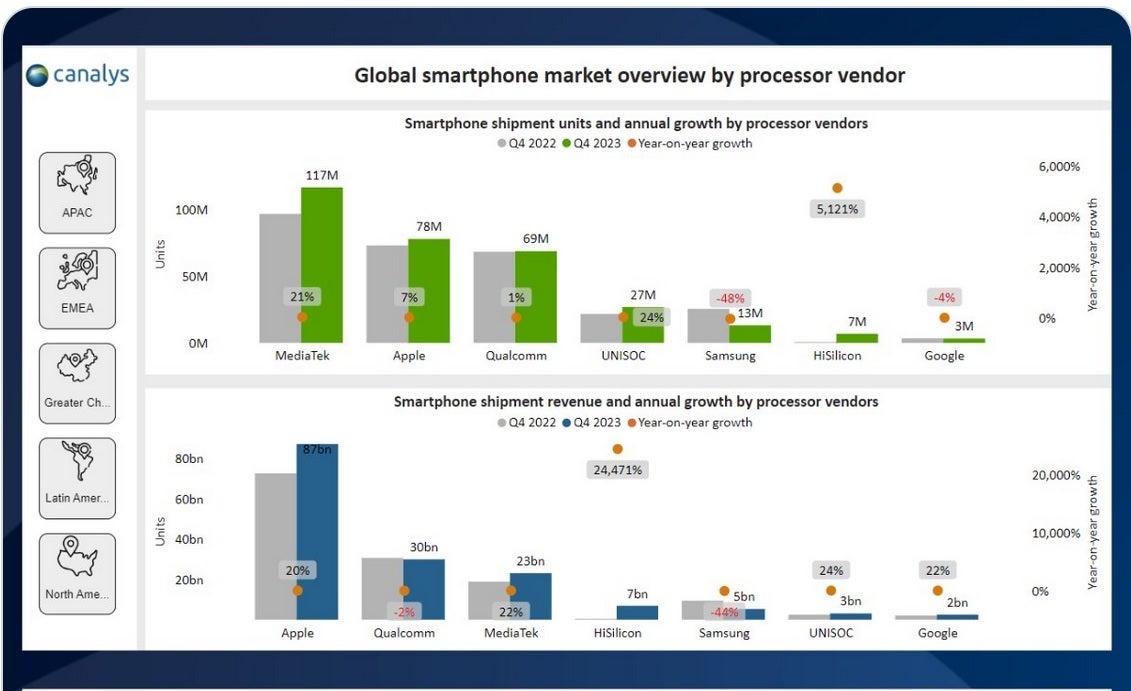

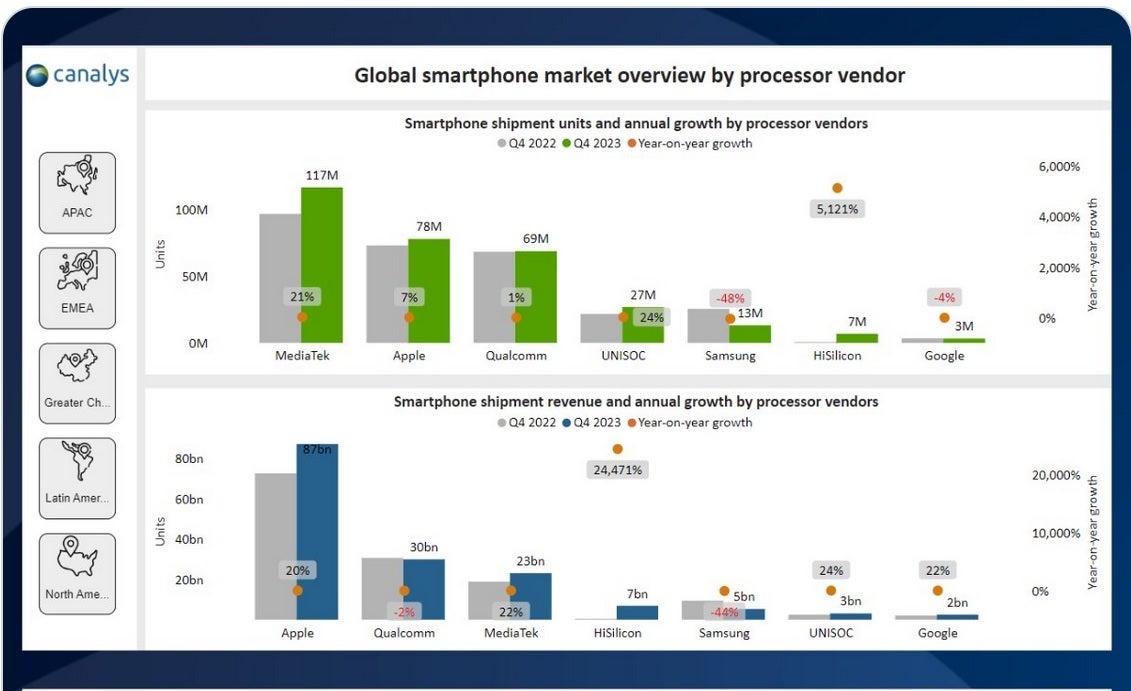

MediaTek was the top chip manufacturer in the fourth quarter of 2023 as 117 million smartphones were shipped with its silicon during the October through December period. That was a 21% increase year-over-year for the chipmaker whose flagship chip, the Dimensity 9300 application processor (AP) had a unique configuration. The Octa-core SoC carries four Cortex-X4 Prime CPU cores and four Cortex-A720 Performance CPU cores. No low-power CPU cores are found inside the Dimensity 9300 AP.

A far distance back from MediaTek was Apple. The company shipped 78 million iPhone units during Q4 2023 with each phone carrying one of the tech giant’s A-series chipsets. The most recent component is the 3nm A17 Pro which powers the iPhone 15 Pro and iPhone 15 Pro Max. Year-over-year, Apple’s chip shipments for the quarter were up 7%. The global data

comes from Canalys.

Based on the number of smartphone units shipped during Q4, MediaTek was the top chipset vendor worldwide

Just behind Apple, third-place Qualcomm had 69 million smartphones delivered in Q4 2023 that contained one of its Snapdragon processors. That was a gain of 1% on an annual basis. Next is UNISOC, a fabless Shanghai smartphone chip designer that used to be known as Speadtrum. During the fourth quarter, 27 million smartphones packed with UNISOC’s chipsets were shipped, up 24% on an annual basis.

Top smartphone chip vendors by phone units old (top) and phone revenue (bottom)

Despite being a better performer than past Exynos APs, the Exynos 2400 SoC failed to lift Samsung in the fourth quarter as the company saw a whopping 48% fewer phones powered by an Exynos chipset delivered during the three months. That’s because there was no Exynos 2300 and phones powered by the Exynos 2400 AP, such as the Galaxy S24 and Galaxy S24+ in most markets (outside of the U.S. and China) weren’t shipped until the first quarter of 2024.

