At the transport adda in Shabad mandal of Hyderabad, 45-year-old Allada Peer Reddy waited in excitement. An executive from a food and beverage company was arriving to onboard some light goods vehicle owners as vendors to support their growing business in the State.

However, his excitement quickly turned into worry after the executive informed Mr. Reddy about his invalid vehicle insurance. All it took was a quick scan of the QR code printed on the policy document, which looked perfectly original.

A resident of Hayathabad, Mr. Reddy had recently purchased a pre-owned Ashok Leyland Dost bearing the number ‘AP 09 TB 1059’ and a ‘Reliance General Insurance’ policy, hoping to find a job with the e-commerce company.

However, he did not expect to become a victim of a vehicle insurance policy scam that has targeted several unsuspecting commercial vehicle owners like him with ‘too good to be true’ discounts.

Panicked, Mr. Reddy made a call to an executive at Reliance General Insurance and narrated his story. P. Mrinal, working as Risk Control Unit (RCU) Manager at the company promptly entered the details shared by the victim only to find no policy was issued to him.

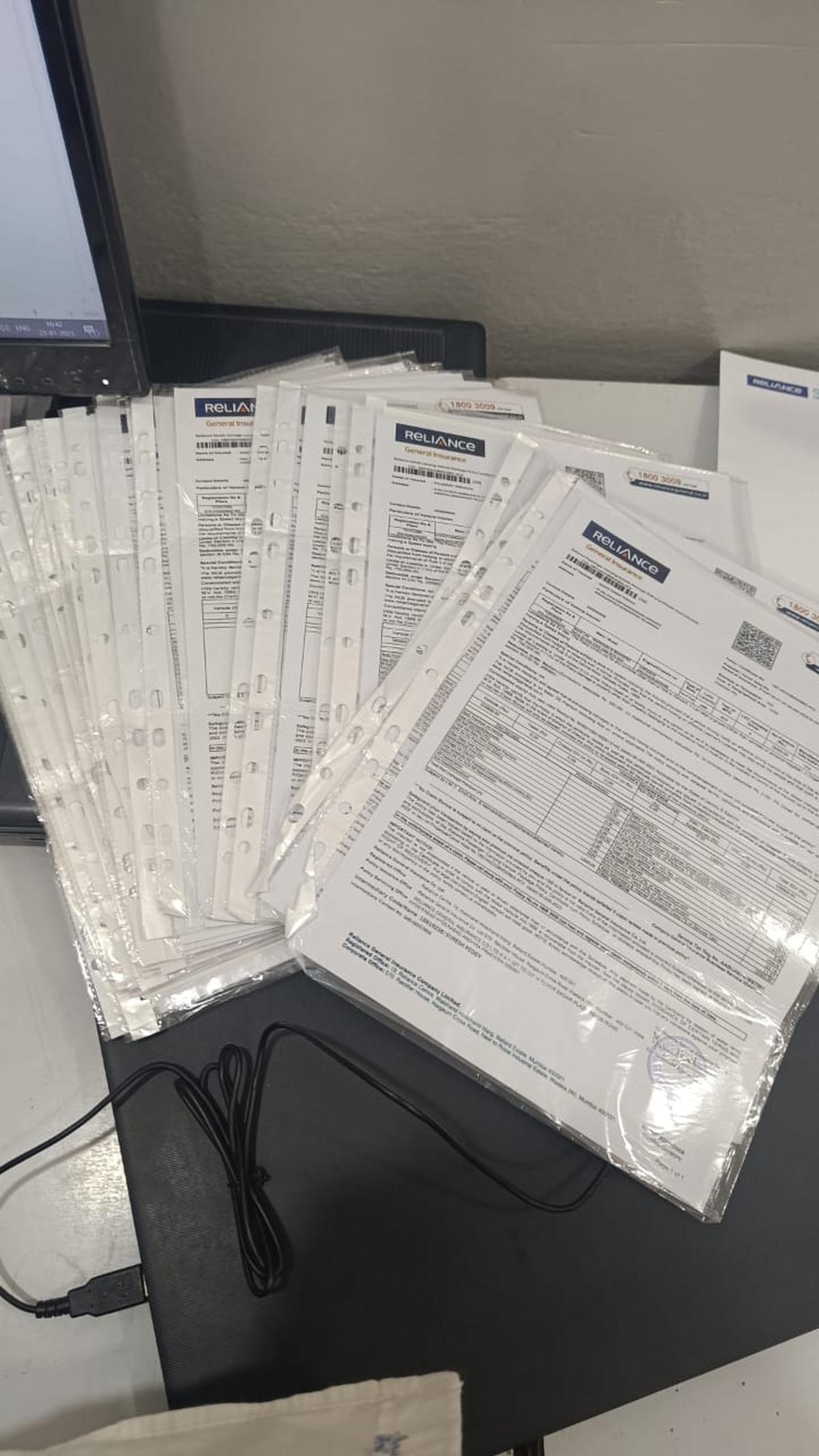

Copies of fake vehicle insurance policies issued by the fraudsters under the name of Reliance General Insurance were flagged by the drivers.

| Photo Credit:

Special Arrangement

Upon meeting Mr. Reddy, he was shocked to see the insurance policy neatly secured in a transparent sheet, replicating the original perfectly but with one key mistake. “The insurance had ‘service tax’ instead of ‘GST’ on it, which cleared it was forged version of a 2017 policy model. Moreover, while the scammers were efficient enough to generate a QR code, it was linked to a random website and not the insurance policy,” Mrinal explained.

Mr. Reddy was not alone. Many of his friends including Chakali Balraj, 32 and Devarakonda Mahendar, 25, operating in the same field had purchased multiple ‘Reliance General Insurance’ policies, none of which were issued by the company.

Based on a complaint by Mrinal, the Shabad police, on January 24, arrested two — Shadul alias Srinivas and Praveen — who were involved in forging and selling these policies to unsuspecting commercial vehicle owners.

The gang members involved in selling forged insurance policies and government documents racket arrested by the Shamshabad police earlier in January.

| Photo Credit:

Special Arrangement

A total of 31 fake documents, including 25 Reliance General Insurance policies, five HDFC-ERGO policies and a SBI General Insurance policy, were seized along with a laptop used to forge them.

