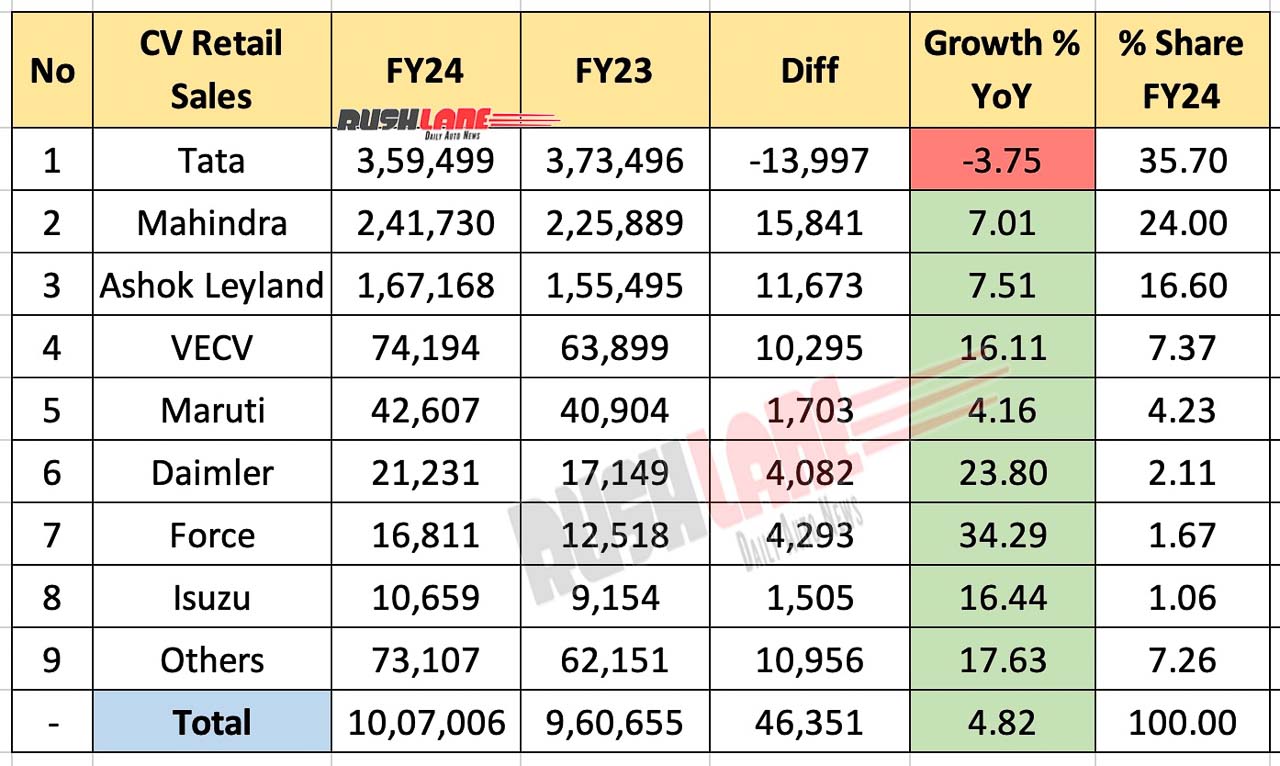

Commercial vehicle segment grew by 5% YoY in FY2024 to 10,07,006 units with Tata and Mahindra commanding a major market share

Financial Year 2024 closed on a promising note with growth seen across all segments. While the 2W segment improved by 9.30 percent, PV sales were up 8.45 percent and tractor sales were higher by 7.55 percent YoY. It was particularly the 3W segment that has reported a 48.83 percent improvement in sales on a YoY basis.

CV Sales FY2024 – Tata Leads the Segment

Speaking particularly amount commercial vehicle sales, FADA states that there were a total of 10,07,006 units sold in FY2024, up from 9,60,655 units sold in FY2023. Growth was seen across all segments MCV (72,907 units), HVC (3,24,308 units) and Others (48,694 units) while LCV sales (5,61,097 units) dipped marginally.

Proper planning, improvement in supplies and several bulk deals along with government tenders boosted sales across this segment. Sales were also boosted as older vehicles were replaced with more fuel efficient ones that also command a higher load carrying capacity.

Every CV OEM on this list has posted YoY growth in sales in FY2024. Tata Motors led in CV sales in the past financial year despite a YoY de-growth. Sales stood at 3,59,499 units in FY2024 down from 3,73,496 units sold in FY2023. This took market share down to 35.70 percent from 38.88 percent YoY.

Mahindra’s exciting range of Pickups, among which is the Bolero Pick-uphas boosted sales in the past financial year. Featuring at No. 2, on this list, Mahindra has posted a growth in CV sales to 2,41,730 units taking up market share to 24 percent. Sales had been at 2,25,889 units in FY2023.

Showing off a YoY growth in CV sales was Ashok Leyland with 1,67,168 units sold in FY2024, up from 1,55,495 units sold in FY2023. Its LCV sales came from its Dost range of vehicles. The company also pays more attention to medium and heavy commercial vehicles (M&HCV) in the Indian markets and credits this increase in sales to improvements across coal and mining industries and also where steel, petroleum and infrastructure is concerned.

Maruti, Daimler, Force, SML Isuzu

Posting sales at 74,194 units in the past financial year, VE Commercial Vehicles has seen a YoY growth over 63,899 units sold in FY2023. Maruti CV sales also improved on a YoY basis to 42,607 units, up from 40,904 units sold in FY2023 while Daimler sales went up even more significantly to 21,231 units in FY2024 from 17,149 units sold in FY2023.

The list also included Force Motors with 16,811 unit sales in FY2024 while SML Isuzu closed the past financial year with sales of 10,659 units, with both posting YoY growth. There were other CV OEMs that added 73,107 to total sales, up from 62,151 units sold in FY2023.