Hero MotoCorp and Honda continued to lead the segment commanding a combined 51% total market share

Indian’s two-wheeler segment continued to show off a strong performance in March 2024 with positive sales demonstrated both in terms of domestic sales and exports. Taking the leading 6 two wheeler makers into account Hero MotoCorp and Honda lead the segment by significant margins over TVS Motor, Bajaj Auto, Suzuki and Royal Enfield.

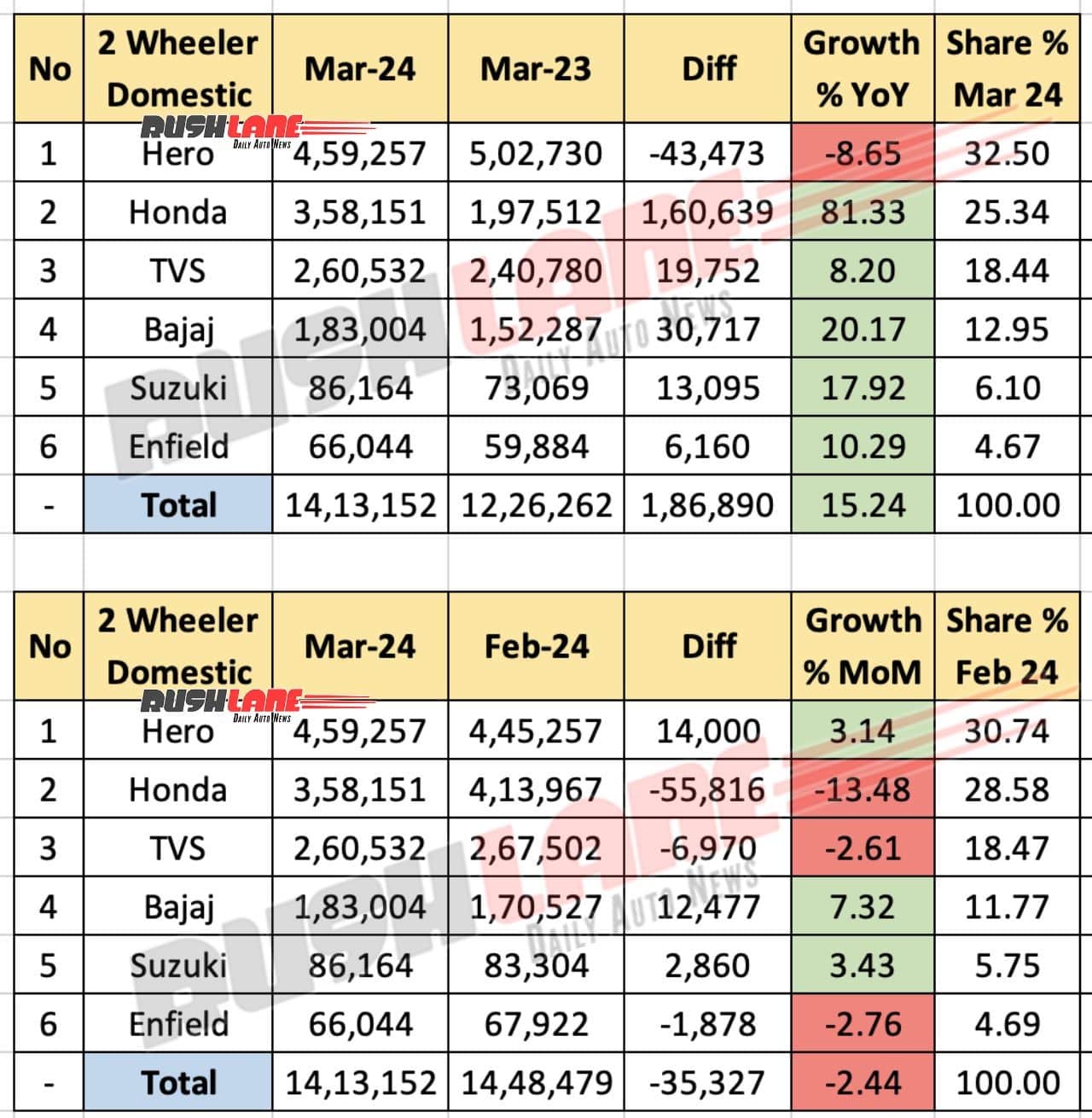

Two Wheeler Domestic Sales March 2024

In domestic markets, sales grew by 15.24 percent YoY to 14,13,152 units, up from 12,26,262 units sold in March 2023. It was however a MoM decline by 2.44 percent over 14,48,479 units sold in February 2024.

Once again, leading this list was Hero MotoCorp despite an 8.65 percent YoY dip in sales. Sales fell to 4,59,257 units, down from 5,02,730 units sold in March 2023 relating to a 43,473 unit volume de-growth. It was however a 3.14 percent MoM growth from 4,45,257 units sold in February 2024. Bringing in these sales figures were commuter motorcycles – Splendor, Glamour, Passion. Sales are about to be boosted with the new Xtreme 125R premium motorcyclethe company’s latest addition in the 125cc segment.

Honda secured a No. 2 spot with an 81.33 percent YoY growth in domestic sales to 3,58,151 units while its MoM performance lacked lustre with 13.48 percent de-growth over 4,13,967 units sold in February 2024. Honda crossed the 6 crore domestic sales milestone in March 2024 ever since it went solo in 1999. A diverse range of products catering to every need of Indian buyers is what has stood it in good stead.

TVS also posted an 8.20 percent YoY growth but a 2.61 percent MoM decline to 2,60,532 units. Bajaj Auto and Suzuki have both seen both YoY and MoM growth to 1,83,004 units and 86,164 units respectively. Royal Enfield also ended March 2024 on a promising note with a 10.29 percent YoY growth to 66,044 units while its MoM performance declined by 2.76 percent from 67,922 units sold in February 2024.

