Times are already tough for Intel, but now it turns out its new, heavily-promoted AI PC chips aren’t selling as well as expected, thus creating a shortage of production capacity for its older chips. The news comes as the CEO announced looming layoffs and a poor financial report sent the company’s stock tumbling.

Intel says its customers are buying less expensive previous-generation Raptor Lake chips instead of the new, and significantly more expensive, AI PC models like the Lunar Lake and Meteor Lake chips for laptops.

During the earnings call, Intel announced that it currently faces a shortage of production capacity for its ‘Intel 7’ process node, and the company expects this shortage to “persist for the foreseeable future.” That’s an unexpected shortage to have, as Intel’s current-gen chips use newer process nodes from TSMC instead of Intel’s older ‘Intel 7’ node.

Intel explained that the shortage of its 7nm production capacity is due to an unexpected surge in demand for its “N-1 and N-2” products, a reference to its two prior-generation chip families.

“What we’re really seeing is much greater demand from our customers for n-1 and n-2 products so that they can continue to deliver system price points that consumers are really demanding,” explained Intel’s Michelle Johnston Holthaus. “As we’ve all talked about, the macroeconomic concerns and tariffs have everybody kind of hedging their bets and what they need to have from an inventory perspective. And Raptor Lake is a great part. Meteor Lake and Lunar Lake are great as well, but come with a much higher cost structure, not only for us, but at the system ASP price points for our OEMs as well.”

Bernstein Research’s Stacy Rasgon pressed Holtahaus about the implications for the company’s upcoming Panther Lake chips, which are set to launch at the end of the year, especially given that the looming tariff disruptions have not yet occurred.

Holthaus said the Panther Lake launch remains on track and the company expects continued success in the commercial market, which she said typically precedes broader consumer adoption. Notably, she did not directly address the company’s expected next-gen AI PC adoption for consumer laptops. Regardless, the company also continues its expansive work to promote and cultivate a growing developer ecosystem to unleash the power of its AI wares.

However, the fact is that AI still doesn’t seem to have the ‘killer app’ that would send waves of customers to stores to purchase an expensive new laptop. Instead, most of the new features revolve around built-in features in existing applications, such as chat and productivity software, that are more nuanced and not quite flashy enough to spark a wave of adoption.

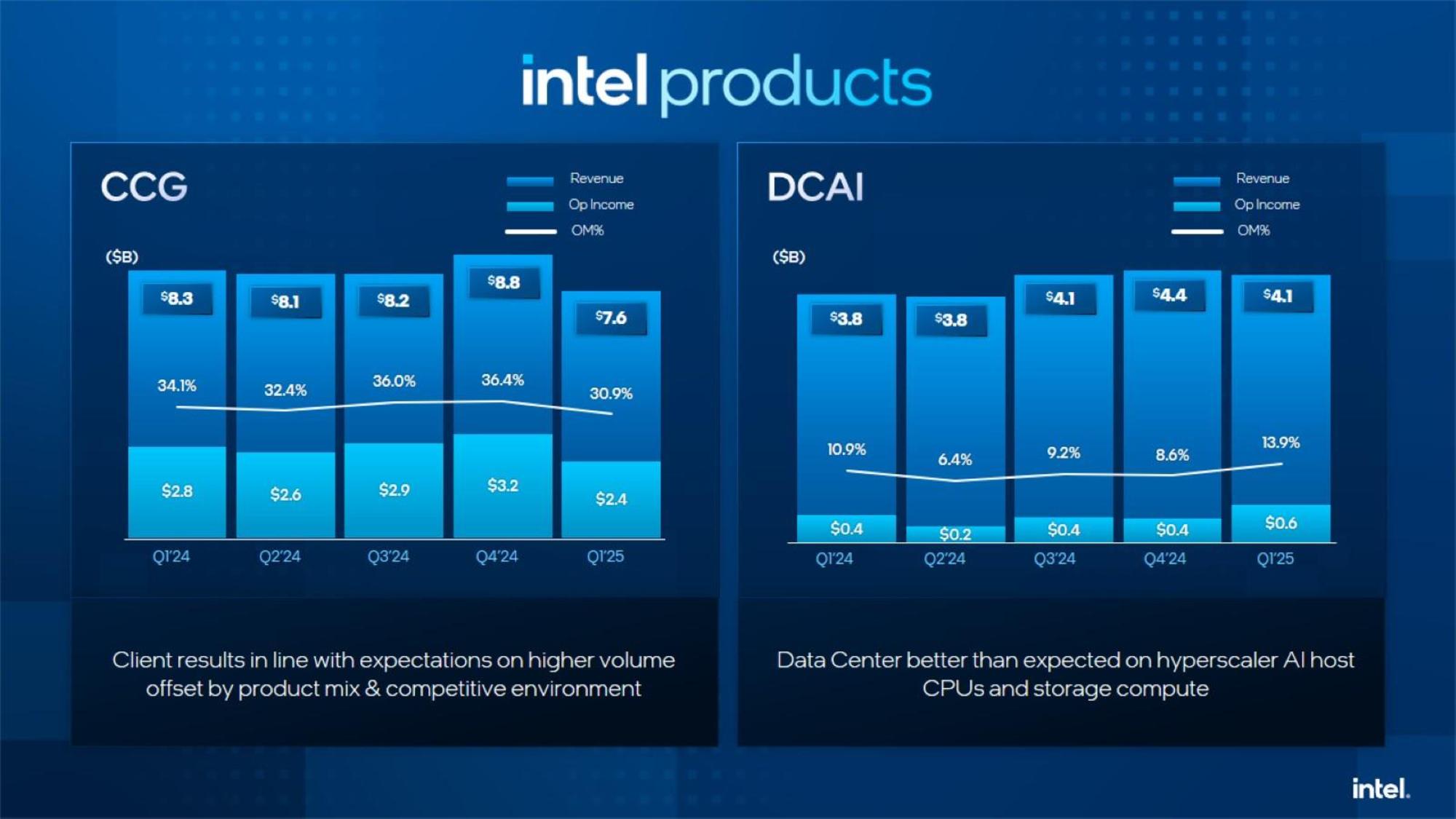

As you can see above, Intel’s Q1 financial results for its Client Computing Group (CCG), which addresses the consumer chip market, are less than stellar, as revenue slumped 8% compared to the same period last year.

Naturally, Intel’s take on the state of the AI PC revolves around its own products, which have obviously seen lackluster uptake, so we’re especially interested to hear AMD’s take on the matter when it reveals its results in ten days. We’ll also have in-depth reporting on CPU market statistics shortly thereafter to track the impact of potential share losses for Intel. Stay tuned.

Follow Tom’s Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.