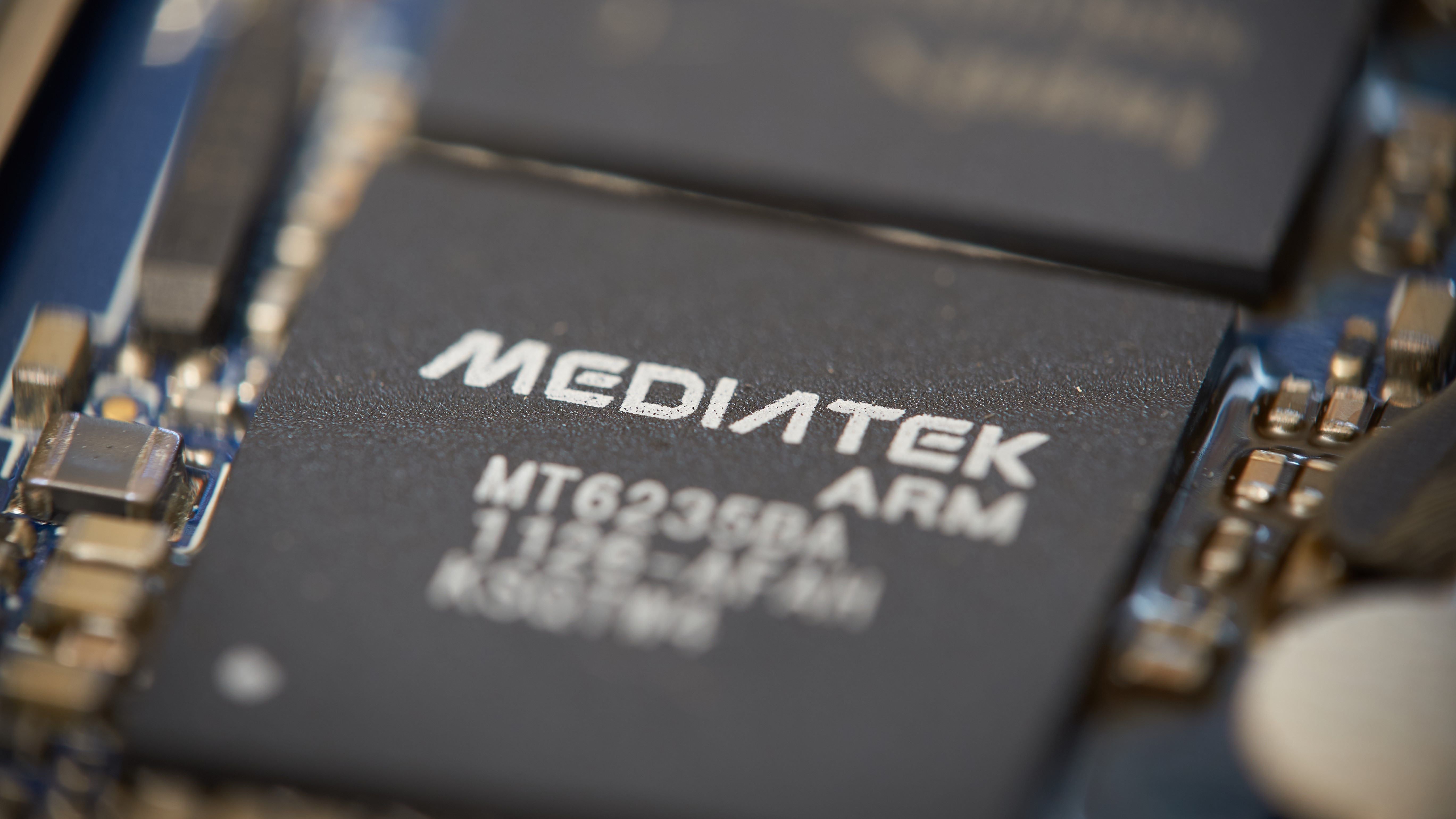

Leading Taiwanese chip maker MediaTek is reportedly conducting simulations to assess the potential impact of U.S. tariffs. The move comes amid growing tensions and trade policy shifts that could reshape the global semiconductor industry. According to Reuters, MediaTek’s CEO, Rick Tsai, acknowledged the uncertainty surrounding the possible tariffs, emphasizing that while the situation remains fluid, the company is preparing for the worst.

“We are making our own assumptions, doing some simulations,” Tsai stated to Reuters, refraining from providing specific details about the scenarios the company is analyzing. He expressed confidence that any potential impact in 2025 would be “manageable” but noted the situation’s complexity, making precise estimates difficult.

If the U.S. imposes new tariffs, MediaTek could face increased costs when exporting its chips to American markets, potentially affecting pricing, supply chains, and profitability. The company relies heavily on manufacturing partnerships in Taiwan and China, which could expose it to trade restrictions depending on how the U.S. structures the tariffs. MediaTek will likely explore alternative supply chain adjustments and pricing strategies to mitigate risks.

Beyond trade concerns, the semiconductor industry is also navigating new competitive pressures. The emergence of DeepSeek, the Chinese startup offering efficient and cost-effective artificial intelligence solutions, recently caused a global dip in tech stocks. This development has raised questions about the long-term investment strategies of chipmakers and data centers. However, Tsai remains optimistic about AI’s future growth. “With the recent DeepSeek phenomenon, we actually are getting more optimistic,” he said. “The trend is democratizing AI. It will spread more for average users.”

MediaTek’s proactive approach underscores a broader industry effort to adapt to changing economic conditions. The company aims to anticipate potential disruptions and maintain stability in a highly competitive global market by running impact simulations. While the implications of future U.S. tariffs remain uncertain, MediaTek’s strategic planning highlights the importance of flexibility and resilience in the semiconductor sector.

Similarly, TSMC is considering significant price increases of up to 15% for its chip production to offset potential losses in response to recent U.S. tariffs on Chinese imports. The move is expected to lead to higher costs for consumer electronics, as companies like Samsung, which rely on TSMC’s chips, may pass these expenses onto consumers. TSMC is exploring shifting production to U.S. facilities currently under construction to mitigate tariff impacts.