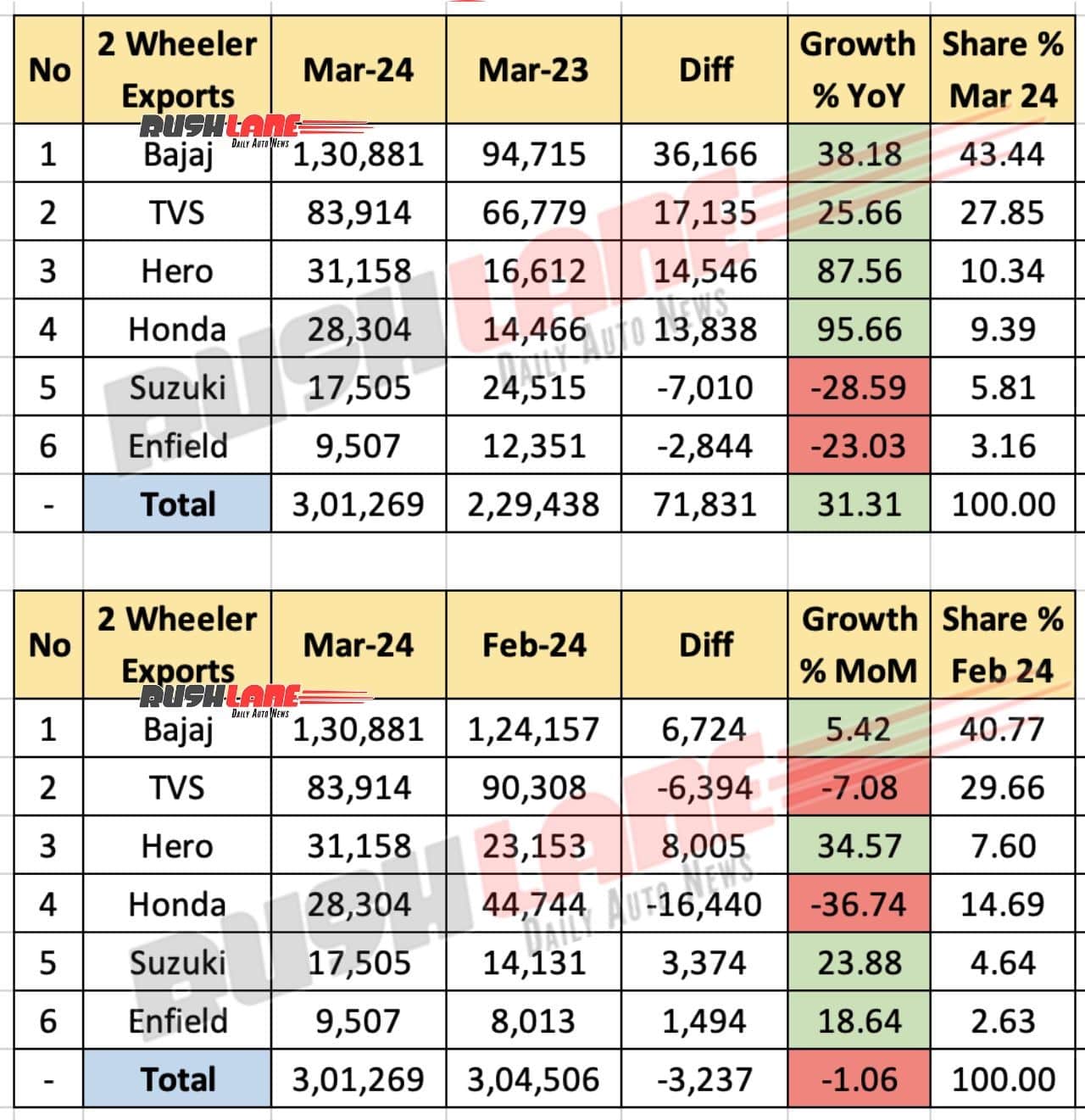

Two Wheeler Exports March 2024

Bajaj Auto saw the highest sales in global markets in March 2024 to 1,30,881 units shipped in the past month, up 38.18 percent over 94,715 units exported in March 2023. MoM exports also improved by 5.42 percent with Bajaj Auto commanding a 43.44 percent share on this export list.

TVS exports improved by 25.66 percent YoY but fell by 7.08 percent on a MoM basis to 83,914 units. Hero MotoCorp followed with 31,158 units shipped in the past month relating to an 87.56 percent YoY and 34.57 percent MoM growth. The company also took over from Honda, which was the 3rd best-selling OEM in February 2024 with 44,744 units exported in the said month.

Suzuki (17,505 units) and Royal Enfield (9,507 units) both posted YoY decline in exports but improved on a MoM basis. Two wheeler exports improved by 31.31 percent YoY to 3,01,269 units while MoM sales fell by 1.06 percent in March 2024.