Huawei’s HiSilicon unit was the beneficiary of Chinese foundry SMIC’s production of the 7nm Kirin 9000s for the Huawei Mate 60 series. This was the first 5G SoC made for Huawei since U.S. export rules revised in 2020 blocked Huawei from obtaining 5G chips from foundries that use American technology. As a result, HiSilicon chips were packed inside 7 million smartphones during the fourth quarter of last year, a stunning 5,121% hike year-over-year.

During the fourth quarter of 2023, Google shipped three million Pixel handsets powered by a Tensor chip. Interestingly, that was down 4% from the number of Pixel phones delivered with a Tensor chipset during the fourth quarter of 2022.

Based on the revenue of phones shipped globally, Apple was the top chip vendor during Q4

What would this list look like if we looked at the amount of revenue generated by the phones powered by the chipsets made by these chip designers? Well first of all, since many of MediaTek’s chips end up in low-priced Android phones, you wouldn’t expect the firm to remain on top. And indeed, it does not. Apple’s pricey iPhone models put the company at the top of the list as $87 billion was generated in revenue by the handsets using Apple’s A-series APs that were delivered during the fourth quarter. That was a 20% year-over-year gain.

Phones powered by Qualcomm’s processors raked in $30 billion during Q4, good enough for second place despite a 2% decline. MediaTek had a nice 22% increase in the revenue collected from phones that used its chipsets during the fourth quarter as that figure hit $23 billion. Huawei’s HiSilicon was next and with an incredible 24,471% increase year-over-year, the revenue of phones shipped with HiSilicon chipsets came to $7 billion during the fourth quarter.

The Q4 revenue of phones powered by Samsung’s Exynos chipsets dropped 44% to $5 billion. Next, phones running UNISOC silicon collected $3 billion in revenue for the last quarter of 2023, up 24% compared to the 2022 fourth quarter. And that brings us to Google. Revenue of Pixel handsets shipped with a Google Tensor AP hit $2 billion during the quarter, up 22%.