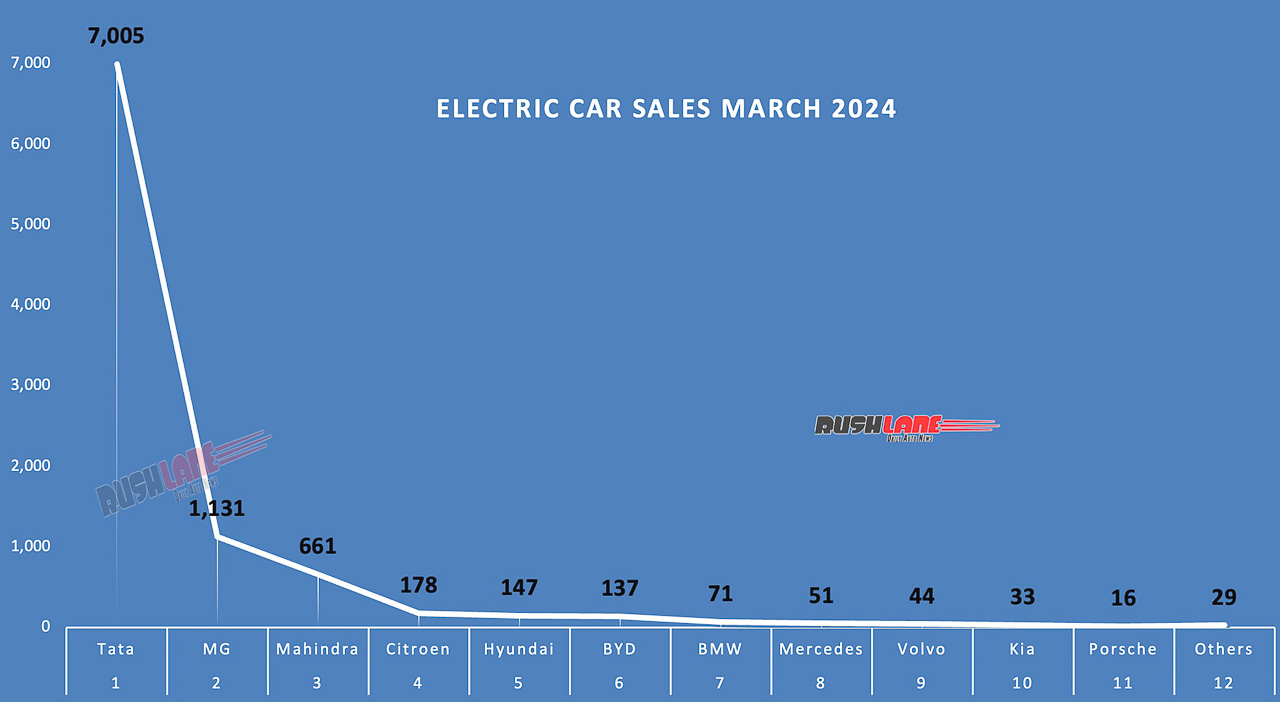

Tata Motors headed this list by a huge margin over MG and Mahindra – Thanks to Punch EV and Nexon EV, Tata has over 73% market share