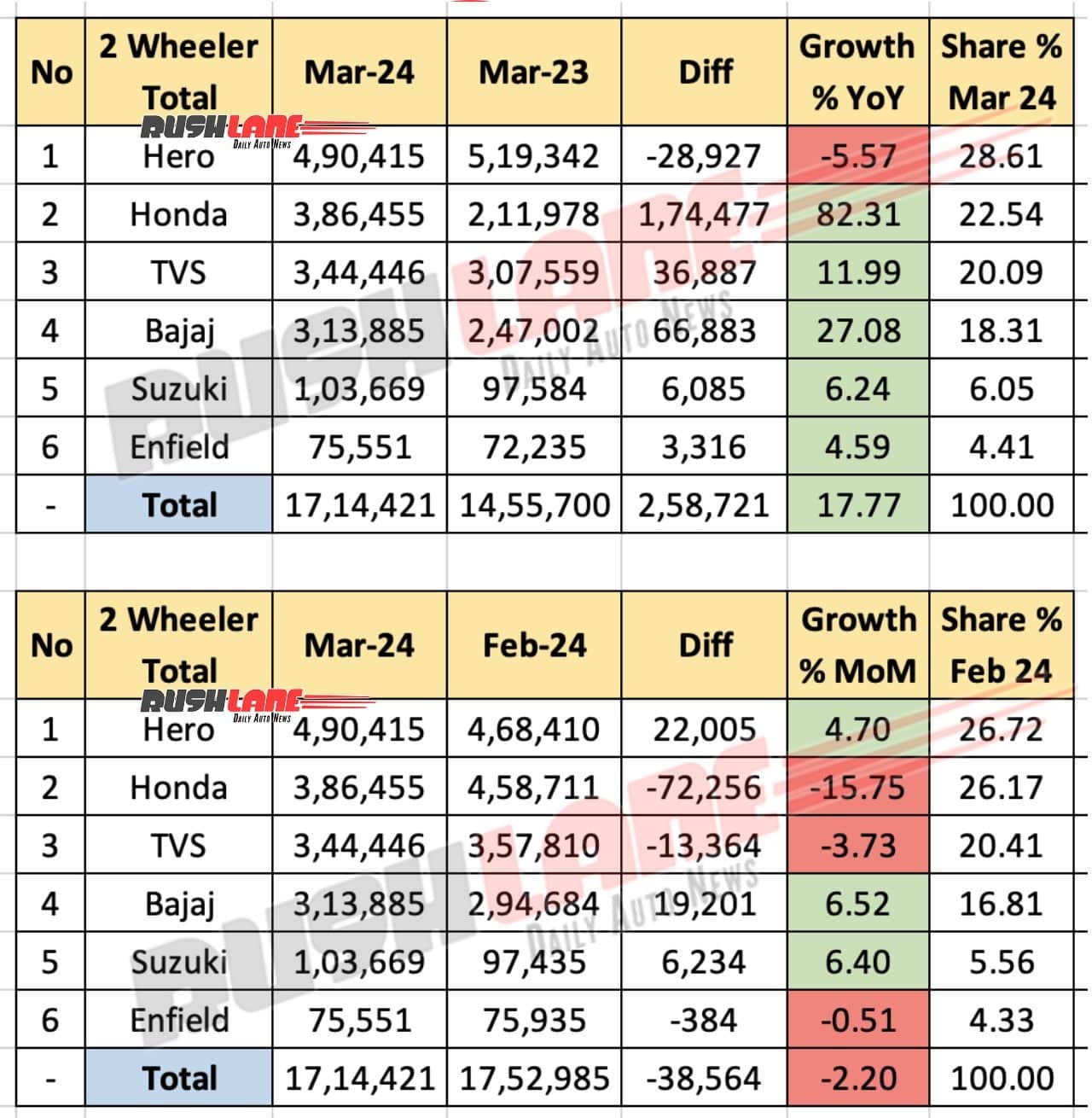

Two Wheeler Total Sales (Domestic + Exports) March 2024

Cumulative two wheeler sales for March 2024 reached a total of 17,14,421 units, a 17.77 percent YoY growth from 14,55,700 units sold in March 2023 but a 2.20 percent MoM decline over 17,52,985 units sold in February 2024.

Hero MotoCorp headed the list with a total of 4,90,415 units sold in March 2024 relating to a 5.57 percent YoY decline but 4.70 percent MoM growth to command a 28.61 percent share. Showing off outstanding performance was also Honda with a massive 82.31 percent improvement in sales to 3,86,455 units while TVS sold 3,44,446 units both in domestic and export markets last month with 11.99 percent YoY growth but 3.73 percent MoM decline.

Bajaj Auto (3,13,885 units) and Suzuki (1,03,669 units) each posted YoY and MoM growth in total sales. Royal Enfield trailed this list with 75,551 units sold last month relating to a 4.59 percent YoY growth but marginal 0.51 percent MoM dip in sales.