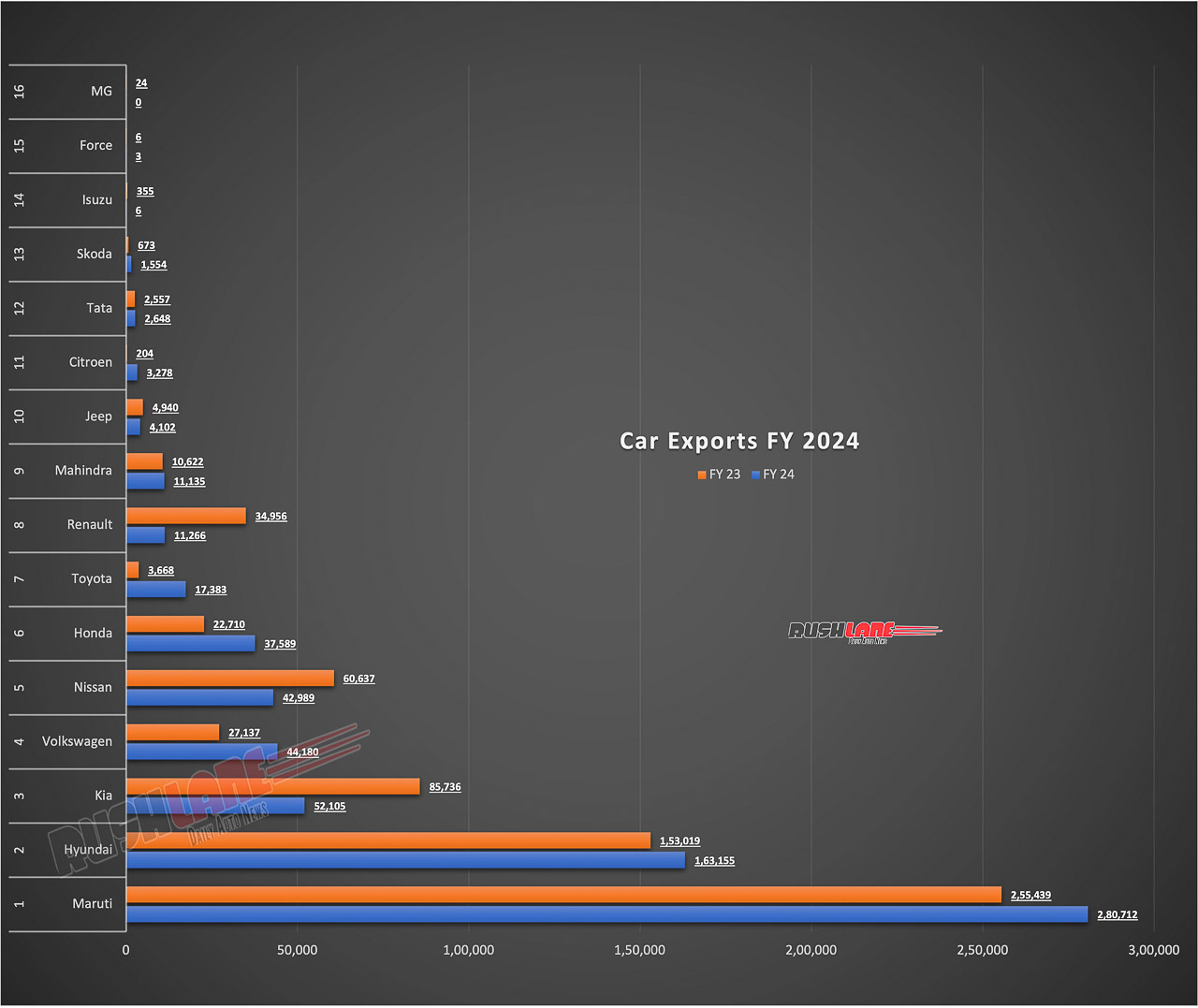

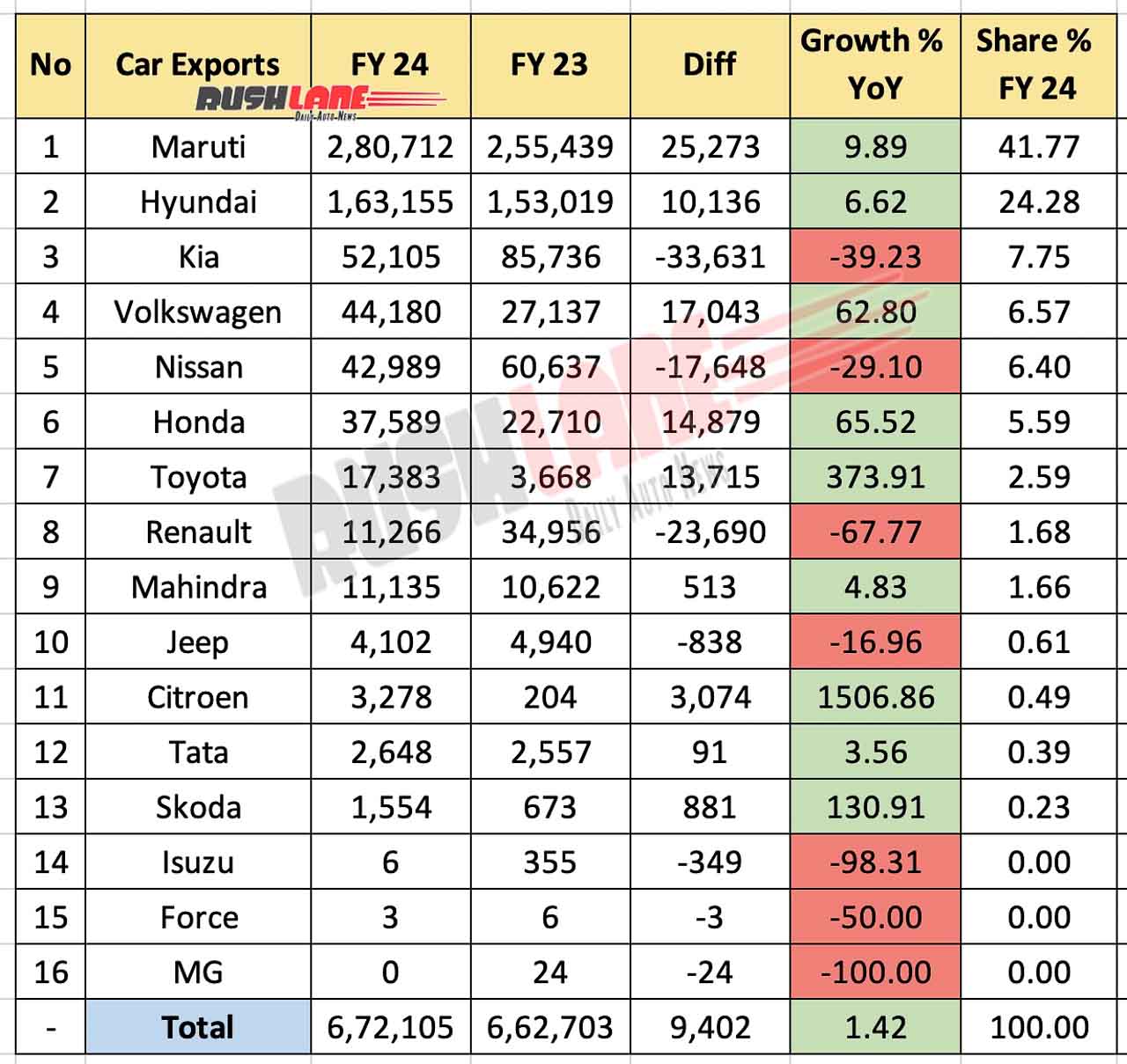

Car exports saw a 1% YoY growth in FY24 with Maruti Suzuki and Hyundai Motors taking top two positions and crossing well over the 1 lakh unit mark

Exports of cars in FY24 was boosted thanks to a series of new launches and increased demand across global markets. Smoother supply chain operations as compared to that seen post-covid along with economic growth, foreign exchange stability and higher demand have all led to this increase albeit minimal. Passenger vehicle shipments from India improved, marginally by 1 percent to 6,72,105 units in the past fiscal from 6,62,703 units sold in FY2023. This was volume growth of 9,402 units.

Maruti and Hyundai Leads Car Exports in FY24

Maruti Suzuki India Limited was not only the largest seller of cars in domestic markets but also amassed the highest exports in FY24. Maruti has held this title for the past 3 years and FY24 exports were their best ever. Leading the domestic car retail sales list FY24 with over 16 lakh units sold, Maruti Suzuki saw the highest exports last fiscal.

Maruti’s make-in-India cars, that make their way across 100 global markets, improved by 10% in FY24 to 2,80,712 units from 2,55,439 units shipped in FY23. Among the 17 models in its portfolio, it was the DZire, Swift, S-Presso and Baleno along with the Brezza SUV that brought in the highest exports.

Exports of Hyundai Motors also improved on a YoY basis by 7% to 1,63,155 units in FY24 from 1,53,019 units sold in FY24. It was the i10 and i20 hatchbacks that saw highest demand in global markets with 80,790 units exported in the past fiscal. There were also 55,170 units of the Verna and 12,504 units of the Venue and Exter besides 10,825 units and 3,859 units of the Alcazar and Creta SUVs exported in FY24.

