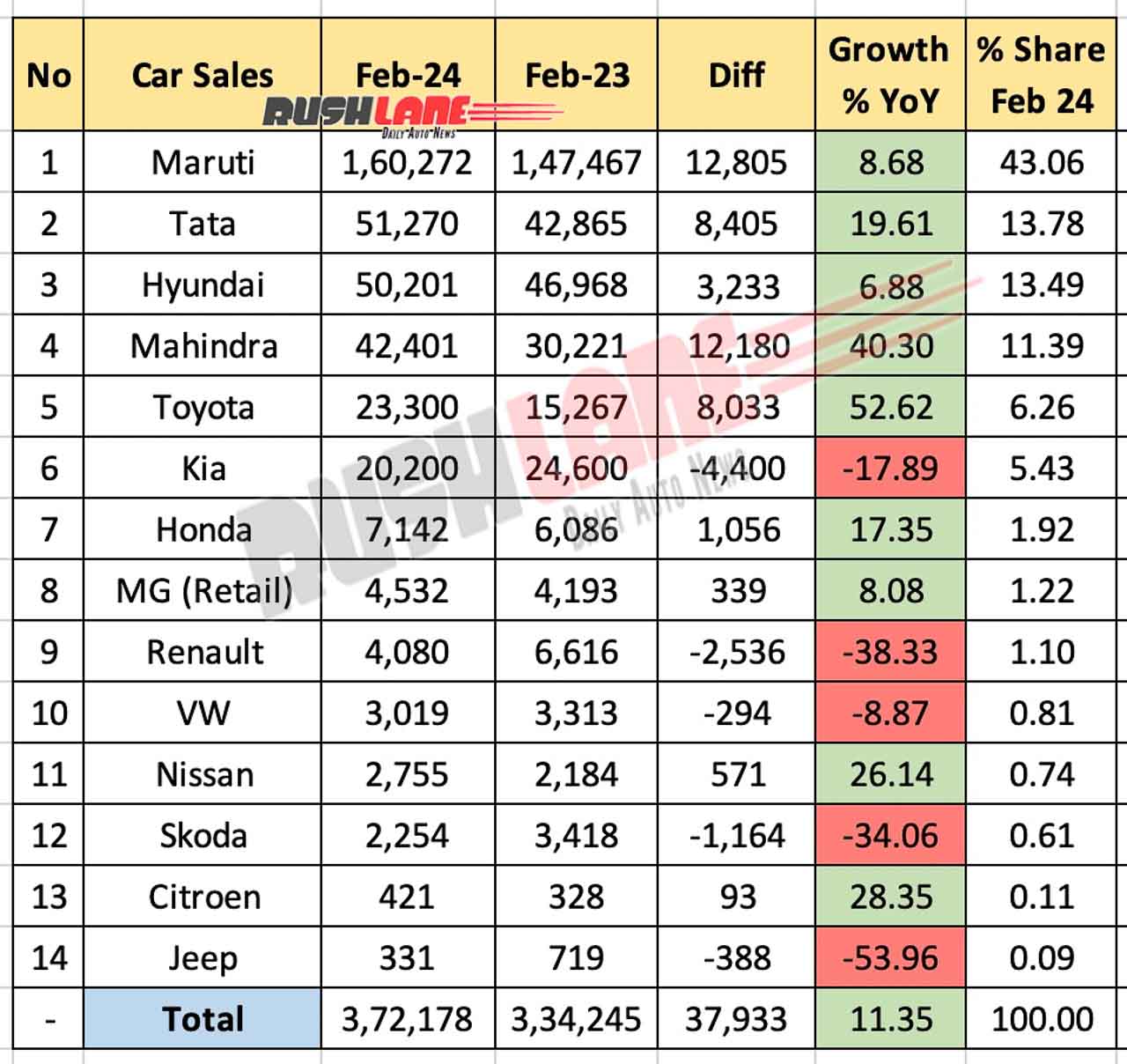

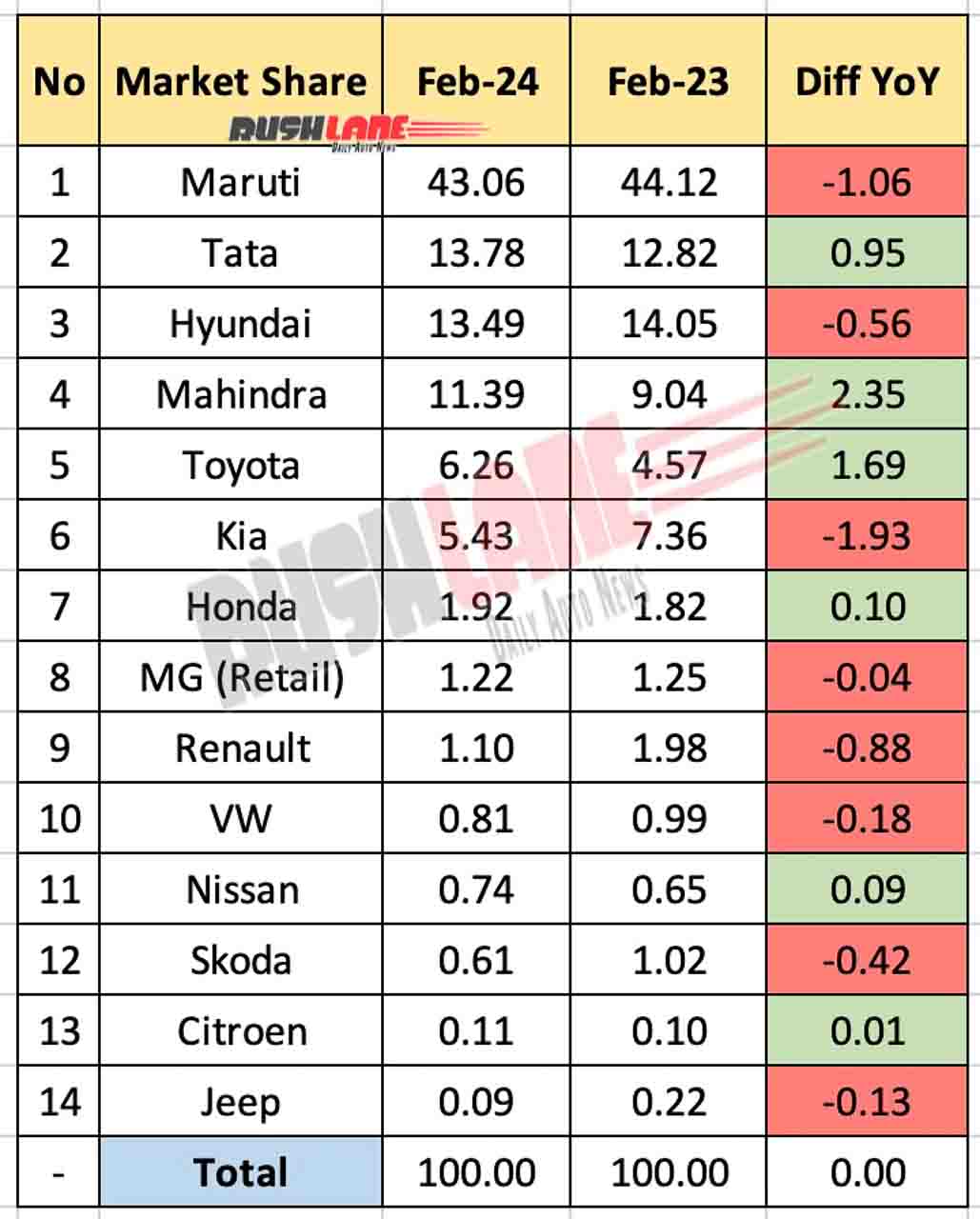

Over 3.72 lakh cars were sold in India during Feb 2024, registering a 11% growth YoY with Maruti, Tata, Hyundai, Mahindra in the top 4 with over 81% market share

