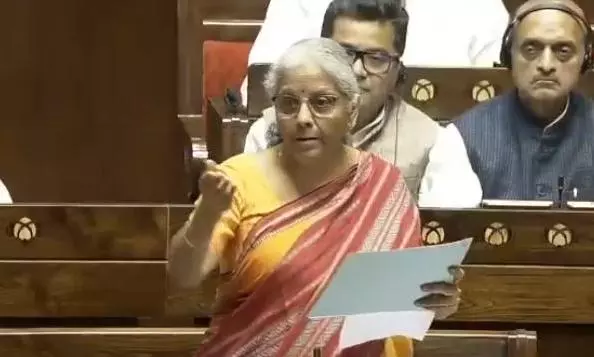

New Delhi: Slamming the Opposition members on custom duty cut in this budget, Union finance minister Nirmala Sitharaman on Thursday said that budget after budget the government is reducing duty to meet India’s aspiration of becoming a manufacturing hub for batteries. Her statement comes at a time when the US tariff threat is escalating day by day. “I heard quite a few members saying a tariff war has started, so in response to the tariff announcements made by President Trump, we are doing it, reducing customs,” Sitharaman said, while replying to the members on the finance bill in Rajya Sabha.

“We have been doing it since 2023 and it has nothing to do with today’s global situation. India had been reducing duties budget after budget “so that India’s aspiration for being a manufacturing hub and also India’s aspiration in building capacities for battery manufacturing advanced chemistry is being supported”, the finance minister said.

Later, Rajya Sabha returned the Finance Bill, 2025 to Lok Sabha, along with 35 government amendments, including one that abolishes a 6 per cent digital tax on online advertisements, and now Parliament completed the 2025-26 budgetary exercise that started on February 1. The House also returned the Appropriation Bill (3) with a voice vote. Earlier in the day, finance minister Nirmala Sitharaman had moved the two bills in the House.

Replying to the Finance Bill, 2025 debate, she also said that the tendency of the finance ministry would be to exercise caution and not let go of revenues. “But, here we wanted to use this opportunity to show our respect for the Indian taxpayer. We have moved towards setting Rs 12 lakh as threshold up to which no one will have to pay any tax,” Sitharaman said.

On income tax relief to the salaried and middleclass in this budget, she also hit back at the Opposition members who raised this issue, thanking Prime Minister Narendra Modi, who set me on this task, much before the budget preparation commenced. “The PM had said to explore the possibilities of helping the middle class and the taxpayers. We wanted to use this opportunity to show our respect for Indian taxpayers, i.e; we have moved towards setting Rs 12 lakh as a threshold upto which no one will have to pay any income tax,” she said.

On validation rules for pensioners, she clarified the Opposition’s remark, saying that the PM had in January 2025 approved the establishment of the 8th Central Pay Commission (CPC) to revise the salaries and benefits of central government employees and pensioners. “All central government pensioners who had retired before 1.1.2016 are receiving pension at par with employees who retired after 1.1.2016. Keeping in view the recommendations, which were made by the 6th CPC, a distinction among pensioners is inevitable and that is what is being brought in as an amendment and by way of validation,” she said.

“The validation rules don’t, in any way, change or alter the existing pensions so fixed of existing civil pensioners from the present stage. The validation rules also don’t also affect defense pensioners in any way as they are covered by separate rules. It is not an amendment to any pension rules or instructions but only a reaffirmation of the same w.e.f. 1st June, 1972, i.e. the date the CCS (Pension) Rules were promulgated. The 6th Central Pay Commission made a distinction between the retirees of pre-1.1.2006 and those of post-1.1.2006 periods,” she added.

The Union Budget 2025-26 envisages a total expenditure of Rs 50.65 lakh crore, an increase of 7.4 per cent over the current fiscal. The total capital expenditure proposed for the next fiscal is Rs 11.22 lakh crore and an effective capital expenditure of Rs 15.48 lakh crore. It proposes a gross tax revenue collection of Rs 42.70 lakh crore and a gross borrowing of Rs 14.01 lakh crore.