The financial services industry continues to face unrelenting cyber-attack attempts due to the nature of high-value data it houses. Financial services providers of all types are in the crosshairs of sophisticated hackers, and it’s easy to understand why.

For banks, a successful cyber-attack can bring about monumental financial losses. No bank is immune to this threat, with ransomware attacks on financial services increasing from 55 per cent in 2022 to 64 per cent in 2023. So what can firms do to better mitigate this risk?

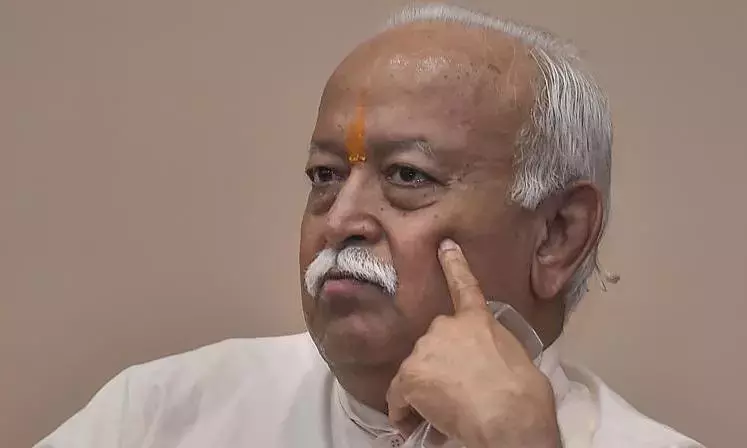

David AtkinsonCEO of SenseOnthe cybersecurity firm, explains why financial organisations should understand vulnerabilities, defend against evolving cyber threats and how leveraging technology that can actively flag and isolate serious threats will decrease the damage.

Confronting modern cyber risks in financial services

Entrusted with the personal data of billions, financial institutions face a relentless barrage of cyber threats, amplified by the proliferation of internet bankingmobile applications and instant payment systems.

The severity of the challenge is demonstrated in IBM’s Cost of a Data Breach Report 2023which ranks data breaches in the financial sector as second only to the healthcare industry in terms of costs. Moreover, The Information Commissioner’s Office has sounded the alarm, urging organisations to bolster their cybersecurity defences. Particularly in light of a more than threefold increase in reported incidents by UK financial services firms.

However, data breaches constitute only one facet of the risks confronting firms. From ransomware attacks and phishing schemes, to account takeovers and distributed denial of service (DDoS) attacks, all these threats can result in serious operational disruptions and loss of customer trust, incurring costly remediation.

Due to the nature of the industry, cyberattacks on banks and other financial institutions have the potential to jeopardise both financial and economic stability. They can undermine confidence in the financial system, disrupt essential services, lock up day-to-day transactions and trigger cascading effects on other institutions. As the financial landscape is increasingly digitised and interconnected, it’s crucial for firms to build long-lasting cyber resilience and better protect themselves from opportunistic intruders.

Mitigating security gaps

Despite tightening regulations, financial firms still encounter multiple cybersecurity blind spots. As organisations rely on third-party vendors for various services like cloud computing, payment processing or customer service, these external relationships can introduce vulnerabilities if proper oversight and due diligence aren’t conducted.

Threats can also easily come from the inside as employees or contractors with access to sensitive information may intentionally or unintentionally compromise security. This could include staff falling victim to phishing scams or maliciously exploiting their access privileges.

In addition, with the proliferation of cloud-based services and mobile applications, employees may use unauthorised software and applications to streamline their work processes. Yet, these unapproved tools often lack the necessary security controls and may contain unpatched vulnerabilities, giving cyber criminals an easy entry point. The same is true for legacy systems and outdated software which many banks and financial firms are still using to manage critical functions.

To address these vulnerabilities effectively, organisations should implement a comprehensive cybersecurity strategy. This starts with assessing both internal and external threats, as well as evaluating the impact of potential security incidents on business operations and data integrity.

A comprehensive monitoring approach is needed, however, traditional security tools often fall short in providing a full view and continuous surveillance across all network areas and endpoints. They create inefficiencies and bottlenecks that lead to security gaps being exposed to hackers.

Financial institutions can enhance their security posture and achieve comprehensive coverage by integrating advanced monitoring technologies. These tools provide detailed insights into every aspect of their digital ecosystem, allowing for more effective asset protection.

Unlike older systems, which often impose operational burdens, these advanced technologies streamline security operations. Such heightened vigilance is paramount for safeguarding highly sensitive data and staying resilient in the face of evolving cyber threats.

Enhancing data correlation

Amidst the daily influx of highly sensitive data, traditional security systems often falter in integrating and analysing data from disparate sources, posing a significant obstacle to threat detection and response endeavours. An effective strategy involves harmonising the correlation of all security data into a unified format.

This integration empowers analysts to swiftly and accurately discern the who, what, where, when, and how of any security event, alleviating the arduous task of linking information across diverse systems. Such a streamlined approach expedites response times and amplifies the efficacy of security measures. By simplifying data analysis, financial institutions can fortify their capacity to anticipate and counter threats, fostering agility and robustness in their cybersecurity operations.

Minimising alert overload

Within the dynamic landscape of security teams, financial services companies often grapple with stretched cybersecurity resources. Consequently, managing the flood of alerts generated by traditional security tools presents a formidable challenge. In fact, according to recent research by Deep Instincta staggering 45 per cent of all alerts turn out to be false positives, leading to widespread alert fatigue across SOC teams. A strategic recourse involves deploying an AI-driven reasoning framework to hone in on true positive alerts.

This precision in alert management markedly diminishes the influx of false alarms, thus alleviating the operational strain on security teams. By prioritising genuine threats, institutions can optimise their security resources and bolster their threat response capabilities. Moreover, by streamlining alert management, financial firms can improve their security operations while reducing associated costs significantly.

Resilient path forward

In navigating the treacherous waters of modern cyber threats, financial services firms must remain vigilant and adaptive. As highlighted, the convergence of highly sensitive data, evolving attack vectors and stretched cybersecurity resources poses unprecedented challenges.

However, implementing advanced technological solutions means firms can confront these challenges head-on, safeguarding assets and maintaining consumer trust. With a steadfast commitment to mitigating security gaps, enhancing data correlation and minimising alert overload, financial institutions can forge a path towards a more secure and resilient future.