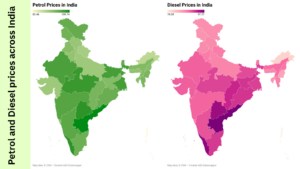

According to the Ministry of Petroleum and Natural Gas’s data, Andhra Pradesh leads the list, with petrol priced at ₹109.74 and diesel at ₹97.57, followed closely by Kerala and Telangana.

A fuel station in India. (iStock)

Synopsis: A recent Union government data revealed that Andhra Pradesh, Kerala and Telangana have the highest petrol and diesel prices. The divergence stems largely from the Value Added Tax imposed by states, which, combined with the Union government’s fixed excise duties, determines the final price at the pump.

The Ministry of Petroleum and Natural Gas recently revealed that Andhra Pradesh, Kerala and Telangana currently top the charts as the most expensive states for petrol and diesel.

The data, presented in the Lok Sabha on 18 July during the Monsoon Session, came in response to a question raised by Congress MP Shafi Parambil, who represents the Vatakara constituency in Kerala. It highlights stark disparities in fuel prices across Indian states, shaped largely by varying state-level taxes.

According to the ministry’s data, Andhra Pradesh leads the list, with petrol priced at ₹109.74 and diesel at ₹97.57, followed closely by Kerala and Telangana.

These figures are based on retail selling prices. In contrast, states like Karnataka and Tamil Nadu report significantly lower prices, ranking outside the top 10 in petrol costs.

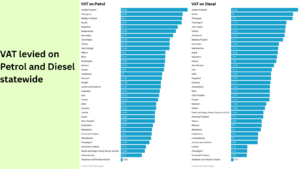

The divergence stems largely from the Value Added Tax (VAT) imposed by states, which, combined with the Union government’s fixed excise duties, determines the final price at the pump.

Andhra Pradesh, Telangana, and Kerala also feature among the states with the highest VAT rates — underscoring a deeper issue of state-level dependence on fuel taxes for revenue amid constrained fiscal transfers under the GST regime.

Also Read: India has diverted over 1.7 lakh hectares of forest land for infra projects

The highest prices and VATs

According to the data in the Lok Sabha response, Andhra Pradesh, Kerala and Telangana stand as the three costliest states for both petrol and diesel. Here were the prices as of 18 July, with Amaravati, Thiruvananthapuram and Hyderabad as references:

- Andhra Pradesh: Petrol – ₹109.74; Diesel – ₹97.57

- Kerala: Petrol – ₹107.48; Dieslef – ₹96.48

- Telangana: Petrol- ₹107.46; Diesel – ₹95.70

Meanwhile, Karnataka ranks 10th in petrol prices at ₹102.92 and ranks 11 in diesel prices at ₹90.99. Tamil Nadu ranks 14 in petrol prices at ₹100.8 and 7 in diesel prices at ₹92.39.

The aforementioned petrol and diesel prices are the Retail Selling Prices (RSPs). However, this cost includes two components: the Excise Duty and the Value Added Tax (VAT). While the union government levies the excise duty, the VAT heads to the state’s coffers.

As such, the state has a fixed excise duty on both petrol and diesel. It charges ₹21.90 for petrol and ₹17.80 for diesel. On the other hand, the VAT varies greatly across states. Each state can charge its own VAT, ranging from ₹11.01 on petrol in Arunachal Pradesh to ₹17.79 on diesel in Chhattisgarh.

Here also, Andhra Pradesh, Kerala, and Telangana charge some of the highest VATs on petrol and diesel.

- Andhra Pradesh: ₹29.06 on petrol, ₹21.56 on diesel

- Telangana: ₹26.92 on petrol, ₹19.8 on diesel

- Kerala: ₹26.41 on petrol, ₹20 on diesel

Somasekhar Mulugu, former Bureau Chief of Business Line, explained that high-priced petrol and diesel are a norm in Telangana and Andhra Pradesh, extending back to the years before the bifurcation as well. “Since the last 20 or 30 years, petrol and diesel prices have been higher in Andhra Pradesh,” he said.

“In these states, the VAT charged on petrol, diesel, and alcohol is important to the government,” he noted. “With an increase in borrowings and a large array of welfare schemes to deliver on, these streams are not only integral to the state’s revenue, but the authorities cannot afford to reduce them,” he added.

VAT is levied on petrol and diesel across India

The ‘double engine’ benefit

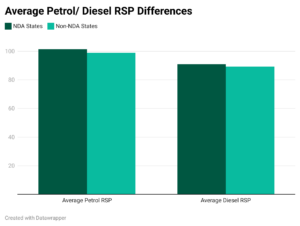

Another phenomenon that Somasekhar highlighted is the difference between NDA and non-NDA states. “Where the Union and state governments are in agreement, there the prices tend to be lower as the centre can provide some leeway,” he posited.

Interestingly, the data corroborates this notion. Among the listed territories, 20 were ruled by the NDA and its allies, while 10 were under non-NDA regimes.

In petrol prices, the NDA states averaged at ₹98.94 across 20 territories. Meanwhile, non-NDA states had an average price of ₹101.44 for petrol across 10 territories. It demonstrates that petrol is on average ₹2.50 costlier under non-NDA regimes as opposed to NDA states.

Similarly, NDA states have an average price of ₹89.30 for diesel. In non-NDA states, this average price is up ₹1.66 to ₹90..96 for diesel.

