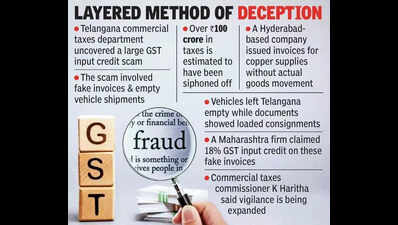

Hyderabad: In a major move to curb tax fraud across state lines, the Telangana commercial taxes department has decided to formally notify the Maharashtra govt about the large-scale GST input credit scam involving fake invoices and empty vehicle shipments , a racket suspected to have siphoned off over ₹100 crore in taxes.At the heart of the scam is a Hyderabad-based company that issued high-value tax invoices for copper supplies to a company in Maharashtra, but with no actual movement of goods. According to preliminary findings, vehicles were dispatched empty from Telangana, while documentation falsely showed substantial consignments being transported.The fraudulent scheme revolves around the use of bogus input tax credit, one of the most common and damaging forms of GST fraud. These schemes typically involve shell or paper-only companies that issue invoices for goods or services that were never actually supplied, allowing colluding firms to illegitimately claim input tax credit from the govt.How the scam workedThe operation followed a layered method of deception. A Hyderabad company generated fake invoices for copper goods, billing a Maharashtra firm without delivering any actual materials. The receiving company in Maharashtra then claimed to have paid 18% GST and sought input credit based on that fabricated transaction. The scam didn’t end there. The Maharashtra firm recycled the fraud, issuing its own set of fake invoices to a third company, again falsely claiming to have supplied goods and paid tax. This chain of deceit allows each party to benefit from tax credits on taxes never actually paid, creating significant revenue losses for the govt.Vigilance intensified Commercial taxes commissioner K Haritha emphasised the expanding scope of the department’s crackdown. “We are increasing vigilance regarding companies that create fake invoices or claim fraudulent input credits. Typically, this type of scam involves a chain of companies,” she said.“We previously focused on identifying firms within our state, but now we will inform state govts about companies participating in this crime. If vigilance is heightened across all states, such fraudulent activities will decrease,” she added.Big push against GST fraudHyderabad: Since April 25, the commercial taxes department has stepped up enforcement and uncovered 304 fake GST cases. In these, ₹170 crore in fraudulent input tax credit was blocked, notices worth ₹49.7 crore were issued and ₹8.36 crore has already been recovered.