A native of Adilabad, Shadul operated from his house in Jillalguda where he forged policies and printed them on bond paper. “The business is operated through referral agents/affiliates, targeting commercial vehicle owners. Reference policy copies are forged, and ₹20,000 worth policy is sold at ₹2,000-₹2,500,” explained Shabad Inspector B Kantha Reddy. Investigation is underway to trace other agents involved in this racket, he added.

From digital forgery to physical replicas

This was not the first time fake policies were reported. Earlier in January, a fraudulent vehicle insurance policy and government documents racket operating in the city for the past three years was unearthed after several fake policies under the names of Reliance General, Bajaj, HDFC, ICICI, and Tata AIG were flagged by customers.

Shamshabad police arrested three from the gang including Md Awyes, 38, Buneti Shravan Kumar Goud, 41 and Morsu Shiva Kumar, 33, while 11 still remain at large.

“These individuals were editing the policy and selling it online through channels like WhatsApp. However, the current racket has stepped up and deals in physical copies. High quality colour printer and bond paper is used to match the look and feel of the original policy,” said Mrinal.

While editing a policy would mean altering details on an original/reference copy, the latest racket is recreating 2017-2018 policy copies on platforms like Excel and printing them, he added.

Driver safety in question

According to insurance company representatives, even if drivers manage to get jobs, accident victims bear the brunt of fake policies. “The role of vehicle insurance comes into the picture at the time of an accident as it covers any damage or injuries caused to the driver, vehicle and others involved in accident We are seeing at least 100 cases every year in which the victims had to bear the loss as the policy was fake,” explained Mrinal.

Over 400 such cases are also pending in the Motor Accident Claims Tribunal (MACT) in Hyderabad.

Insurance company representatives said that their policies are sold through proper channels including company showrooms across the city, petrol pumps, ecommerce platforms including PolicyBazaar, Paytm and other verified applications. Policies are also sold by registered agents and brokers, who are identified with unique agent code. Experts also stressed the amount paid by the insuree must match the amount mentioned in the policy document.

Published – January 25, 2025 12:07 pm IST