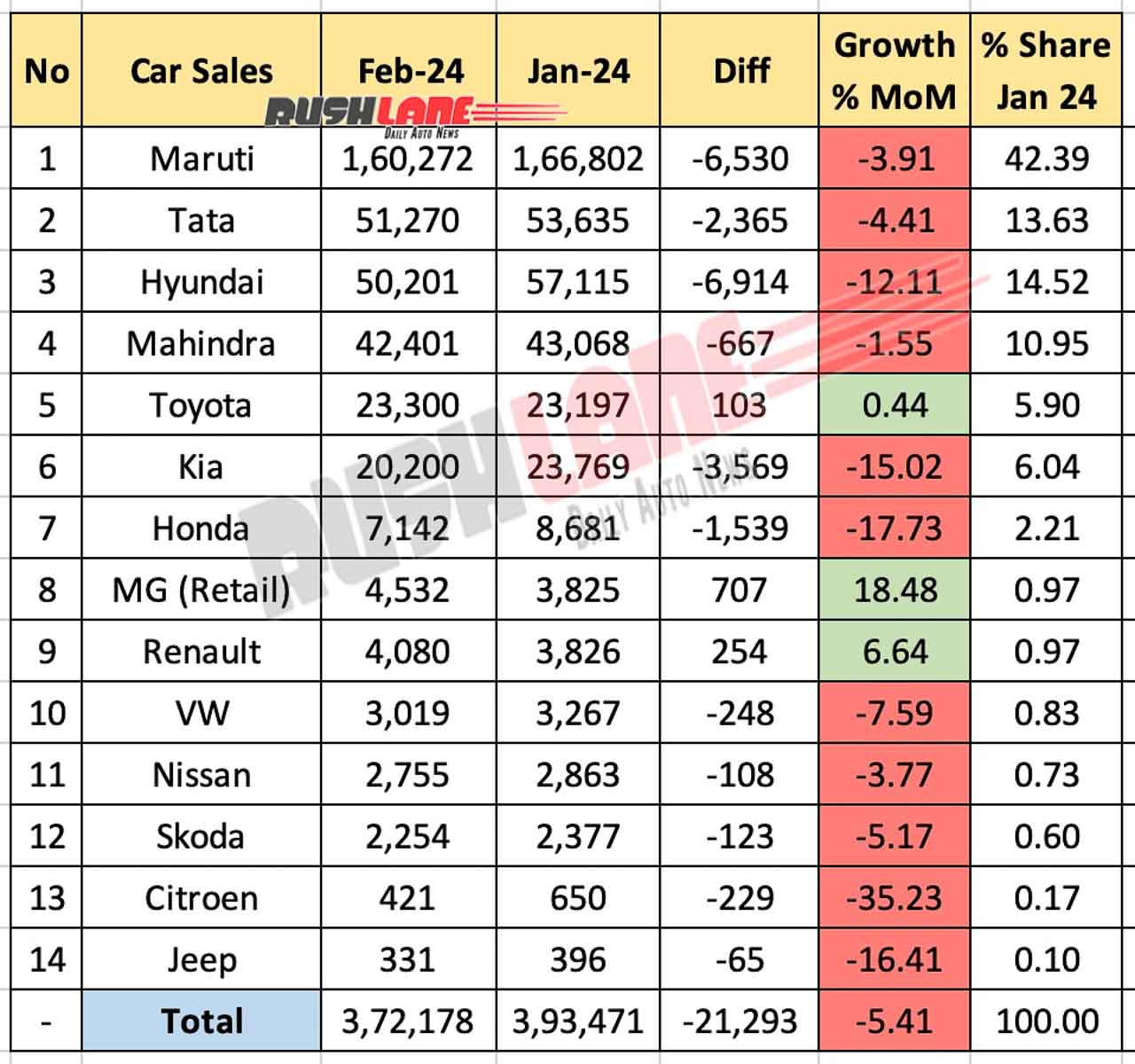

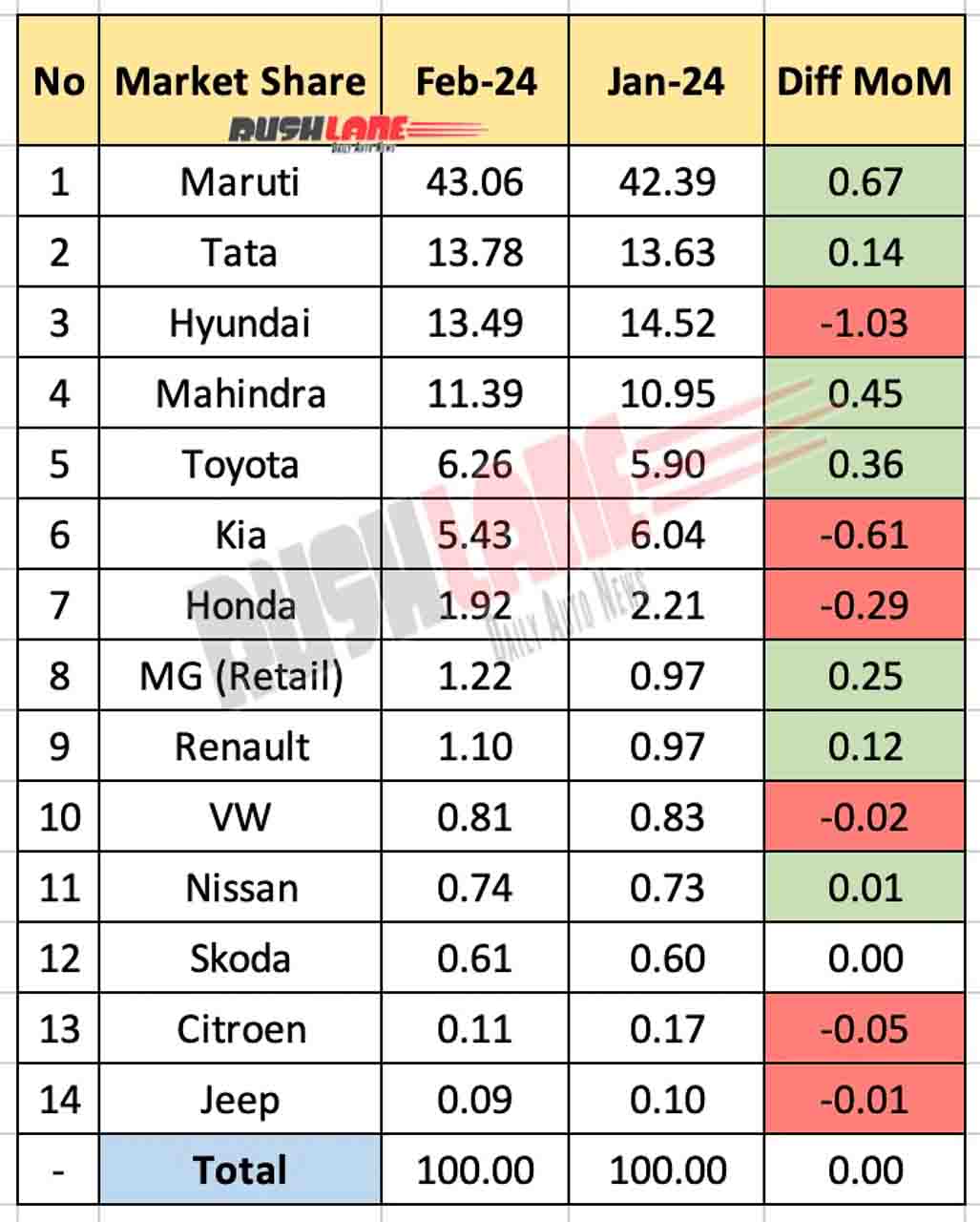

The car segment in India performed well in February 2024 with 3,72,178 units sold in the past month, an 11.3 percent growth from 3,34,245 units sold in February 2023. It was however a MoM decline by 5.4 percent as there had been 3,93,471 units sold in January 2024. Every automaker, except for Toyota, MG and Renault have recorded lower MoM sales.

Car Sales February 2024 – Maruti Suzuki Leads

Maruti sales scaled to 1,60,272 units last month, up 8.7 percent from 1,47,467 units sold in February 2023. As always, it was only Maruti Suzuki to record sales above the 1 lakh unit mark. MoM sales dipped 3.9 percent from 1,66,802 units sold in January 2024 taking market share to 43.1 percent. Maruti sales were boosted by its UV lineup while the mini and compact segments have both seen YoY degrowth.

At No. 2 was Tata Motors crossing the 51,000 unit sales mark. With total sales of 51,270 units last month, Tata Motors scaled over Hyundai Motors by a clear 1,000 units. The company recorded a 19.6 percent YoY growth to 51,270 units sold while MoM sales dipped by 4.4 percent. It was however an improvement in market share to 13.8 percent from 12.8 percent YoY. It was the company’s electric vehicle lineup that drew in the most crowd into company dealerships.

Hyundai India sales which stood at 50,201 units in February 2024, reported a 6.9 percent YoY growth but a 12.1 percent MoM decline. There were 46,968 units and 57,115 units sold in February 2023 and January 2024 respectively. Hyundai sales were also boosted by the Creta facelift while the company now gear up to launch the Creta N Line on 11th March 2024 for which bookings have already commenced.