Kia India has seen a dip in its export numbers in FY24 by 39%. Exports dipped from 85,756 units shipped in FY23 to 52,105 units in the past fiscal, a volume de-growth of 33,651 units. Kia exports the Seltos, Sonet and Carens to the Middle East, Africa, Central and South America, Mexico and Asia-Pacific markets.

Volkswagen exports were up 63% YoY in FY24 to 44,180 units from 27,137 units shipped in FY23. At a No. 5 position was Nissan Motor India with a 29% YoY decline in exports to 42,989 units, down from 60,637 units shipped in FY23.

Toyota and Skoda Post Triple Digit Growth

Honda Cars saw its exports surge 66% to 37,589 units in FY24 from 22,710 units exported in FY23. However, it was Toyota Kirloskar Motors that has reported the highest percentage growth in terms of exports. Exports grew by 374% YoY to 17,383 units in FY24, up from just 3,668 units shipped in FY23.

Renault India (11,266 units) suffered a setback in terms of exports in FY24 by 68% while Mahindra exports improved by 5% to 11,135 units. FCA India (Jeep) exports also dipped 17% YoY to 4,102 units while PCA India (Citroen) experienced a 1507% YoY increase to 3,278 units in FY24.

Tata Motors exports were up 4% to 2,648 units while Skoda Auto saw a 131% YoY growth with 1,554 units shipped in the past fiscal. De-growth was seen by Isuzu Motors (6 units), Force Motors (3 units) while MG Motors’ exports dipped 100% from 24 units shipped in FY23.