TSMC’s demand for CoWoS chipmaking materials has become so great that it is causing material shortages in the memory market. Mitsubishi Gas Chemical has announced to clients that shipments of raw materials for the production of BT substrate will be heavily delayed due to low supply.

As the largest supplier of BT substrate raw materials in the world, MGC’s delays will trigger potential long-term shortages in the substrate supply chain, exacerbating existing issues and cost hikes in the memory production segment, particularly NAND flash controllers. Suppliers with existing NAND controller stock, such as Phison, are expected to win big in the ensuing months.

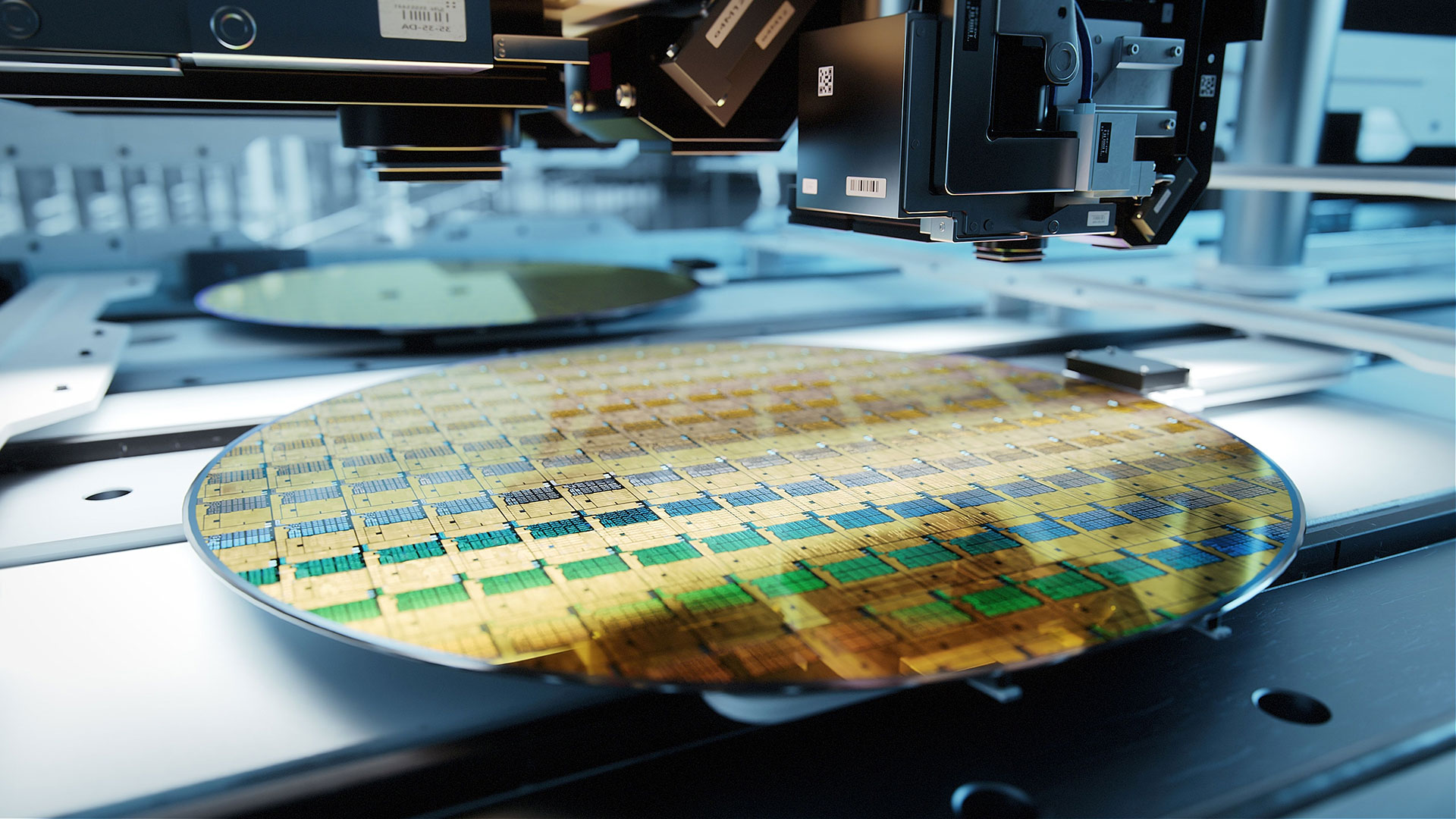

TSMC’s CoWoS advanced packaging has been identified by the chipmaking industry as the source of this materials shortage. The chip-on-wafer-on-substrate packaging technology has become a major hit for TSMC among high-end clients like Nvidia and AMD for use in leading-edge enterprise GPUs like Blackwell. And TSMC has been steadily expanding its CoWoS production capacity ever since introducing the CoWoS package.

CoWoS relies on ABF substrates, which typically share production materials with BT substrates. TSMC’s lion status in the industry puts a squeeze on supply, with BT substrate suppliers receiving the short end of the stick. And with TSMC considering production of 1000W processors built on massive 120×150 mm CoWoS substrates, the squeeze is only expected to continue.

MGC attributed delays to shortages of low-CTE glass cloth, copper-clad laminates (CCL) and prepreg (PPG) materials. Glass cloth is also used in packaging and motherboard printing of enterprise servers and consumer smartphones, with BT substrate suppliers taking up the near-bottom of the priority list.

To avoid a shock to the market and end supply, companies at all points in the BT substrate supply chain have begun coordinating orders and supply of material. A low demand for consumer electronics and market hesitance attributed to the uncertain barrage of tariff announcements and removals by the U.S. government are helping to keep consumer demand for material low, also avoiding true shortages.

Companies like Phison and Silicon Motion, premier suppliers of NAND flash controllers and eMMC cards made with BT substrate, stand to gain the most from this period of uncertainty. Phison has already begun acquiring additional production capacity from TSMC to secure NAND flash controller sales as its “chief growth engine”, and controller orders have increased to outrun the market shortages. It would not be surprising to see an increase in pricing for NAND flash controllers as the material squeeze goes on.

The AI gold rush continues to be the greatest force driving hardware development worldwide, as we saw at this year’s Computex, and TSMC continues to receive immense gains as the proverbial shovel salesman. And while this AI boom fails to reach the current doldrums of consumer electronics, this current supply squeeze proves that it may be a good thing; a consumer electronic rush now could threaten to make this squeeze a much more severe shortage.

Follow Tom’s Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.