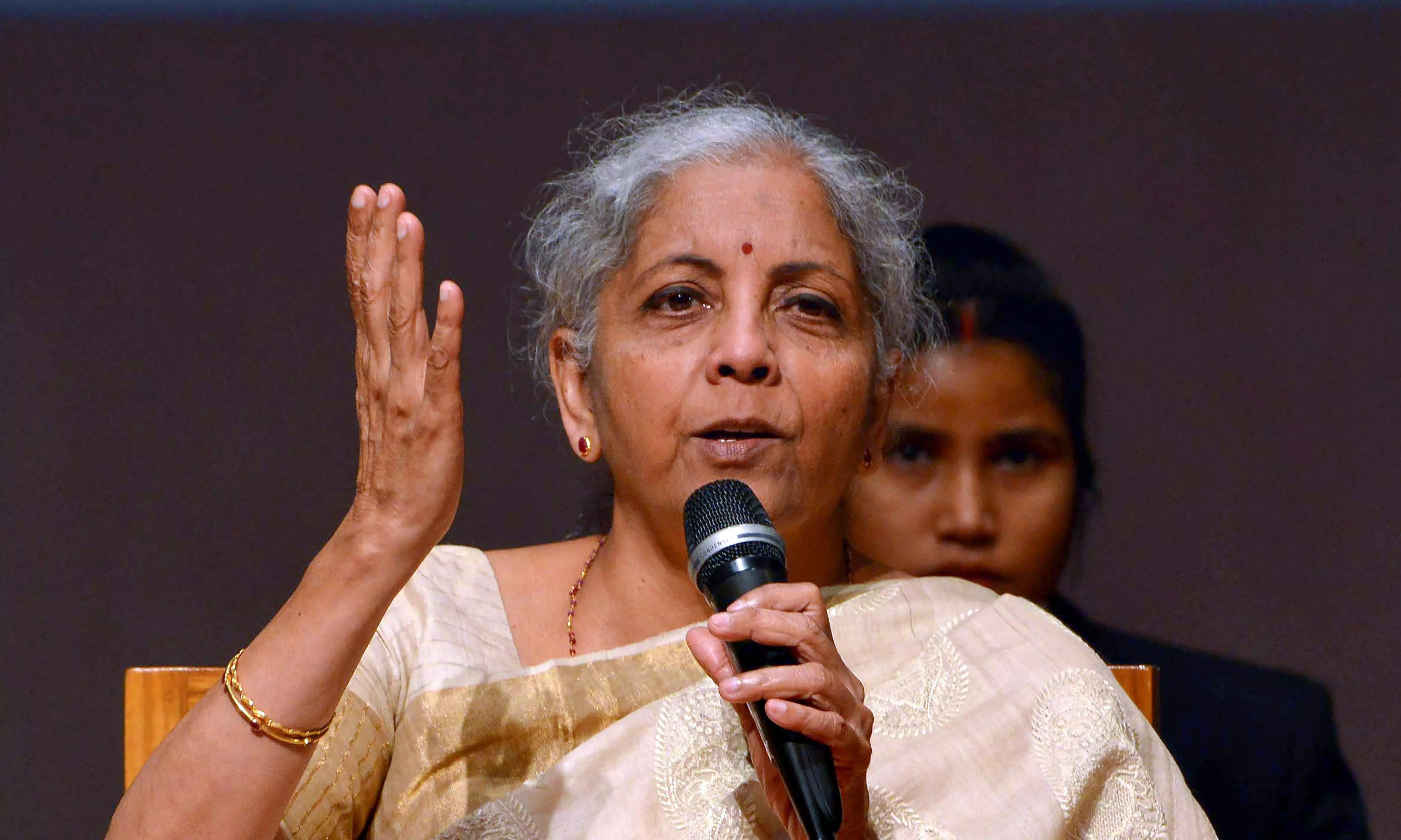

New Delhi: Union finance minister Nirmala Sitharaman on Friday asked public sector banks (PSBs) should maintain profitability momentum in FY26 and take advantage of Reserve Bank of India’s 50-basis points rate cut to increase lending toward productive sectors of the economy, according to the sources.

The finance minister’s statement came after chairing a meeting with the heads of PSBs to review financial performance of banks. Sitharaman also emphasised that banks should also onboard more customers on government’s schemes in a bid to increase financial inclusion.

“The finance minister expected that PSBs credit growth should improve post RBI’s rate cut and banks need to maintain the FY25 credit growth level or increase during the current financial year,” the sources said.

As per government data, cumulative profit of 12 PSBs rose to record Rs 1.78 lakh crore in FY25, registering a growth of 26 per cent over the previous year. “The year-on-year increase in profit in absolute terms was about Rs 37,100 crore in FY25,” the data showed.

On June 6, the RBI’s six-member monetary policy committee, headed by governor Sanjay Malhotra lowered the benchmark repurchase or repo rate by 50 basis points to 5.5 per cent. It also slashed the cash reserve ratio by 100 basis points to 3 per cent in tranches that will add Rs 2.5 lakh crore to already surplus liquidity in the banking system.

Comprehensive review of various segments and progress in government schemes including Kisan Credit Card, PM Mudra and three social security schemes — Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Atal Pension Yojana (APY) were done during the meeting.

Besides, the banks were also advised to work on ways to garner more low cost deposits. “On the asset quality side, the finance minister appreciated the low level of non-performing assets in the banking sector and exuded confidence that the top management will ensure to keep it at that level,” the sources said.