Bajaj Pulsars took 4th position on the Top 10 Two Wheelers February 2024 charts and is India’s best selling premium commuter lineup

India is the largest market for 2W vehicles in the world. Owing to their affordability, lower up-front costs and lower running costs, 2W vehicles witness greater acceptance from Indian audience. This price-sensitive market favours budget commuter 2W vehicles the most, as seen in the sales charts below.

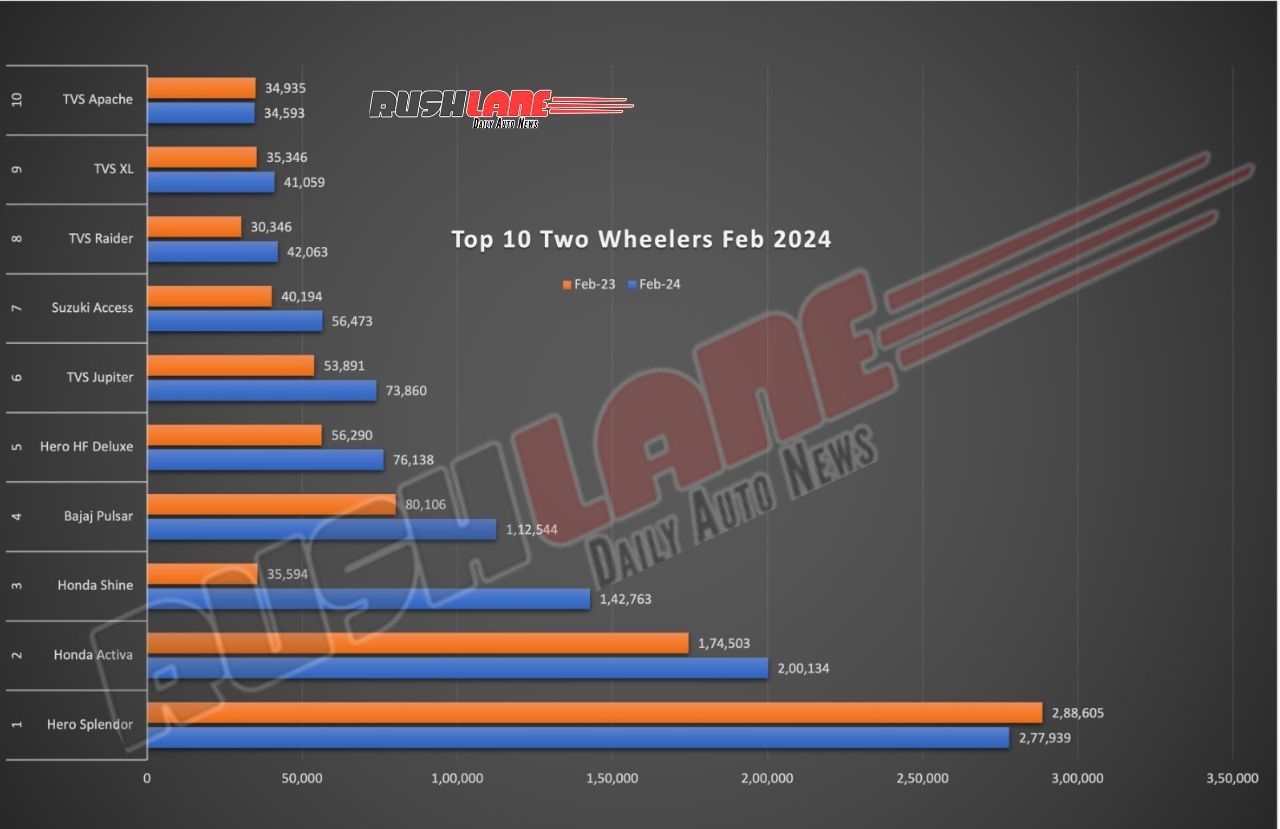

Top 10 Two Wheelers February 2024

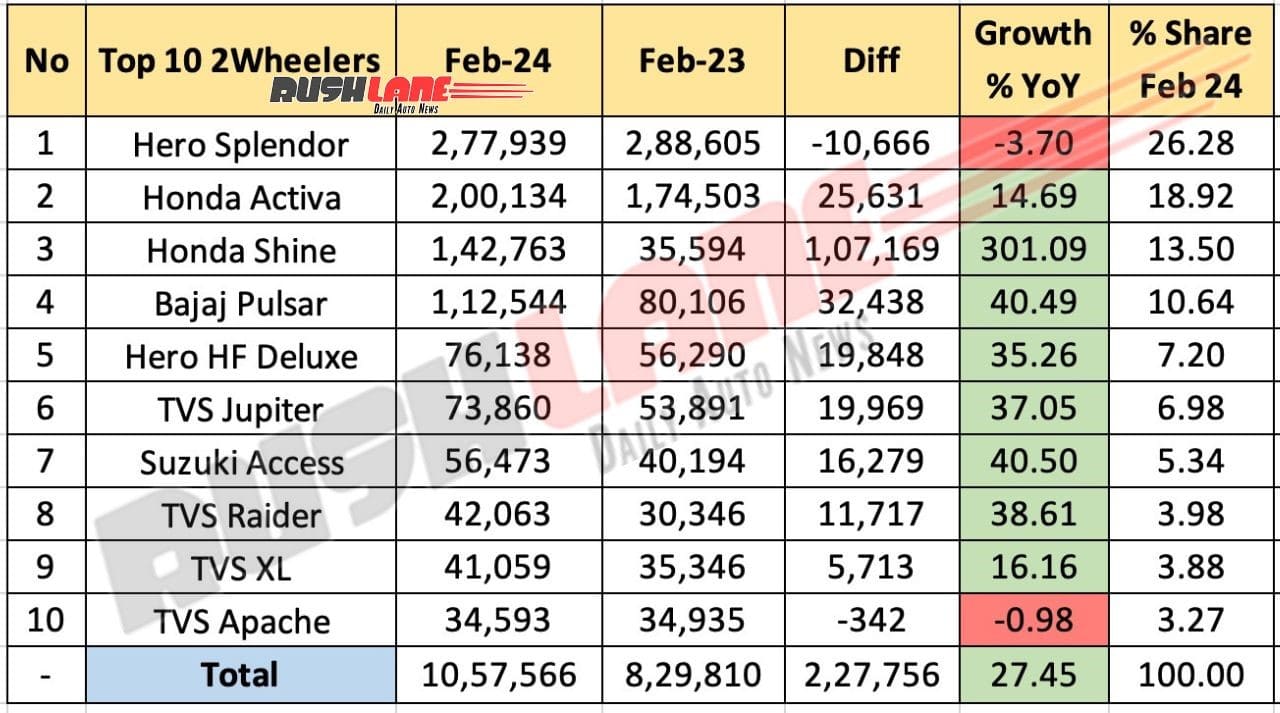

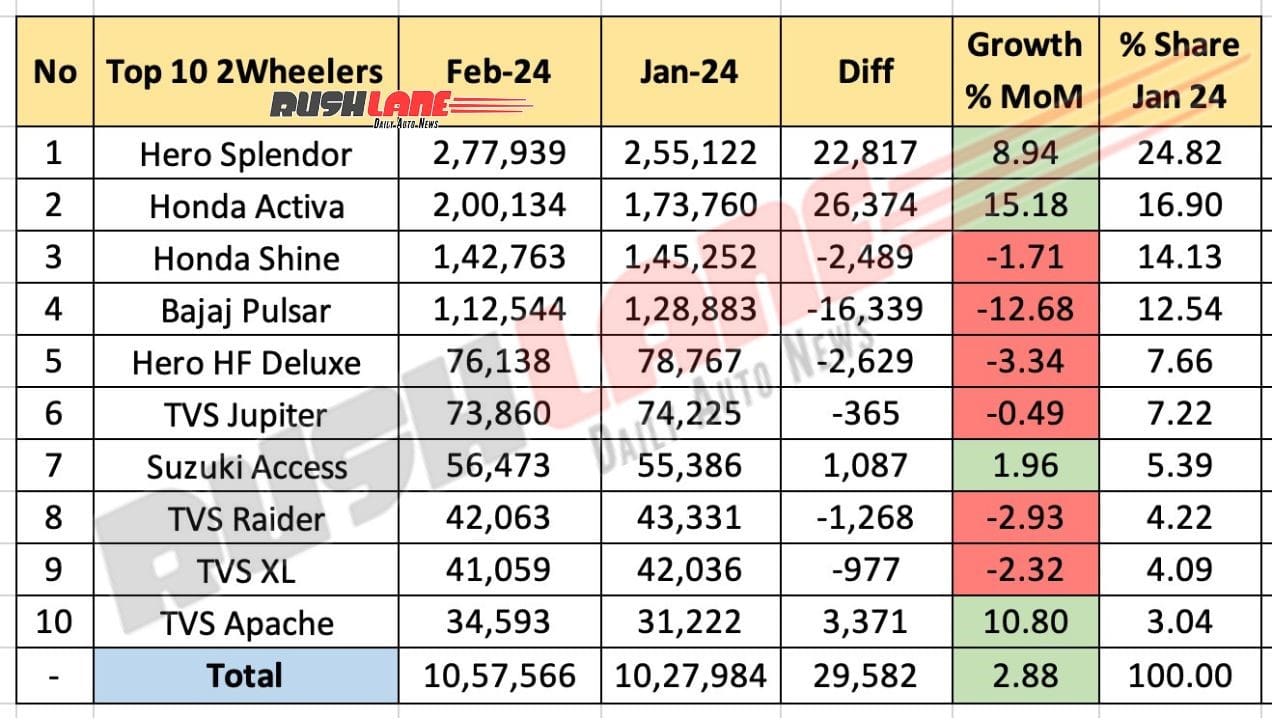

Like clockwork, Hero MotoCorp’s Splendor grabbed the top spot with 2,77,939 units sold last month. Splendor alone accounts for 26.28% of the top 10 2W vehicles, up from 24.82% in January 2024. Splendor saw 3.70% YoY decline when compared to 2,88,605 units sold last year and an impressive 8.94% MoM gain when opposed to 2,55,122 units from a month before.

Volume gain MoM was 22,817 units while losing 10,666 units YoY. Honda’s Activa is the best selling scooter in India. The company sold 2,00,134 units of these trusty ol’ Activa and the scooter registered 14.69% YoY growth, up from 1,74,503 units and 15.18% MoM growth, up from 1,73,760 units. Volume gain was 25,631 units YoY and 26,374 units MoM.

