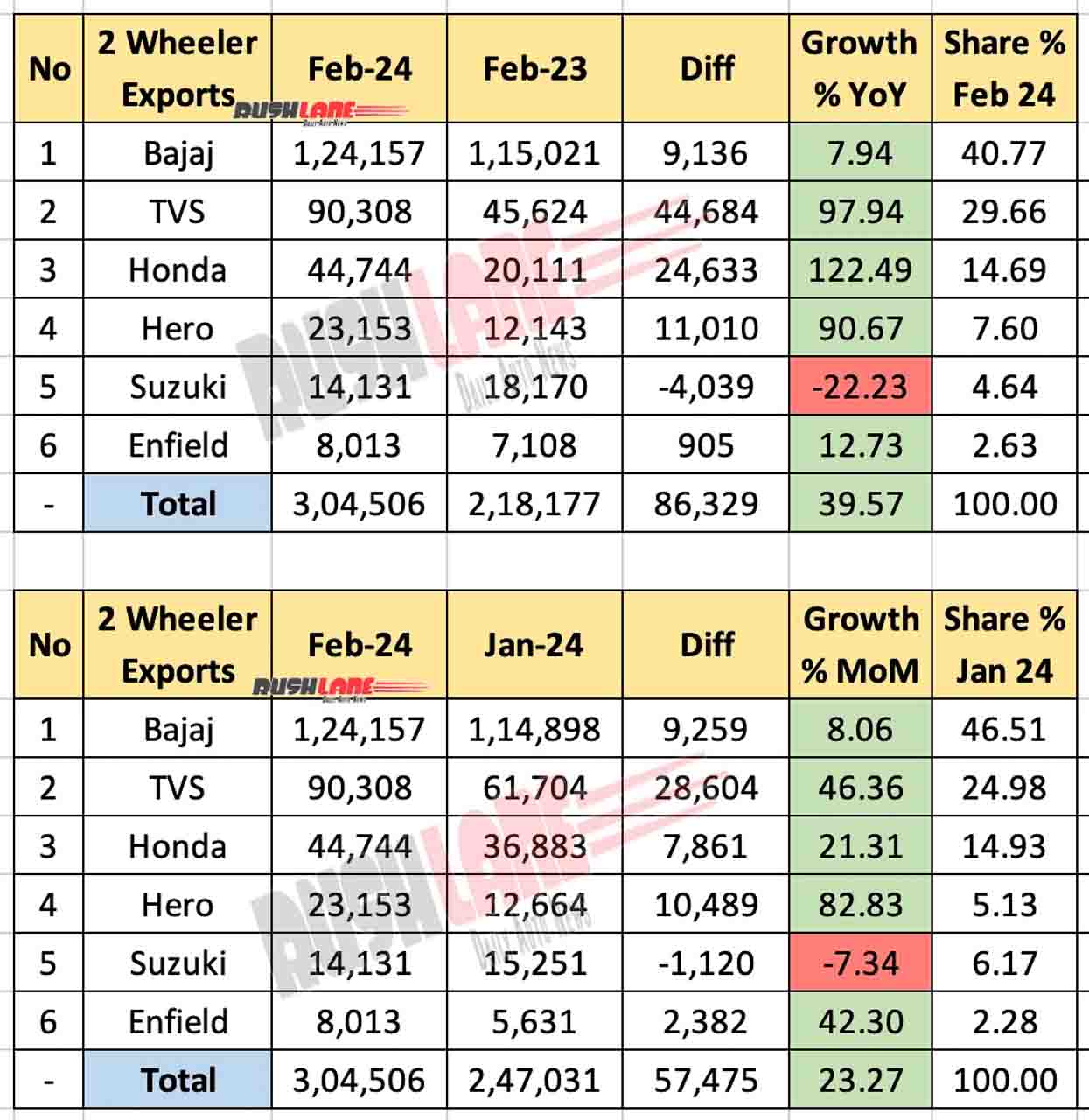

Two Wheeler Exports Feb 2024

Bajaj Auto, with a notable 7.94% year-on-year (YoY) growth, led the export charts, shipping 1,24,157 units in February 2024 compared to 1,15,021 units in the same period last year. TVS demonstrated an impressive YoY growth of 97.94%, exporting 90,308 units, a significant increase from 45,624 units in February 2023. Honda, securing the third spot, reported a remarkable 122.49% YoY growth, exporting 44,744 units, while Hero MotoCorp and Suzuki also displayed substantial growth percentages of 90.67% and 22.23%, respectively.

The cumulative two-wheeler exports for February 2024 reached a staggering 3,04,506 units, marking a remarkable 39.57% YoY growth. Bajaj dominated the export market with a 40.77% share, followed by TVS with 29.66%, showcasing their stronghold in the global arena.

On a month-on-month (MoM) basis, Bajaj Auto maintained its momentum with an 8.06% growth, exporting 1,24,157 units in February 2024 compared to 1,14,898 units in January 2024. TVS witnessed a substantial MoM growth of 46.36%, exporting 90,308 units. Honda and Hero MotoCorp also demonstrated positive MoM growth, while Suzuki faced a marginal decline of 7.34%.

