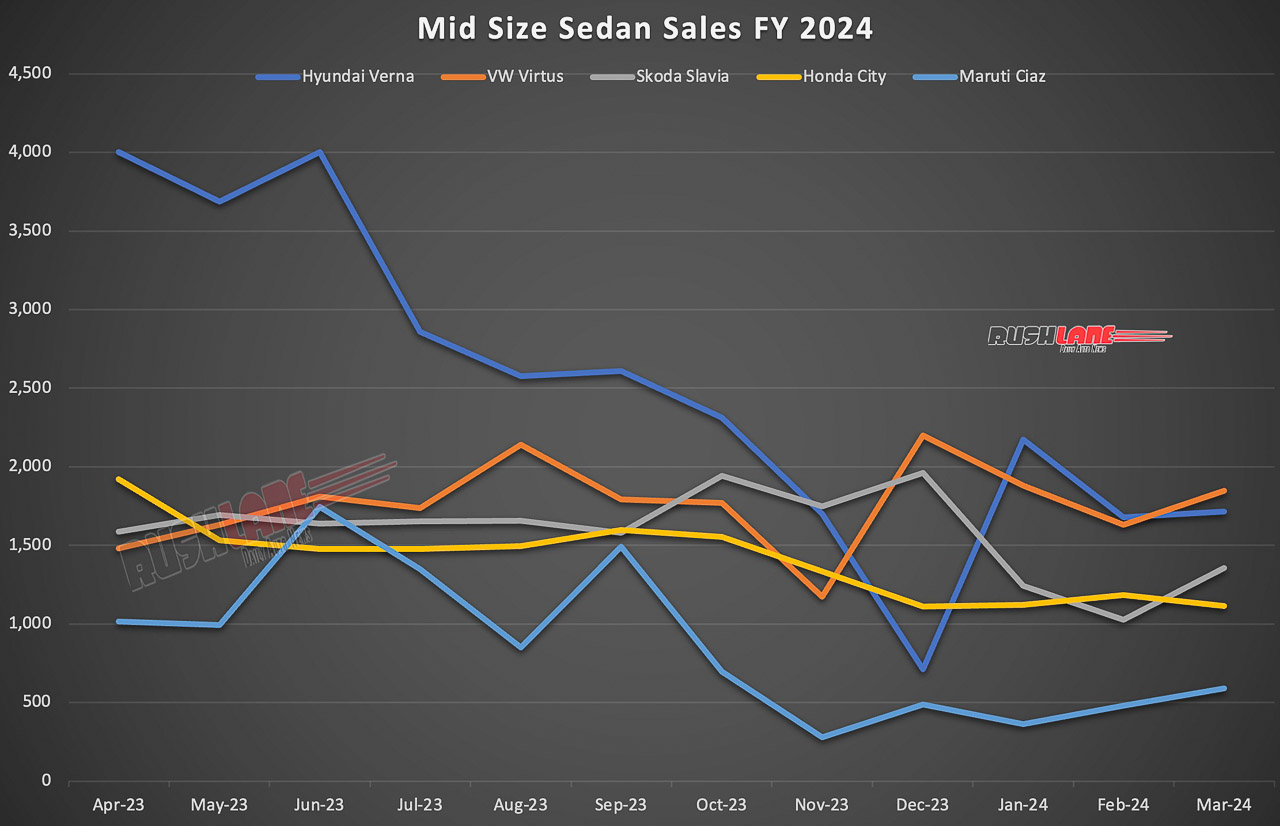

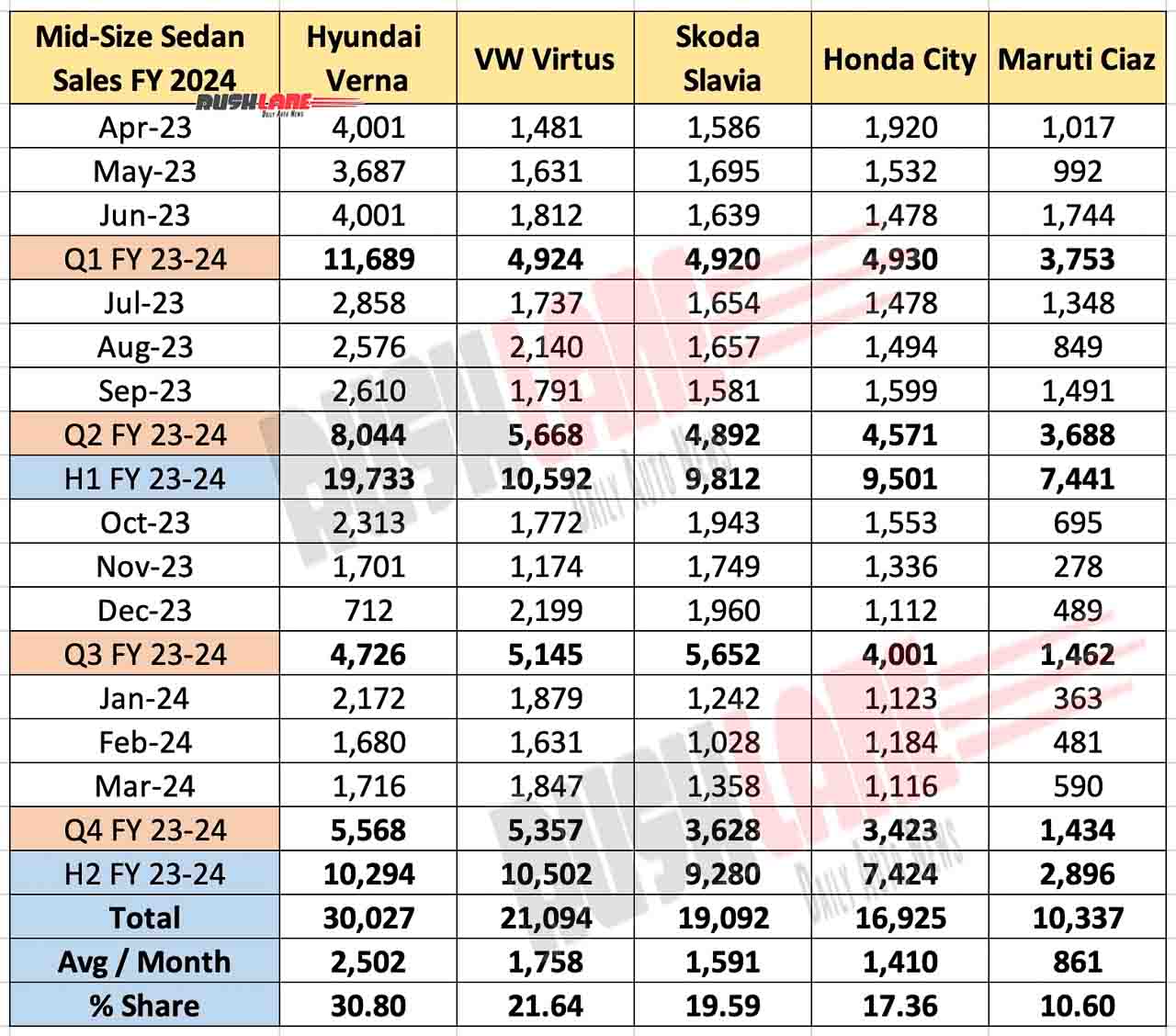

Hyundai Verna outsold Volkswagen Virtus, Skoda Slavia, Honda City and Maruti Ciaz in FY24 by a huge margin to command a 30.80% market share

The mid-size sedan segment in India was once considered highly competitive, with several models vying for attention. However, now, this segment is fighting for survival in a market that is more inclined towards SUVs in the sub-4m, compact and mid-sized segments while even hatchback claim more attention from buyers in the country.

Mid-Size Sedan Sales FY24 vs FY23

Hyundai Verna, Volkswagen Virtus, Skoda Slavia, Honda City and Maruti Suzuki Ciaz are the mid-size sedans currently on sale in India with combined total sales of 97,475 units in FY24. In FY24, sedans in the mid-size segment saw the Hyundai Verna emerge victorious from among its rivals Virtus, Slavia, City and Ciaz as the most preferred choice among sedan buyers in the country.

Verna sales stood at 30,027 units in the FY24 period with an average of 2,502 units sold each month to command a 30.80% share. Even as Verna sales set off to a strong start in the first quarter of FY 23-24 with 11,689 units sold, its sales dipped considerably in Q2 FY23-24 to 8,044 units to end H1 period with 19,733 unit sales. The 2nd half of the year was also not as promising as sales continued to dip each month to 4,726 unit sales in Q3 FY23-24 but improved slightly to 5,568 units in the Q4 period. H2 sales fell to 10,294 units, a 47% decline from sales seen in the H1 period.

VW Virtuswith a 5 Star safety rating at Global NCAP, was at No. 2 on the list of mid-size sedan sales in FY24 with 21,094 units sold. It currently commands a 21.64% share in this segment and has seen an average monthly sales of 1,758 units. Sales in the Q1 period stood at 4,924 units which improved to 5,668 units in Q2 FY 23-24 but fell marginally to 5,145 units and 5,357 units in Q3 and Q4 period.