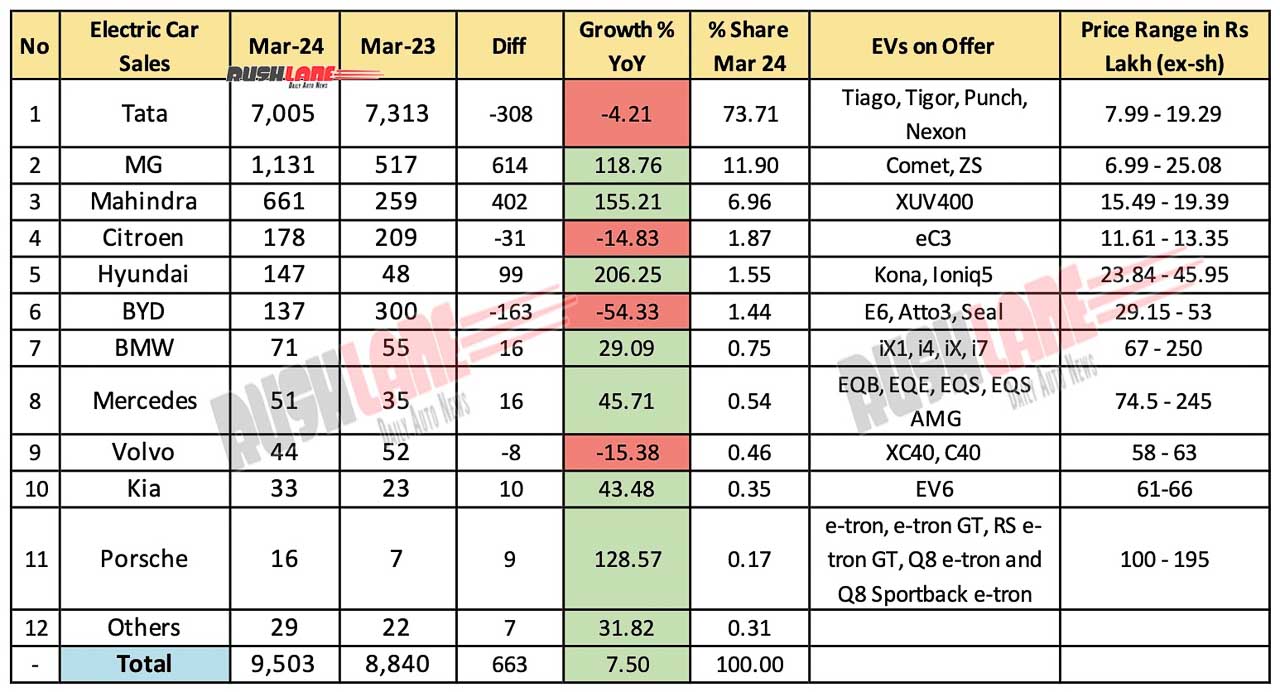

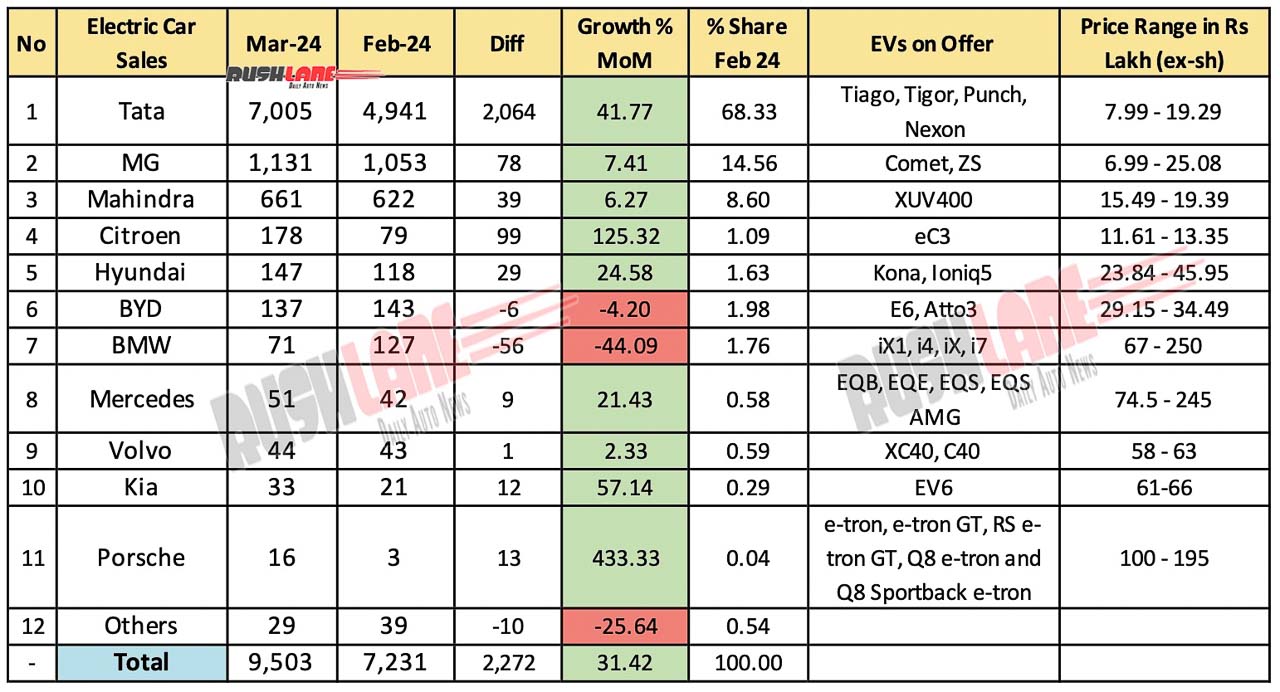

Thanks to the Government of India’s favourable policies regarding promotion of electric vehicles (EVs), sales in this segment are increasing by leaps and bounds. There are several cars currently on sale in this segment and there were nearly 91,000 electric cars sold in India during the period FY 2024 (April 2023 and March 2024). In March 2024, electric vehicle sales grew 7.50% YoY and 31042% MoM to 9,503 units. There had been 8,840 units sold in March 2023 and 7,231 units sold in February 2024 thus showing the growing demand that this segment has experienced.

Tata Motors Commands 73.71% Market Share

Tata Motors, with an EV lineup that includes the Tiago, Tigor, Punch and Nexon has seen sales of 7,005 units in March 2024 to command a 73.71 percent market share. Though this was a 4.21 percent YoY decline from 7,313 units sold in March 2023, sales improved dramatically by 41.77% on a MoM basis from 4,941 units sold in February 2024. Apart from a healthier lineup, Tata Motors’ EV are also more affordable priced between Rs 7.99 – 19.29 lakh. (ex.sh). There is now the Tata Curvv EV that is currently being tested ahead of launch sometime in the 2nd quarter of financial year 2024-2025.

MG Motor has the Comet and ZS in its electric segment and has seen sales of 1,131 units last month. This was a 118.76% YoY growth while MoM sales also showed off strong growth by 7.41%. The Comet and ZS are priced from 6.99-25.08 lakh. MG has also started testing the Cloud EV which will be its 3rd electric car when launched in India later this year or by early 2025.