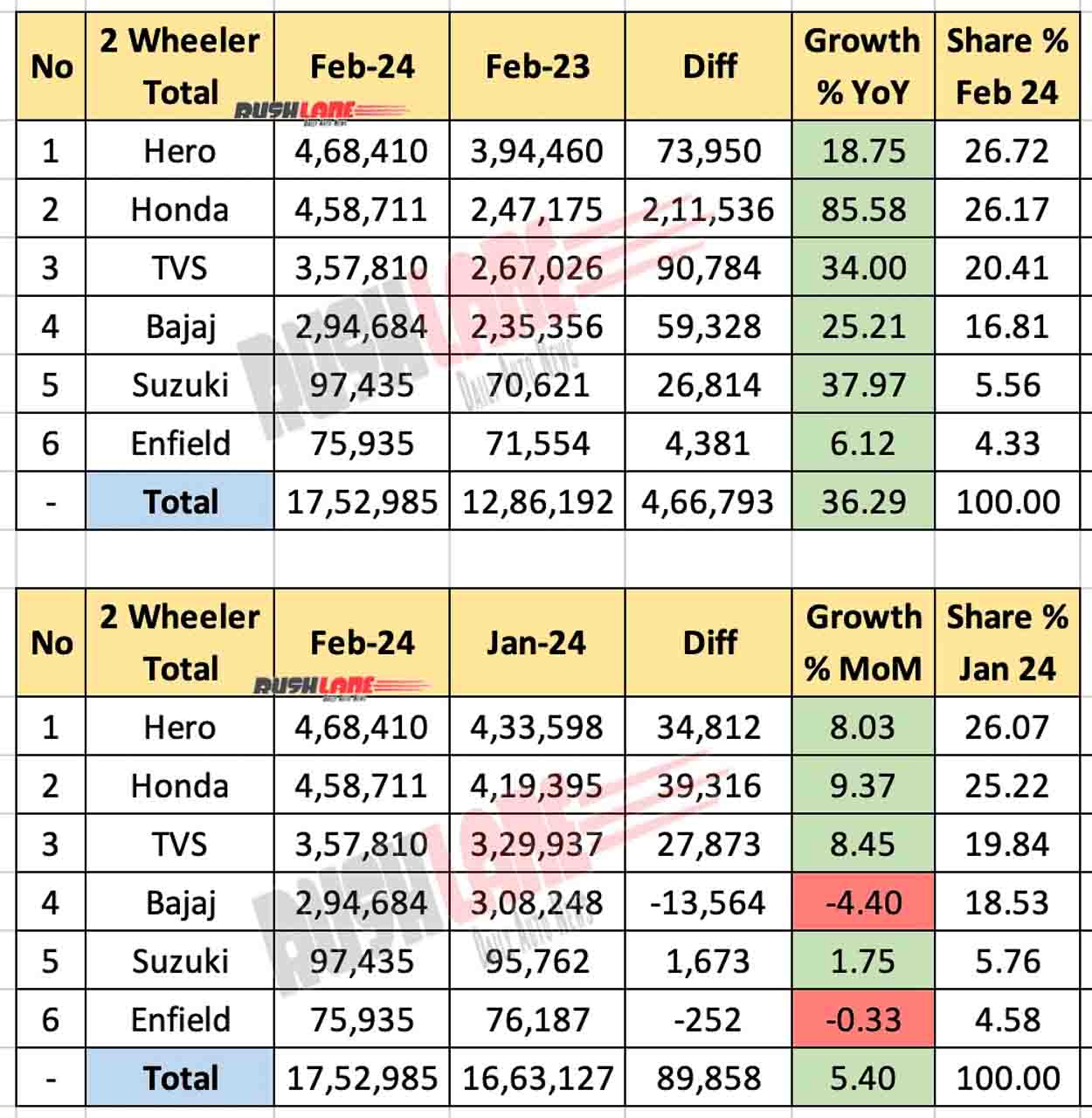

Two Wheeler Total Sales Feb 2024 – Exports + Domestic

Hero MotoCorp reported an impressive 18.75% year-on-year (YoY) growth, with a total of 4,68,410 units sold in February 2024, compared to 3,94,460 units in the same period last year. Honda, securing the second position, showcased exceptional YoY growth of 85.58%, with a total of 4,58,711 units sold in February 2024. TVS also played a pivotal role, achieving a remarkable 34.00% YoY growth, selling a total of 3,57,810 units.

Bajaj Auto and Suzuki displayed commendable performances, contributing to the industry’s overall growth with YoY growth percentages of 25.21% and 37.97%, respectively. Royal Enfield also posted a positive YoY growth of 6.12%. The cumulative two-wheeler sales for February 2024 reached an impressive 17,52,985 units, marking a notable 36.29% YoY growth. Hero MotoCorp led the market with a 26.72% share, closely followed by Honda with 26.17%, highlighting the dominance of these two manufacturers in the industry.

On a month-on-month (MoM) basis, the industry continued to exhibit positive trends. Hero MotoCorp, Honda, and TVS experienced MoM growth percentages of 8.03%, 9.37%, and 8.45%, respectively. Bajaj Auto faced a marginal decline of 4.40%, while Suzuki and Royal Enfield also experienced slight fluctuations.