It was followed by the Skoda Slavia, which is also a 5 Star safety rated sedan, with 19,092 units sold in FY24. This was at an average of 1,591 units each month with the Slavia commanding a 19.59% share in this segment. While there had been 4,920 units and 4,892 units of the Slavia sold in the Q1 and Q2 periods of FY23-24, its Q3 sales improved to some extent to 5,652 unit. However, sales declined again in the last quarter to 3,628 units.

Honda City, Maruti Ciaz Sales FY24

The once dominant Honda City suffered a severe decline in sales in FY24 to 16,925 units averaging at 1,410 units per month to command a 17.36% share. The company’s latest entrant Elevate in the SUV segment has grabbed some of the attention away from the City. City sales which had stood at 4,930 units in Q1 FY23-24 dipped to 4,571 units in the Q2 period to end H1 FY23-24 at 9,501 units. Sales continued to decline to 4,001 units in Q3 FY23-24 and to 3,423 units in Q4 FY23-024 to end H2 with 7,424 unit sales.

Maruti Ciaz too has recorded lackluster sales in FY24. Ciaz is one of two sedans in Maruti Suzuki’s portfolio, the other being the more popular DZire which is positioned in the sub 4 meter sedan segment. With 10,337 units of the Ciaz sold in FY24, this displays an average monthly sale of just 861 units with the Ciaz commanding a 10.60% share in the mid-size sedan segment. Triple digit sales were seen through most months of FY24 with Q1 FY 23-24 sales at 3,753 units which dipped to 3,688 units in the Q2 period and then down to 1,462 units and 1,434 units in Q3 and Q4.