While this data illustrates that petrol and diesel are, on average, cheaper in NDA states, the issue of prices is not as black and white.

“Taking the southern states into account, you’ll notice that since the establishment of the GST, the states’ revenues have generally stagnated. In the last decade, most of the Southern states had a regional or opposition party at the helm, whether it’s the BRS, YSRCP, or Congress,” he explained.

Average Petrol/ Diesel RSP differences across governments

“As such, with diminished central support, VAT on petrol, diesel, and alcohol became important streams of revenue for the states. The other alternatives would either be to increase taxation on citizens and industries, which is unpopular, or to generate additional sources of income, which is hard without central support,” he elaborated.

“Furthermore, the smaller devolution of taxes the states receive on their GST has made these taxes crucial for the governments,” he added.

Also Read: ‘Unfair’ tax devolution to states has Karnataka CM, Tamil Nadu FM riled up

Revenue collection and sharing

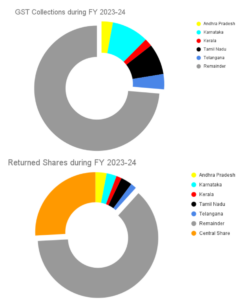

In fact, in a Lok Sabha response on 3 February this year, the Union government revealed the collected revenues from each state. Here is how much each South Indian state paid in taxes to the union:

- Andhra Pradesh: ₹44,298 crore

- Karantaka: ₹1,45,266 crore

- Kerala: ₹30,677 crore

- Tamil Nadu: ₹1,21,329 crore

- Telangana: ₹59,942 crore

This amounts to ₹4,01,502 crore in State Goods and Services Tax (SGST), Central Goods and Services Tax (CGST), Integrated Goods and Services Tax (IGST), and Cess.

Excluding the imports of ₹4,95,0001 crore, the total Domestic GST Collection came up to ₹15,23,249 crore during the Financial Year 2023-24. Hence, the five states contributed 26.35 percent of the total GST collection.

However, the returns are seemingly disproportionate. During the same Financial Year, the Union released ₹11,29,493 crore back to the states as their share, or 73.75 percent.

Of this, the share of the Southern states is as follows: Andhra Pradesh (4.047%), Karnataka (3.647%), Kerala (1.925%), Tamil Nadu (4.079%), and Telangana (2.102%). This amounts to 15.8 percent of the total release, adding up to ₹1,78,460 crore, constituting only 11.71 percent of the entire GST collections.

“As the states are unable to fight the formula-based returns of the GST system, they have to safeguard their revenue sources,” Somasekhar noted.

GST Collections and Returns during FY 2023-24

The curious case of Andhra Pradesh

Despite an NDA government, led by the TDP, being in power, Andhra Pradesh stands out as an exception to this phenomenon. In fact, it appears to be an outlier, not just having a high RSP, but having the highest in the country for both petrol and diesel.

As mentioned earlier, Andhra Pradesh charges the highest VAT on petrol and diesel, levying ₹29.06 and ₹21.56, respectively.

However, Somasekhar explained that this exception will not last long. “With Andhra Pradesh, you can still see the high prices during the YSRCP regime. The NDA regime is just continuing this,” he noted. “Additionally, even though it’s unfortunate, petrol, diesel, and alcohol have become a primary source of revenue in the Telugu states,” he observed.

He also highlighted that the TDP’s poll promises assured more benefits than the prior YSRCP regime. “They promised more than Jagan (Mohan Reddy), and they need revenue for that. They cannot afford to lower the VAT at this point,” he stressed. Yet, he also explained that this will not always be true.

“Being an NDA ally, Chandrababu Naidu is eyeing alternative sources of revenue besides petrol, diesel, and alcohol. He is pushing for central support and projects to up revenue in the state and reduce its dependence on VAT on these products. When they meet their goals, they might ease the burden on the consumers,” he added.

Also Read: South Indian states combined receive less than Uttar Pradesh

Price revision and consumer burden

“There was once a means to adjust the ever-changing prices of petrol and diesel in India. Based on the crude oil prices globally, the government would decide on the price of petrol through the Administered Price Mechanism,” Somasekhar recalled.

“This was done fortnightly, even up until 2016-17,” he stated, adding that: “Since then, the frequency has gone down, to now happening once every few months.” The last time India saw an APM revision was in March 2025.

“Through this mechanism, the burden of the cost would be softened on the consumer, with states altering their share according to the market prices. However, recently, the Union government has also shown a reluctance to reduce the consumers’ burden in petrol and diesel prices, making various excuses,” he highlighted.

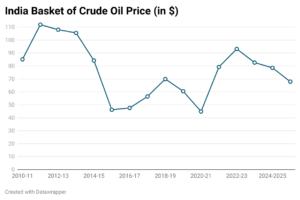

Notably, the Ministry of Petroleum and Natural Gas also revealed the prices of an Indian Basket of Crude Oil since 2010-11. Notably, India has had to pay less for crude oil for three years in a row, currently paying $67.87 per barrel in 2025. This is down from $78.56 India spent in 2023-24.

Indian Basket of Crude Oil Prices since 2010-11

“Even those prices were often based on the Arab imports of crude oil, which were later processed by Indian Oil or Hindustan/Bharat Petroleum Private Limited. For the last few years, thanks to global conditions, we have been importing crude oil from Russia at a cheaper price. However, the same companies are not processing them, and the lowered procurement price is not translating into a lesser burden on the consumers,” Somasekhar pointed out.

(Edited by Muhammed Fazil.)