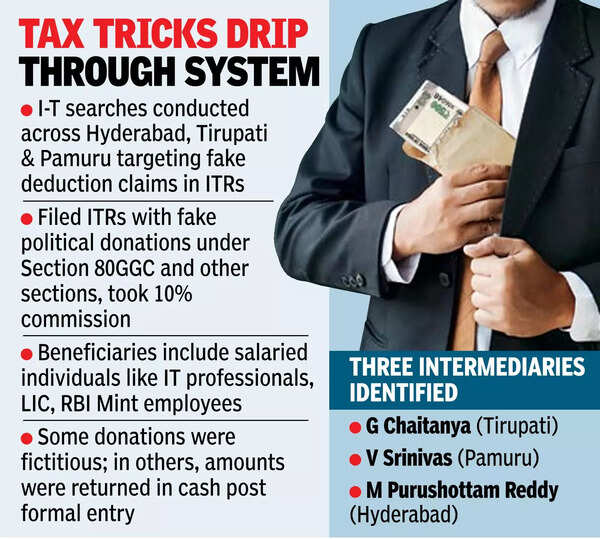

HYDERABAD: Income tax (I-T) officers on Monday carried out searches at multiple locations across Andhra Pradesh and Telangana, including Hyderabad, targeting three intermediaries allegedly involved in facilitating fraudulent claims of deductions in income tax returns (ITRs) through fake political donations and other fabricated expenses. The searches are part of a broader investigation into organised rackets across the country involving false filings under various I-T sections, including 80GGC.

In three separate operations, searches were conducted in Tirupati (Chittoor district), Pamuru (Prakasam district), and Nizampet (Hyderabad). According to sources, the department identified the individuals as G Chaitanya in Tirupati, V Srinivas in Pamuru, and M Purushottam Reddy in Nizampet. They allegedly acted as intermediaries, collecting a 10% commission for filing ITRs on behalf of clients using false claims under Section 80GGC – a provision meant for genuine political donations and other sections.Investigators found that the intermediaries helped a wide section of salaried individuals, including IT professionals, LIC employees, and employees of RBI Mint in Hyderabad – claim inflated refunds based on either fictitious or manipulated donation entries. In some instances, no donation took place, while in others, the amount was routed back to the employees in cash after a formal donation entry was shown. Most of the political parties involved were found to be based in Gujarat, Uttar Pradesh, and Bihar.Section 80GGC abusedThe department’s probe revealed systematic misuse of several sections of the I-T Act, including 10(13A), 80GGC, 80E, 80D, 80EE, 80EEB, 80G, 80GGA, and 80DDB. The fake claims were often filed using temporary email IDs and common IP addresses, a pattern that helped the tax authorities track down the intermediaries. These email accounts were later abandoned, which prevented taxpayers from receiving official notices or alerts.In the Chittoor case, six LIC employees were reportedly questioned and admitted to paying a commission to the intermediary in exchange for refunds generated through inflated political donation claims for the financial year 2022-23. The I-T department has also noted that growing awareness has led several employers, particularly in the IT sector, to reject dubious Section 80GGC claims during verification. This has pushed intermediaries to file returns directly on behalf of taxpayers, using falsified entries to secure higher refunds.The ongoing investigation also exposed attempts to submit fraudulent TDS returns to inflate refunds. Individuals from MNCs, PSUs, academic institutions, and the startup ecosystem were among those implicated.