Mahindra XUV400, the sole electric model in the company lineup has seen sales of 616 units last month, up 155.21% from 259 units sold in March 2023. MoM sales also grew by 6.27% from 622 units sold in February 2024. Mahindra will be expanding its EV lineup to include the XUV.e8, XUV.e9 and BE.05, each of which have been seen while on speed tests at the company’s track in Chennai. In the Citroen electric lineup is the eC3 priced from Rs 11.61-13.35 lakh. Sales dipped to 178 units in the past month from 209 units sold in March 2023 while it was outstanding growth of 125.32% when compared to just 79 units sold in February 2024.

Among the higher priced electric cars in the non-luxury segment are the Hyundai Kona and Ioniq 5. Priced from Rs 23.84-45.95 lakh (ex.sh), sales of these two cars grew by 206.25% YoY to 147 units in the past month from 48 unit sold in March 2023. It was also outstanding MoM growth of 24.58 percent over 118 units sold in February 2024. Hyundai recently updated the Ioniq 5 with new colour schemes in a bid to boost sales. BYD E6, Atto3 and Seal have seen sales dip 54.33% YoY and 4.20 % MoM to 137 units while MoM sales also suffered a setback by 4.20%.

BMW India Claims Top Spot Among Luxury Brands

In the luxury electric vehicle segment, BMW India took a top spot among luxury brands with its iX1, i4, iX and i7 gaining in YoY sales by 20.09% to 71 units from 55 units sold in March 2023. MoM sales however, saw sales dip 44.09 percent from 127 units sold in February 2024.

Heralding outstanding YoY and MoM growth was Mercedes India with its electric vehicle lineup growing by 45.71% YoY and 21.43% MoM to 51 units in the past month. There had been 35 units and 42 units sold in March 2023 and February 2024 respectively. The Mercedes EV lineup is currently priced from Rs 74.5 lakh-2.45 crores.

Lower down the sales list was Volvo with its XC60 and C40 commanding sales of 44 units while Kia EV6 sales stood at 33 units. Porsche sales have escalated several fold to 16 units in March 2024, up 128.57% YoY and 433.33% MoM taking up market share to 0.17% from 0.54% on a MoM basis.