Mahindra and Toyota have each posted significant YoY growth. Mahindra sales stood at 42,401 units last month with a 40.3 percent YoY growth while Toyota sales were up 52.6 percent to 23,300 units. It is the company’s portfolio, spanning various segments that has led to its increased sales. Toyota also saw a very marginal improvement in its MoM sales by 0.4 percent from 23,197 units sold in January 2024.

Kia sales fell both on YoY and MoM basis to 20,200 units taking down market share to 5.4 percent from 7.4 percent YoY. Kia has its Sonet, Carens and Seltos as top sellers primarily due to these cars offering the lowest maintenance cost. Demand is such that the company plans to boost production. Kia will launch a new luxury MPV, full size SUV EV and an all new SUV this year (codenamed AY, rumoured name Clavis).

Car Sales at Sub-10,000 Units

Lower down the sales list of car sales in February 2024 and in number under 10,000 units was Honda with 7,142 unit sales in February 2024. This was a 17.4 percent YoY growth from 6,086 units sold in February 2023. Honda sales of the City, Amaze and relatively new Elevate steered the company to this success. MoM sales, however, fell by 17.7 percent from 8,681 units sold in January 2024.

MG posted 4,532 unit sales in February 2024 with an 8.1 percent YoY and 18.5 MoM growth while Renault sales at 4,080 units saw a YoY de-growth of 38.3 percent from 6,616 units sold in February 2023 while MoM sales improved by 6.6 percent. Sales are sure to be boosted by the new Duster which will launch later this year.

The sales list also included VW (3,019 units), Nissan (2,755 units), Skoda (2,254 units) and Citroen (421 units) out of which VW and Skoda have posted both YoY and MoM de-growth while each of these have seen lower MoM sales. Jeep sales fell to 331 units in February 2024 relating to a 54 percent YoY and 16.4 percent MoM decline.