HYDERABAD: The Hyderabad police have arrested three senior bank officials — two of them from Bengaluru — for allegedly helping cyber fraudsters open mule accounts in return for hefty commissions of Rs 50,000 (for savings a/c) to Rs 80,000 (current a/c). The three are among 52 people arrested for cyber fraud in the last seven days.

The arrests follow raids conducted by Hyderabad police across nine states — Telangana, Andhra Pradesh, Gujarat, Karnataka, Delhi, Uttar Pradesh, Maharashtra, West Bengal, and Bihar — over one week.

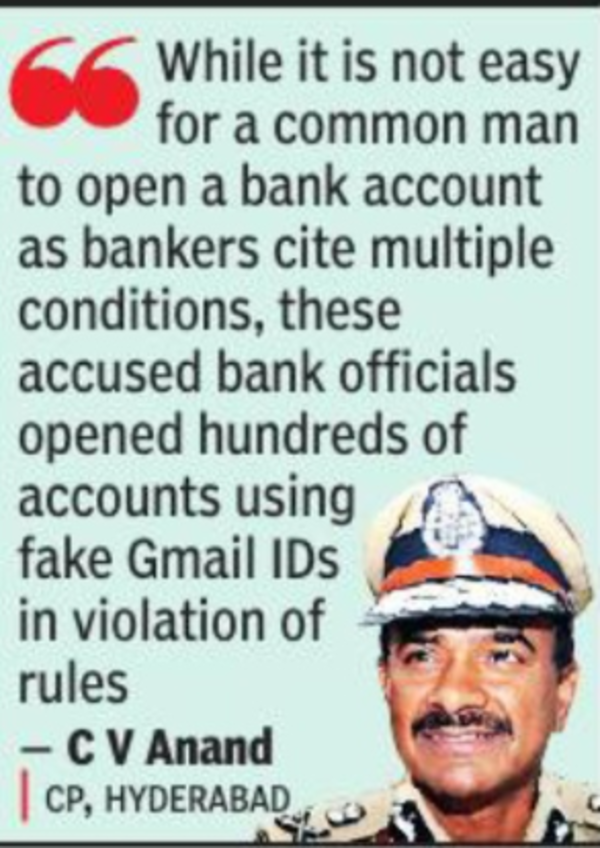

During a press conference on Wednesday, Hyderabad police commissioner C V Anand said Shubham Kumar Jha, deputy manager of RBL Bank; Haroon Rasheed Imamuddin Dharawad, assistant vice-president of Axis Bank — both from Bengaluru — and Kata Srinivasa Rao, sales manager of Kotak Mahindra Bank from Hyderabad, exploited loopholes in the banking system and illegally opened hundreds of mule accounts in connivance with cyber fraudsters.

Rs 80k commission for mule account

A mule account is a bank account opened in the name of other people but controlled by cyber crooks. They use it for anonymous illegal banking transactions. According to Telangana Cyber Security Bureau’s estimates, there are at least five lakh mule accounts being misused by fraudsters across India at the moment.

Hyderabad police’s probe into 39 mule accounts, following complaints from customers, revealed different violations that eventually led them to the senior bank officials.

“While it is not easy for a common man to open a bank account as bankers cite multiple conditions, these accused opened hundreds of accounts in violation of rules,” Anand said, adding that Shubham, Rasheed, Rao and their associates opened these mule accounts using fake Gmail IDs.

These were later provided to cyber fraudsters, allegedly in exchange for commissions.

Cops said the arrest of 52 accused led to the detection of 33 cyber crime cases involving Rs 8.8 crore. The offences include trading fraud, digital arrest, investment fraud, data theft, part-time job fraud, APK file fraud, and others. Police have seized Rs 87.9 lakh in properties and cash from the accused.

Cops meet RBI officials

Given the crucial role of banks in arresting cyber crime, Hyderabad’s cyber crime sleuths held a meeting with RBI officials recently to discuss the matter. “Since there is pressure on bank officials to open more accounts, some of the staff are getting involved in illegal activities. We have highlighted the areas where the irregularities have been taking place and informed them about the need for an improved system to avoid misuse of bank accounts,” Hyderabad police commissioner C V Anand said. Police have also stressed the need for banks to raise red flags on anomalies in transactions to help protect the interest of cyber crime victims.