Apple and Samsung have been in a constant race for market share, and after both companies rolled out major launches recently – the iPhone 16 series and the new Galaxy Z series – they are now almost tied in terms of market share.

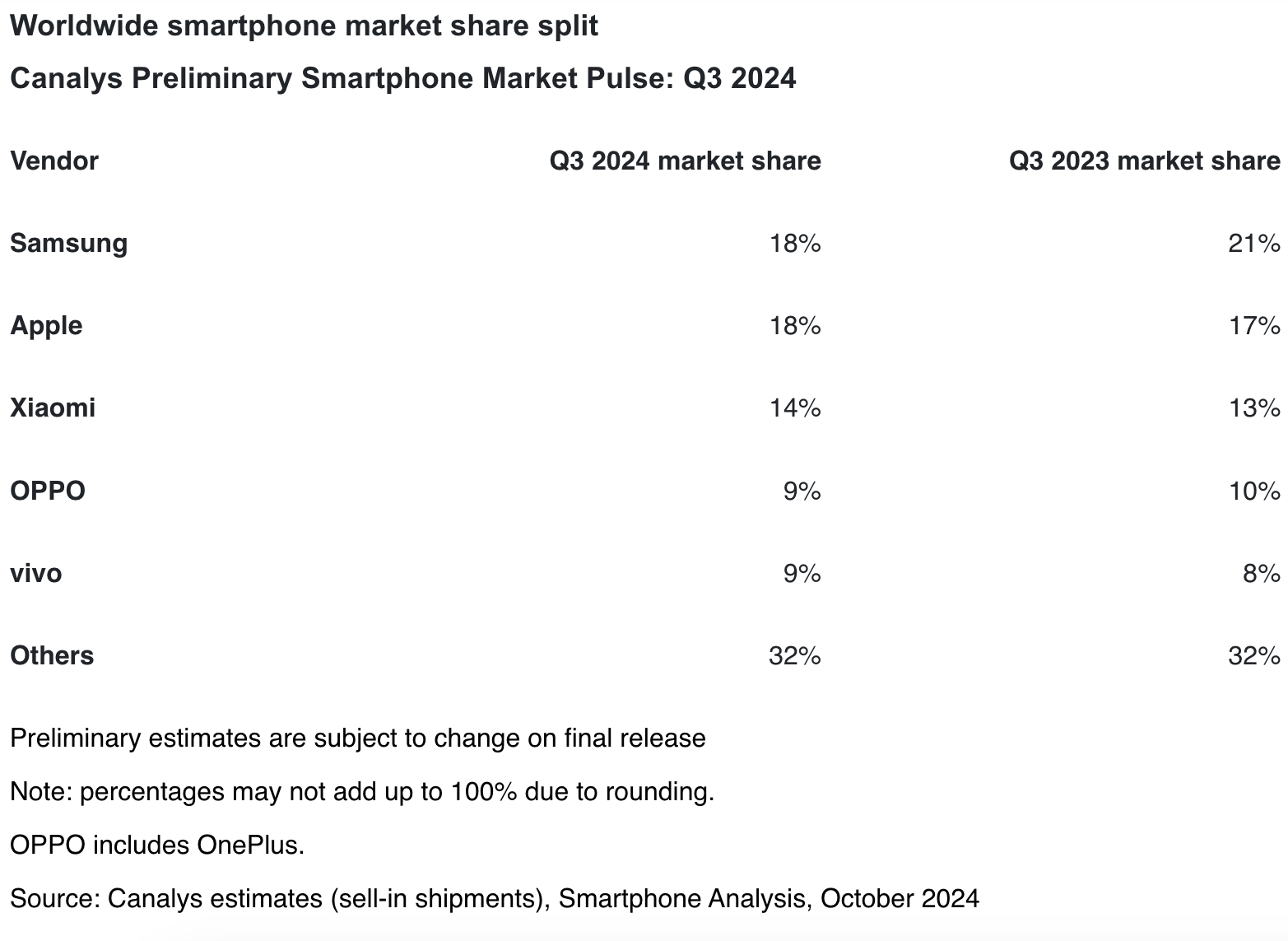

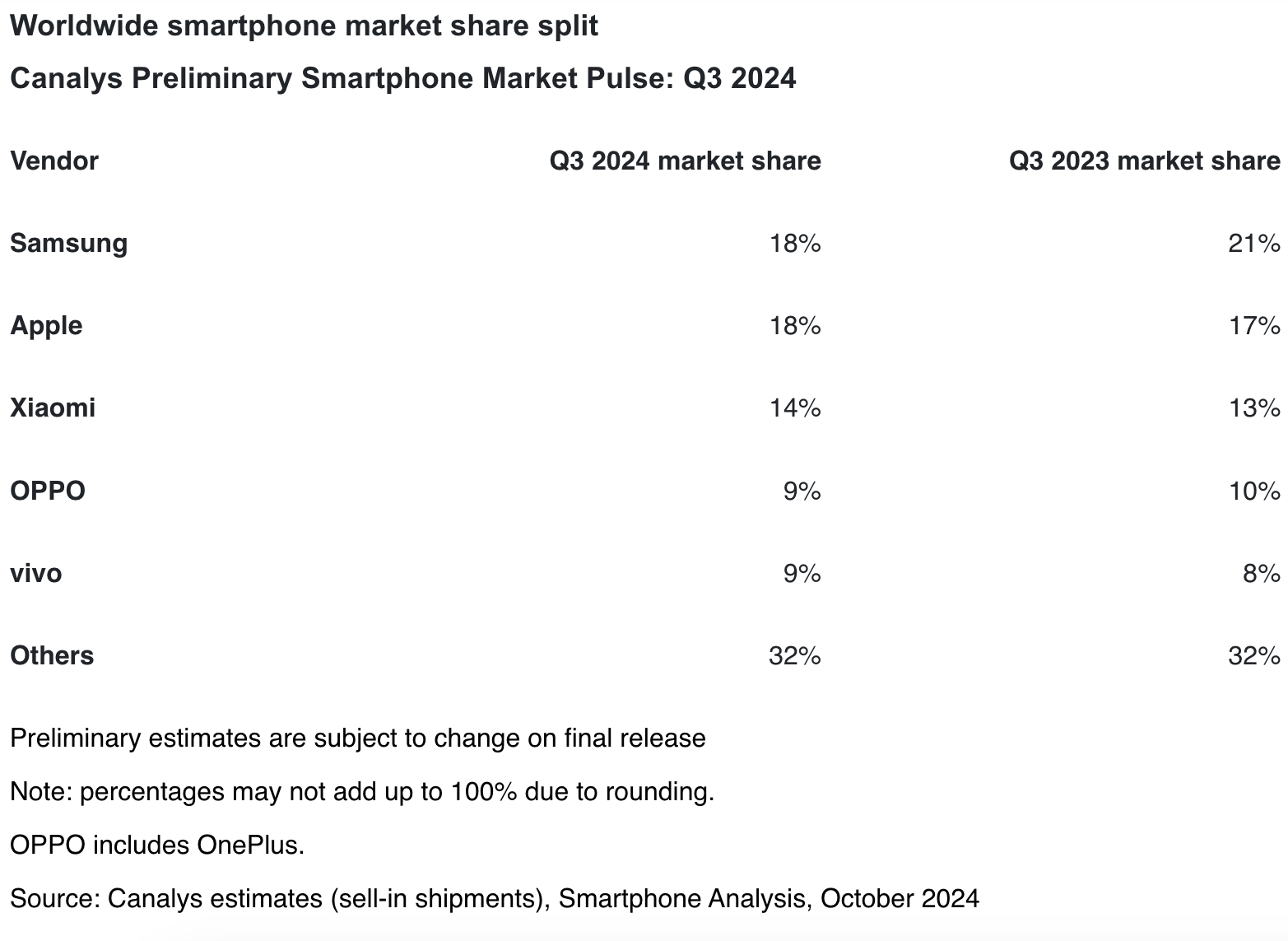

Both brands captured 18% of the market, putting them in a tie, while Xiaomi secured the third spot

According to a new report by the technology market analyst firm Canalys, Apple and Samsung both secured an 18% market share in Q3 2024, but Samsung still edged ahead for the top spot. Following them, Xiaomi held a solid third place with 14% of the market, while Oppo and vivo both finished in the top five, each with 9%.

Top five brands in the global smartphone market.

Apple achieved its highest third-quarter volume to date and has never been closer to leading the global smartphone market in Q3 than now. The ongoing strong demand for the iPhone 15 series, along with Apple’s legacy models, played a crucial role in its Q3 performance. The market’s shift towards premium devices, intersected by an ongoing refresh cycle of devices bought during the pandemic, is benefiting Apple, particularly in its strong-hold regions such as North America and Europe.

– Runar Bjørhovde, Analyst at Canalys, October 2024

In addition, it seems that Apple’s enhanced product diversification has played a key role in reducing lead times. Although the iPhone 16 saw a lukewarm start, it’s anticipated to bolster Apple’s performance as 2024 wraps up and carry that momentum into the first half of 2025. This is especially true as Apple Intelligence makes strides into new markets and adds support for more languages.

All in all, the iPhone 16 series didn’t really shake things up in Q3 since it was only on the market for three days. However, Apple could very well take the lead from Samsung in Q4 as the true effects of the iPhone 16 launch start to kick in.

Global smartphone market grew 5% YoY in Q4.

What is obvious from this latest analysis is that the gap among the top five smartphone vendors is closing, making the competition fiercer than ever. Still, while conditions are looking up, demand is shaky as companies grapple with growing global challenges in generating demand and navigating regulatory hurdles.

On another note, other research firms suggest that Apple could snag the title of the world’s largest phone maker by 2025. This potential leap is likely driven by the upcoming 2025 iPhone SE 4, expected to launch at a budget-friendly price of $499, along with the continued shipments of older iPhone models in emerging markets like India.