Activa accounts for 16.90% of the market share of this list. Honda’s streak continues with Shine motorcycle in 3rd place selling 1,42,763 units. The newly launched Shine 100 has significantly contributed to sales numbers. And we can see sales figures tripled YoY at 301.09% growth. MoM analysis reveals a small 1.71% decline in numbers and market share in this list stood at 14.13%.

In 4th place, Bajaj Pulsar rose to shine with 1,12,544 units sold last month. As opposed to 80,106 units sold in February 2023 and 1,28,883 units sold in January 2024, Bajaj saw 40.49% YoY growth with 32,438 units gained in volume and 12.68% MoM decline with 16,339 units lost in volume. Pulsars accounted for 12.54% market share of this list.

Vehicles with sub 10% market share

Hero’s second motorcycle on the list is HF Deluxe with 76,138 units sold. Unlike Splendor, HF Deluxe registered a 35.26% YoY growth and a minor 3.34% MoM decline and accounted for a 7.66% market share. Volume growth YoY was 19,848 units and volume lost MoM was 2,629 units. In 6th place, we have TVS Jupiter scooter, which is the 2nd best-seller of its genre.

Jupiter sold 73,860 units last month and registered 37.05% YoY growth over 53,891 units sold last year and a 0.49% MoM decline when compared to 74,225 units sold a month before. Suzuki Access is the company’s best-selling product and is the 7th best-selling 2-wheeler in India. With 56,473 Access sold, Suzuki saw 40.50% YoY growth and 1.96% MoM growth along with 5.34% market share.

The 8th, 9th and 10th best-selling of the Top 10 Two Wheelers charts are bagged by TVS Raider, XL and Apache respectively. Raider’s and XL’s sales figures fell close to each other. Raider’s at 42,063 units and XL’s at 41,059 units. While Raider saw 38.61% YoY growth and 2.93% MoM decline, XL saw 16.16% YoY growth and 2.32% MoM decline.

Lastly, we have TVS Apache motorcycles with 34,593 units. Apache registered 0.98% YoY decline along with 10.80% MoM growth last month. In total, Top 10 Two Wheelers February 2024 chart accounted for a total of 10,57,566 units. When compared to 8,29,810 units from February 2023 and 10,27,984 units in January 2024, there was 27.45% YoY and 2.88% MoM growth. Volume growth YoY was 2,27,756 units and 29,582 units MoM.